Do you want labour inspector knocking at your door for non-compliance of Shop Act Registration in Bangalore (Shops and Establishment Act)?

The answer obviously is no !

You have successfully started your entrepreneurial journey by registering a company, be it proprietor, partnership or private limited, the movement you register you are supposed to comply with many laws both central and state laws, once such labour law being Shop Act Registration in Bangalore ( Also referred to as Shop and Establishment Act Registration).

WHAT IS SHOP ACT REGISTRATION ( SHOPS AND ESTABLISHMENT ACT REGISTRATION) IN BANGALORE?

In simple terms, when you have employees or in case you are a director, the law mandates for Mandatory Holidays (National Holidays) to be given to employee say for example on Republic Day (Jan 26), Independence Day( Aug 15) Gandhi Jayanthi (Oct 2nd) These are mandatory holidays

Karnataka Shops and Commercial Establishments Act, 1961 Governs the Rules and regulations relating to Shop Act Registration in Bangalore (Shop and Establishment Act) Registration

WHAT ARE OBJECTIVES GOVERNMENT WANTS TO ACHIEVE BY SHOP ACT REGISTRATION IN

BANGALORE (Shop & Establishment Act Registration)?

The Basic objective behind the Shop Act Registration in Bangalore (Shop and Establishment Act Registration), State labour department through the Labour Inspector wants to ensure and monitor

- Working Hours per day

- weekly holidays,

- leave structure for employee

- Maternity Policy (In case of Female Employees)

IS IT MANDATORY FOR ALL TO REGISTER UNDER SHOP ACT

BANGALORE ( Shop & Establishment Act)?

Do you want to be Non Compliant? Obviously No !

The Compliance under Shop Act ( Shops and Establishment Act) is compulsory for the following business

- Shops

- Commercial establishments (Start Ups and All Companies)

- Restaurants

- Hotels

- Theaters

- Public amusement

- Retail trade

Form the above it should be clear that this license is mandatory for all business entities irrespective of size or nature

WHAT IS THE TIME LIMIT, WITHIN HOW MANY DAYS DO YOU NEED TO REGISTER UNDER SHOP ACT ( SHOP AND ESTABLISHMENT ACT)

SHOP ACT Registration needs to be done within 30 days of commencement of Business with the Labour Department

HOW IS ” SHOP ” DEFINED UNDER SHOP ACT ( SHOP AND ESTABLISHMENT ACT)?

Shop: A shop refers to your business or trade which is physically situated on a place where it is providing the services/goods to whom, whether it may sells their goods or services as retailer or wholesaler where services are rendered to customers.

It includes the following

- your offices,

- storerooms,

- godowns and etc. are in the same building for the business purpose

- Any Retail Outlet of any kind

HOW IS ” ESTABLISHMET” DEFINED UNDER SHOP ACT ( SHOP AND ESTABLISHMENT ACT)?

Establishment: A commercial establishment is refers to an economic unit or banking sector or an insurance organization engaged in commerce to produces or sells their goods/services from a single location.

A commercial establishment is an establishment defined under the shop & establishment act to hold on the activities on commercial purpose;

The List Being

- Produces or sells its goods/services from a specific location.

- hotels, restaurants, coffee bar,

- theater,

- banking Companies,

- financial institutions,

- Start Up Company ( Be it of Any nature of Activity Software Development or otherwise )

- All the above under the State Governments Shop and Establishment Act.

WHAT IS THE PROCEDURE TO REGISTER UNDER SHOP ACT ( SHOP AND ESTABLISHMENTS ACT)

Procedure for Karnataka Shop Act Registration in Bangalore (Shops & Establishment) Registration

