3 REASONS NOT TO MISS FILINGS ANNUAL RETURN

There is old idiom “Prevention is better than cure” the same analogy applies to Annual Return flings to ROC ( Registrar of Companies)

The Government of India is very keen to eliminate all private limited companies which are shell companies and do not comply with annual return procedures , more than 3 lakh companies have already been struck off for the records of the registrar of companies

3 REASONS NOT TO MISS ANNUAL RETURN TO ROC

1) Currently, the penalty is limited to a maximum of 13 times the original fess from 1st July 2018 the same stand removed and after the amendment of The Companies (Registration Offices and Fees) Second Amendment Rules, 2018 was notified by the Ministry of Corporate Affairs on 7th May 2018. The fees will be Rs.100 per day w.e.f 1st July 2018 shall become payable at 100Rs per day of default

2) Increase the risk of Non-Compliance and invite penalty and prosecution against the directors of the private limited company

3) Disqualification of Directors if the case of continues non-filing & Strike off of companies if the company does carry any activity or has not filed the annual returns along with penalty and prosecution against the directors

FORMS TO FILED : AOC-4 & MGT-7

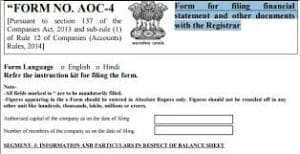

FORM AOC-4

Form AOC-4 has to be submitted with the MCA for each Financial Year within 30 days of AGM(Annual General Meeting), the entire financial of the company i.e. Profit & Loss Account and Balance Sheet are annexed to it along with Audit Report and Resolution passed at the AGM

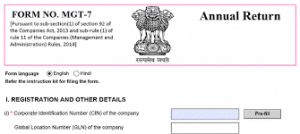

FORM MGT 7:

Form MGT-7 is the form for filing an annual return by a company describing the number of the Board meeting held during the year and shareholding pattern and share transfer during the year and other details of Directors change and indebtedness of the company

The due date for filing MGT-7 is 60 days from the date of AGM ( Annual General Meeting). The due date for conducting annual general meeting is on or before the 30th September following the end of a financial year except in case of the First Annual General Meeting

To file your ANNUAL Returns under companies act 2013, VirtualAuditor.in offers, an easy and online process for maintaining your company’s compliance through an online platform Talk to our Compliance Advisors at + 91 9962230333 or email us at [email protected]