How to Avoid Angel Tax for Start-ups! Angel Tax Exemption Procedure

Table of Contents

- Introduction: How to Avoid Angel Tax for Start-ups

- What is Angel Tax?

- Why Angel Tax Matters for Start-ups

- Angel Tax Exemption for Start-ups

- Angel Tax Exemption Procedure

- Best Practices to Avoid Angel Tax Issues

- Frequently Asked Questions (FAQs)

Introduction: How to Avoid Angel Tax for Start-ups

Hello, fellow entrepreneurs and start-up enthusiasts! Are you worried about the impact of Angel Tax on your start-up? Fret not! In this comprehensive guide, we’ll discuss everything you need to know about Angel Tax, why it matters for start-ups, and how you can seek exemption from it. Let’s dive in and uncover the secrets to avoiding Angel Tax and ensuring your start-up’s financial health!

What is Angel Tax?

Angel Tax is a tax levied in India on the capital raised by unlisted companies from angel investors through the issuance of shares. The tax was introduced in 2012 under Section 56(2)(viib) of the Income Tax Act, 1961. The primary objective behind the introduction of Angel Tax was to curb money laundering and prevent the inflow of black money into the start-up ecosystem.

However, the tax has also impacted genuine start-ups, as they are required to pay tax on the excess amount raised above the fair market value (FMV) of the shares. This can be a significant burden for start-ups that rely heavily on angel investments to fund their growth and operations.

Why Angel Tax Matters for Start-ups

Angel Tax is a critical issue for start-ups in India because it can hinder their growth and innovation. Here are some reasons why Angel Tax matters for start-ups:

- Financial burden: Start-ups are typically cash-strapped and rely on external funding to fuel their growth. Angel Tax can add to their financial woes, as they are required to pay tax on the excess amount raised above the FMV of the shares.

- Valuation challenges: Valuing a start-up accurately can be difficult, as it involves multiple factors and assumptions. The tax authorities may not always agree with the valuation provided by the start-ups, leading to disputes and litigation.

- Investor sentiment: The uncertainty around Angel Tax can make angel investors wary of investing in start-ups, thereby reducing the availability of much-needed capital for these companies.

Angel Tax Exemption for Start-ups

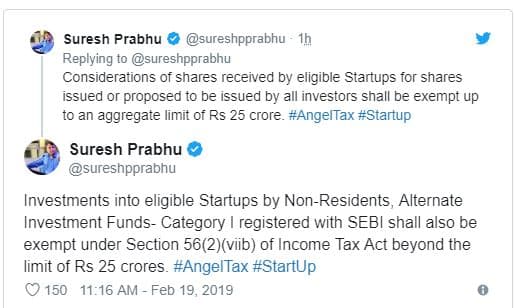

To address the concerns of the start-up community and boost innovation, the Indian government has introduced several measures to provide relief from Angel Tax. Start-ups that meet specific criteria are eligible for exemption from Angel Tax Here are the key eligibility criteria for Angel Tax exemption:

- Start-up recognition: The start-up must be recognized by the Department for Promotion of Industry and Internal Trade (DPIIT) under the Start-up India initiative.

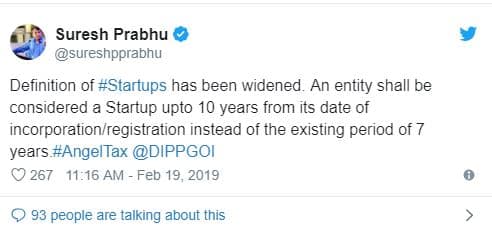

- Age of the start-up: The start-up must not be older than 10 years from the date of its incorporation or registration.

- Turnover: The annual turnover of the start-up must not exceed ₹100 crores in any financial year since its incorporation or registration.

- Investment limit: The aggregate amount of paid-up share capital and share premium of the start-up must not exceed ₹25 crores, excluding the investments received from non-resident Indians (NRIs), venture capital funds, and specified other investors.

Angel Tax Exemption Procedure

If your start-up meets the eligibility criteria for Angel Tax exemption, you can follow these steps to apply for the exemption:

- Get DPIIT recognition: Register your start-up with DPIIT by submitting the required documents and obtaining a recognition certificate.

- File Form 2: File Form 2 with the Inter-Ministerial Board of Certification to seek approval for Angel Tax exemption. Ensure that you provide all the necessary details and documents in the form.

- Approval from the Inter-Ministerial Board: After evaluating your application, the Inter-Ministerial Board will grant approval if your start-up meets the eligibility criteria and complies with all the requirements.

- Exemption certificate: Upon approval, your start-up will receive an exemption certificate from the Income Tax Department. You must submit this certificate while filing your income tax return to claim the Angel Tax exemption.

Best Practices to Avoid Angel Tax Issues

Here are some best practices that can help start-ups avoid Angel Tax issues and ensure a smooth exemption process:

- Obtain DPIIT recognition: Register your start-up with DPIIT and obtain the recognition certificate as early as possible to be eligible for Angel Tax exemption.

- Keep accurate records: Maintain detailed records of your investments, share issuance, and valuation to support your Angel Tax exemption application.

- Get expert advice: Consult a tax professional or legal expert to ensure compliance with the Angel Tax exemption norms and guidelines.

- Monitor your start-up’s growth: Keep track of your start-up’s age, turnover, and investment limits to ensure that you remain eligible for the Angel Tax exemption.

Frequently Asked Questions (FAQs)

-

-

- What is the rate of Angel Tax?

Angel Tax is levied at a rate of 30% on the excess amount raised above the fair market value (FMV) of the shares. - Can foreign investments also attract Angel Tax?

No, Angel Tax is applicable only to investments received from Indian angel investors. Foreign investments are not subject to Angel Tax. - What is the fair market value (FMV)of shares?

Fair market value (FMV) refers to the reasonable value of the shares, considering various factors like the company’s financial performance, assets, liabilities, and future prospects. FMV is used to determine if the capital raised by a start-up is above the FMV, which can trigger Angel Tax.

- What is the rate of Angel Tax?

- Can an existing start-up apply for Angel Tax exemption?

Yes, existing start-ups can apply for Angel Tax exemption if they meet the eligibility criteria set by the DPIIT and follow the exemption procedure. - Is there a time limit for claiming Angel Tax exemption?

No, there is no specific time limit for claiming Angel Tax exemption. However, it’s essential to obtain DPIIT recognition and the exemption certificate before filing your income tax return to claim the exemption.

Conclusion

Angel Tax can be a significant concern for start-ups in India, as it can hinder their growth and innovation. However, by understanding the eligibility criteria and following the exemption procedure, start-ups can seek relief from Angel Tax and focus on their core business activities. Moreover, adopting best practices and staying informed about regulatory changes can help start-ups avoid Angel Tax issues and maintain a healthy financial position. So, gear up, and let’s build a thriving start-up ecosystem in India!

Angel Tax on Startups

NEW DEFINITION OF STARTUPS?

An entity shall be considered as a startup if its turnover for any of the financial year, since its incorporation or registration, has not exceeded ₹100 crore instead of the existing ₹25 crore which is expected to give a lot

Definition of Start up For any support/query relating to filing of angel exemption for start ups , please contact experts Virtual auditor at +91 9962230333 / 044 -48560333 or [email protected]

-