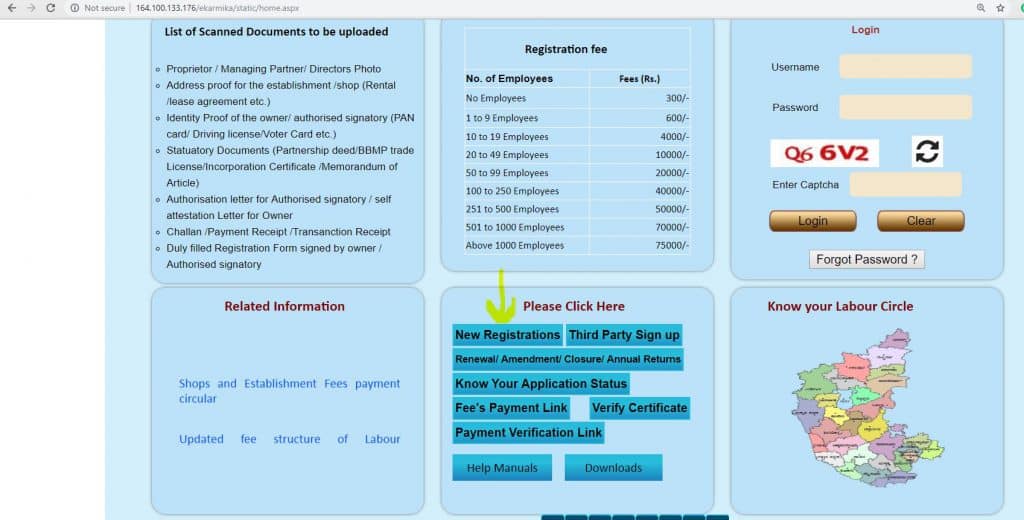

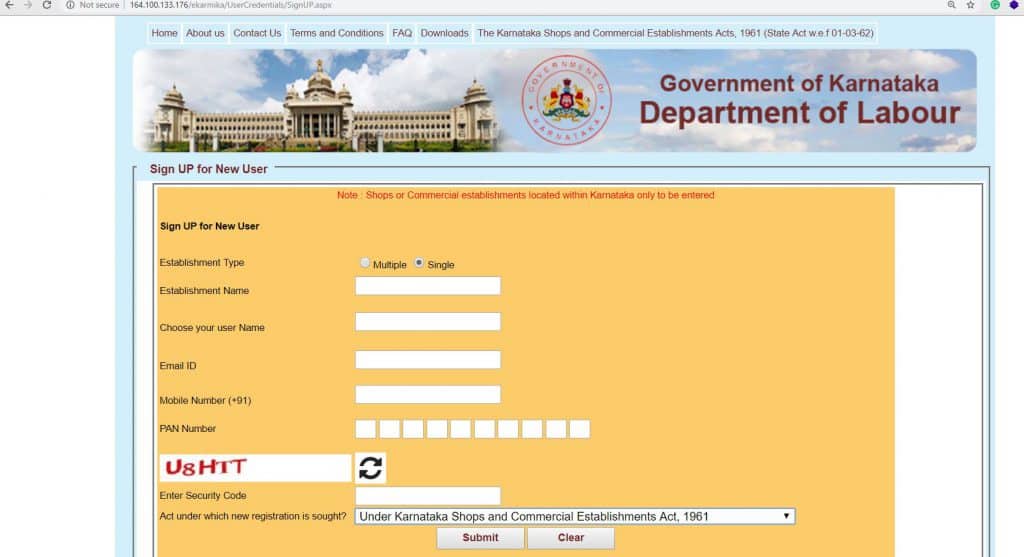

- Login into Govt Portal https://labouronline.kar.nic.in/ to E-Labour Department for online registration/ renewal of shops & establishments license.

- Click on APPLY ONLINE menu and click on the Shops and Commercial Establishments Act

- Proceed with New Registrations and fill the form online and submit it.

- Fill the Signup forms

- Unique User id and password will be generated

- Fill and submit the application form online to Chief Inspector of your concerned regional circle office

- Make the challan from any nationalized bank based on your number of employees

- Make attachment of necessary documents along with the Bank Challan

- Submit the physical copy of online application form in the particular regional circle

- Pay the Requisite out of pocket expenses

- After verification by the Senior Labour Inspector, if everything is well; you shall be granted the registration certificate

- The Processing time is 15 working days, within which applkication would be either accpeted or rejected

Documents to be uploaded during the shops and establishments registration

KYC (Know Your Customer) Documents of the company and the directors need to uploaded as scanned copy , list of documetns is mentioned below

- Proprietor/ Designated or Managing Partner/ Director’s photo

- Identity proof of the owner/ authorized signatory (PAN Card/ AADHAAR Card/ Driving License/ Voter ID)

- Address proof of shop/ establishment with rental or lease agreement

- Authorization letter from authorized signatory/ self attestation letter of owner

- Duly filled Registration Form signed by owner/ authorized signatory

- Challan/ Payment Receipt/ Transaction Receipt

- Statutory documents (BBMP Trade License/ Partnership Deed/ Incorporation Certificate [COI]/ Memorandum of Business [MOA & AOA])

Attachment Required for Private Limited / One Person Company

- COI (Company Incorporation Certificate)

