GST Registration in Chennai: A Complete Guide for Businesses

In this blog post, we will walk you through the process of GST registration in Chennai. The Goods and Services Tax (GST) has revolutionized the Indian taxation system, simplifying the tax structure for businesses and individuals alike. If you are a business owner in Chennai looking to register for GST, this comprehensive guide will help you understand the benefits, eligibility criteria, required documents, and the online registration process.

Table of Contents

- Benefits of GST Registration

- Eligibility Criteria for GST Registration

- Documents Required for GST Registration

- Step-by-Step Process for Online GST Registration in Chennai

- Frequently Asked Questions (FAQs)

- Conclusion

Benefits of GST Registration in Chennai

GST registration has numerous advantages for businesses, including:

- Seamless input tax credit mechanism, which reduces the cascading effect of taxes.

- Elimination of multiple taxes, reducing the compliance burden.

- Increased transparency in the taxation process.

- Enhanced competitiveness among businesses due to uniform tax rates.

- Streamlined process for claiming tax refunds.

Eligibility Criteria for GST Registration

Businesses in Chennai that meet the following criteria must register for GST:

- Individuals or businesses with an annual aggregate turnover exceeding ₹20 lakhs (₹10 lakhs for northeastern states and hill states).

- Inter-state suppliers of goods and/or services.

- Casual taxable persons or non-resident taxable persons.

- Agents or brokers of a taxable person.

- Online service providers or e-commerce operators.

- Businesses subject to reverse charge mechanism.

Documents Required for GST Registration

To register for GST in Chennai, businesses must provide the following documents:

- PAN card of the business entity or proprietor.

- Aadhaar card of the business owner or authorized signatory.

- Proof of business registration, such as Certificate of Incorporation or Partnership Deed.

- Bank account statement or canceled cheque.

- Proof of address for the business location (rent agreement, utility bills, or property tax receipt).

- Photographs of the business owner, partners, or authorized signatories.

- Letter of authorization or board resolution for the authorized signatory.

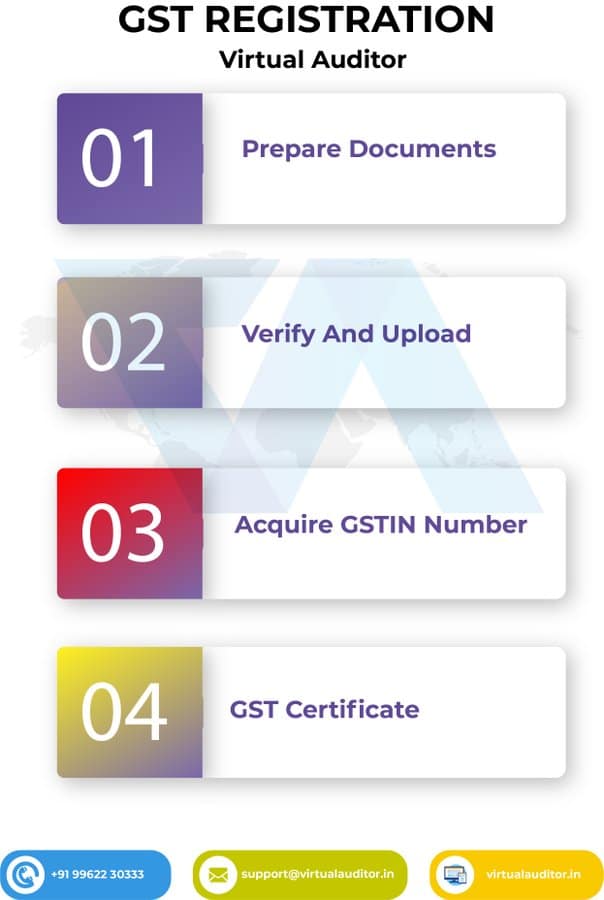

Step-by-Step Process for Online GST Registration in Chennai

Follow these steps to complete your online GST registration in Chennai:

- Visit the GST Portal: Go to the official GST portal (gst.gov.in) and click on the “Register Now” button under the “Taxpayers” section.

- Fill in the Preliminary Details: Choose “New Registration” and fill in the necessary details, including your business state, legal name, PAN, and mobile number. Click “Proceed” after filling in the captcha code.

- Receive the OTP: You will receive an OTP on your registered mobile number and email ID. Enter the OTP and click “Continue.”

- Get Your Temporary Reference Number (TRN): After successful verification, you will receive a TRN. Note down the TRN for future reference.

- Log in Using TRN: Go back to the GST portal and click on “Register Now.” Select “Temporary Reference Number (TRN)” and enter your TRN along with the captcha code. Click “Proceed” after entering the OTP received on your registered mobile number and email ID.

- Complete the Application: In the dashboard, click on the “Edit” icon in the “Action” column. Complete the application by providing the required information and uploading the necessary documents.

- Sign and Submit the Application: After filling in all the details, sign the application using your Digital Signature Certificate (DSC) or E-Signature. Click “Submit” to complete the application process.

- Receive the Application Reference Number (ARN): After successful submission, you will receive an ARN on your registered mobile number and email ID. Use this ARN to track the status of your application.

GST Registration Cost in Chennai

GST Registration cost in Chennai would typically range from Rs 1199 to Rs 3000 based nature of the entity Once you make the payment to the service provider for GST Registration you should Get ARN number post verification in GST Department, the GST Certificate will be issued within 3 to 7 Working days and if still clarification is requested then the time limit will be extended within 15 to 20 working days of time

Frequently Asked Questions (FAQs)

- What is the validity of GST registration?

GST registration is valid until it is surrendered or canceled by the tax authorities. - What is the processing time for GST registration in Chennai?

Typically, GST registration is processed within 3-7 working days from the date of submission of the completed application. - Is it necessary to have a physical office in Chennai for GST registration?

No, it is not mandatory to have a physical office in Chennai for GST registration. However, you must provide a valid address for your business location. - Can I register for GST voluntarily even if my turnover is below the threshold?

Yes, you can register for GST voluntarily even if your turnover is below the specified threshold. This allows you to avail input tax credit and claim tax refunds.

Conclusion

GST registration in Chennai is a critical step for businesses to ensure compliance with the tax laws and to avail the benefits of the GST regime. This comprehensive guide aims to simplify the registration process for business owners in Chennai. By following the outlined steps and preparing the required documents, you can successfully register your business for GST online and contribute to India’s economic growth.

For More Services in GST

GST Registration in Bangalore

GST Registration in Mumbai