3 Reasons Why Not Miss Annual Return Filings for Private Limited Companies

Annual return filings are an integral part of compliance for private limited companies in India. As a business owner, you may wonder why it is so crucial to file annual returns on time.we will explore three compelling reasons why you should never miss annual return filings for your private limited company. So, let’s dive in and uncover the importance of timely compliance and understand 3 Reasons Why Not to Miss Annual Return Filings for Private Limited Companies!

Table of Contents

- Legal Compliance: Avoid Penalties and Fines

- Credibility: Build Trust with Stakeholders

- Future Growth: Maintain a Clean Track Record

- Understanding the Annual Return Filing Process

- Frequently Asked Questions (FAQs)

1. Legal Compliance: Avoid Penalties and Fines

One of the primary reasons for timely annual return filings is to ensure legal compliance. The Companies Act, 2013, mandates that all private limited companies in India must file their annual returns with the Registrar of Companies (ROC) within the stipulated deadlines. These returns provide essential information about the company’s financial health, shareholding structure, and management, among other things . Now we will understand the 3 Reasons Why Not Miss Annual Return Filings

Failing to file annual returns on time can result in hefty penalties and fines for both the company and its directors. Non-compliant companies may face a fine of up to INR 5 lakhs, while the directors may be subject to a penalty of up to INR 1 lakh. Additionally, defaulting directors may be disqualified from holding directorship positions for up to five years. By filing annual returns on time, you can avoid these legal repercussions and maintain your company’s good standing.

2. Credibility: Build Trust with Stakeholders

Timely annual return filings play a vital role in building credibility and trust among your company’s stakeholders, including investors, lenders, customers, and suppliers. By submitting accurate and up-to-date financial information, you demonstrate transparency, accountability, and good corporate governance.

Investors and lenders, in particular, are more likely to support companies that adhere to statutory compliance requirements, as it reduces the risk of legal complications and financial losses. Additionally, customers and suppliers may prefer to do business with companies that have a clean compliance record, as it indicates financial stability and reliability. By prioritizing annual return filings, you can foster trust and confidence among your stakeholders, paving the way for long-term success.

3. Future Growth: Maintain a Clean Track Record

A clean compliance track record is essential for the future growth and expansion of your private limited company. Timely annual return filings contribute to this track record, enhancing your company’s reputation and prospects for raising capital, entering into partnerships, or even going public.

By maintaining a clean compliance record, you also ensure that your company remains eligible for government incentives, grants, and subsidies. This can be especially beneficial for startups and small businesses operating in sectors that receive government support. Furthermore, a strong track record can give your company a competitive edge when bidding for contracts or projects, as it demonstrates your commitment to ethical business practices and financial transparency.

4. Understanding the Annual Return Filing Process

Now that you know the importance of timely annual return filings, let’s briefly discuss the process involved. The annual return filing process for private limited companies in India typically involves the following steps:

- Prepare financial statements: Prepare your company’s balance sheet, profit and loss account, and notes to the accounts, adhering to the Indian Accounting Standards (Ind AS).

- Audit the financial statements: Appoint an independent auditor to audit your company’s financial statements and provide an audit report.

- Hold an Annual General Meeting (AGM): Convene an AGM of shareholders to adopt the audited financial statements and approve the director’s report and auditor’s appointment.

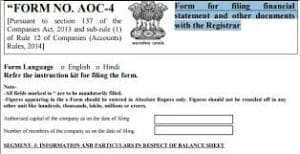

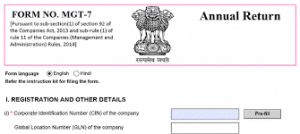

- File annual returns with the ROC: Submit the necessary forms and documents, including Form MGT-7 (Annual Return) and Form AOC-4 (Financial Statements), along with the prescribed fees, to the ROC within the specified deadlines.

By following this process and staying abreast of the latest compliance requirements, you can ensure that your company’s annual return filings are accurate, timely, and hassle-free.

5. Frequently Asked Questions (FAQs)

What is the due date for filing annual returns for private limited companies in India?

Private limited companies in India must file Form MGT-7 within 60 days of their AGM, while Form AOC-4 must be filed within 30 days of the AGM.

What happens if a private limited company fails to file its annual returns within the due date?

If a private limited company fails to file its annual returns within the due date, it may face penalties and fines, as well as possible disqualification of its directors. The company may also be subject to legal proceedings and other regulatory actions.

Can a private limited company file its annual returns after the due date?

Yes, a private limited company can file its annual returns after the due date, but it will be subject to late filing fees and penalties. The longer the delay, the higher the late filing fees.

FORMS TO FILED : AOC-4 & MGT-7

FORM AOC-4

Form AOC-4 has to be submitted with the MCA for each Financial Year within 30 days of AGM(Annual General Meeting), the entire financial of the company i.e. Profit & Loss Account and Balance Sheet are annexed to it along with Audit Report and Resolution passed at the AGM

FORM MGT 7:

Conclusion

Filing annual returns on time is crucial for private limited companies in India. By doing so, you can avoid penalties and fines, build trust with stakeholders, and maintain a clean compliance track record, which is essential for your company’s future growth and success. Remember, timely compliance is not just a legal obligation but also a sign of responsible and ethical business practices. So, make sure you never miss annual return filings for your private limited company.