- MOA and AOA

- PAN of the Company

- PAN of the Directors

- Passport size photo of directors

- Address proof of the Directors

- Authorization Letter

- Rental Agreement/Sale Deed/Lease Deed

- Electricity bill for office address proof

- Rental Agreement/Sale Deed/Lease Deed for additional place of business

- NOC (No Objection Certificate)

Attachment Required for Limited Liability Partnership (LLP)

- COI

- LLP Agreement

- PAN of the Company

- PAN of the Directors

- Passport size photo of directors

- Address proof of the Directors

- Authorization Letter

- Rental Agreement/Sale Deed/Lease Deed

- Electricity bill for office address proof

- Rental Agreement/Sale Deed/Lease Deed for additional place of business

- NOC

Attachments Required for Proprietorship

- PAN of the proprietor

- Address proof of the proprietor

- Passport size photo of proprietor

- Authorization Letter

- Rental Agreement/Sale Deed/Lease Deed

- Electricity bill for office address proof

- Rental Agreement/Sale Deed/Lease Deed for additional place of business

- NOC

Attachment Required for Partnership

- Certificate of firm

- Partnership deed

- PAN of the Firm

- PAN of the partners

- Passport size photo of Partners

- Address proof of the Partners

- Authorization Letter

- Rental Agreement/Sale Deed/Lease Deed

- Electricity bill for office address proof

- Rental Agreement/Sale Deed/Lease Deed for additional place of business

- NOC

What is the Government Fees that need to paid for Shop Act Registration in Bangalore ( Shop and Establishment Act) Registration in Bangalore

- If yours is a proprietorship (You are the one running the business) and you do not have any employee other than yourself you would need to pay a registration fee of INR 250

- In case there are between one and nine employees in your establishment you would need to part with INR 500

- . In case the number is between 10 and 19 you would have to pay INR 3000 as registration fees for a complete list find the table below

| Registration Fee | |

| No. of Employees | Fees (Rs.) |

| No Employees | 250/- |

| 1 to 9 Employees | 500/- |

| 10 to 19 Employees | 3000/- |

| 20 to 49 Employees | 8000/- |

| 50 to 99 Employees | 15000/- |

| 100 to 250 Employees | 30000/- |

| 251 to 500 Employees | 35000/- |

| 501 to 1000 Employees | 45000/- |

| 1000 Above Employees | 50000/- |

In case of any help or assistance in filing your Shop Act Registration in Bangalore, contact Virtual auditor support team on + 9513 939 333/080- 61935527 /mail us [email protected], our team will guide through the entire process and help you comply

EXACT OF LAW GOVERNING SHOP ACT ( THE KARNATAKA SHOPS AND COMMERCIAL ESTABLISHMENTS ACT 1961 AND RULES 1963 )

THE KARNATAKA SHOPS AND COMMERCIAL ESTABLISHMENTS ACT 1961 AND RULES 1963

1. ACT ENFORCEMENT, PURPOSE and APPLICATION: This act has been enforced from 01-03-1962 in karnataka state and time to time amendments are made.

2. This Act provides for the regulation of conditions of work and employment in Shops & commercial establishments in the State of Karnataka.

3. This Act applies to the areas notified by the Karnataka Government.

DEFINITIONS:

Shops: ‘shops’ means any premises where any trade or business is carried on or where services are rendered to customers and includes offices, storerooms, godowns, warehouses, whether in the same premises or otherwise, used in such connection with such trade or business, but does not include a commercial establishment or a shop attached to a factory.

Commercial Establishment: Commercial Establishment means a commercial or trading or banking or insurance establishment, an establishment or administrative service in which persons employed are mainly engaged in office work, a hotel, restaurant, boarding or eating house, a café or any other refreshment house, a theatre or any other place of public amusement or entertainment.

Owner: Owner means the person having charge of or owning or having ultimate control over the affairs of an establishment and includes members of the family of an employer, a manager, agent, other person acting in the general management and control of an establishment.

Employee: Employee means a person wholly or principally employed in or in connection with, any establishment whether working on permanent, periodical, contract or piece – rate wages or on commission basis, even though he receives no reward for his labour and includes an apprentice.

DUTIES OF OWNERS:

1. Registration of Organization:

- Each owner, within 30 days from starting the business shall submit application form in form ‘A’ to register his establishment.

- Registration certificate must be displayed on visible place inside the office premises.

- Registration certificate is valid for ‘5’ years period. Before the expiry of the period, renewal application to be submitted for the next period.

- It shall be the duty of an employer to notify to the registration authority, in the prescribed form, any change with respect to any information contained in his statement during registration/renewal within 15 days after the change. Ex. Change in address, change in ownership, change in number of employee etc.

- After closing the business of his establishment, should surrender the registration certificate to the registration authority.

Exemptions from Registration:

Following organizations are exempted from registration.

- Offices of, or under the central or state Government, or local authorities, except commercial undertaking.

- Any railway service, water transport service, postal, telegraph or telephone service, any system of public conservation or sanitation or any industry, or services like water, power, light to the public.

- Railway dining cars .

- Establishments for the treatment or care of the handicap or mentally unfit.

- Establishments of the food corporation of India.

- Offices of legal practitioners and medical practitioners in which not more than 3 persons are employed.

- Offices of bank.

2. Weekly Holiday:

Every establishment shall remain closed for one day of the week.

The employer shall fix such day in the beginning of the year and notify it to the registration authority and specify it in a notice prominently displayed in a conspicuous place inside the establishment. Instruction: Any employer is taking exemption from weekly holiday , shall fix different days as holiday for his establishment and shall obtain the weekly holiday break by submitting the report to the deputy labour commissioner.

Establishments exempted from weekly holiday:

Following establishments are exempted from weekly holiday.Medicine and Medical equipment sale.Club, Lodging and Hotel, Hostel, Hostel attached to school or college, Residential schools.Shops, Stalls and refreshment rooms at bustand and railway station.Hair cutting saloon.Shops dealing mainly in Meat, Fish, Egg, Milk and Dairy product(except ghee) Bread, Chocolate, Fresh ingredients, Confectionery, Ice cream and cooked food for sale, Fruits, Vegetables, Flowers ,raw fodder sales.Paan Beedi, Cigarette, Soft drink sales shop.Daily news paper, Weekly magazine sails shop and related office.Cinema, Theater, and other public Recreation centers.Petrol, Diesel for sale.Tan bodies.Exhibition Shops and Museum.Oil, Flour mill, Brick and Lime manufacturing industries.Copper, Brass, Container, Manufacturing firms.Information / Biotechnology information / Biological engineering related service.Organizations conducting research on infectious diseases.

3. working hours:

Any establishment shall not run its business before and after following hours.In Bangalore city; Morning before 6 am and Night after 9 pm.Other places ; Morning before 8 am and Night after 8 pm.Prohibitions and Exemptions of work:

1. No child, under 14 years shall be required or allowed to work in any establishment. 2. No women shall be required or allowed to work whether as an employee or otherwise in any establishment after 8 pm.

INSTRUCTION; IT/BT organizations can get permission to allow women to work after 8 pm by submitting Form ‘R’ with necessary information.

4. Employment and Regulation:

Every employer, employing any person in or in connection with his establishment shall issue an appointment order in form ‘P’.Every day, employee attendance shall be registered in form ‘T.The organizations having weekly holiday exemption, after taking continuous service of 6 days from any employee, shall give 7th day as mandatory holiday for him. In special cases 7th day can not be given as holiday, 11th day should be given as mandatory holiday.After each month salary shall be paid before 7th date of next month.Working period of any employee should not exceed 48 hours and 58 hours including extra working hours.End of the year, counting the working day of the employees for present year; 1 day per 20 days as earned leave and 1 day per 30 days as sick leave shall be calculated. This leave account shall be recorded in the format ‘F’ .Any employee who has completed 180 days service to the establishment can not be dismissed without prior notice.

5. Records management:

format ‘A’ ; for Establishment registration/Renewal/To report change of information.

format ‘P’ ; to fix the different day as the weekly holiday.

format ‘F’; to maintain leave records and

format ‘H’ ;to give the copy to the employee.

format ‘T’; to maintain daily attendance of employee.

format ‘R’; to get permission to allow women to work after 8 pm.

6. Submission of annual report:

Annual report ending with 31st December shall be submitted before 31st January of next year in the format ‘U’.

Employees’ Rights:

Every employee have rights to take weekly one day as compulsory holiday.Where an employee works in any establishment for extra hours in any day or any week, he shall in respect of such overtime work to be entitled to wages at twice the rate of normal wages.

Every employee shall be entitled to preserve earned leave for 40 days.Every employee shall be entitled to encash unavailed earned leaves.

An employee, removed or dismissed shall have a right of appeal to jurisdiction officer on the ground that there was no reasonable cause for the removal or dismissal.

Where an employee has been removed or dismissed without reasonable cause or without proof of misconduct is proved, the employee shall be entitled to get compensation as one month’s pay for every year of service.

APPLICATION OF OTHER ACTS:

Every employee have rights to take weekly one day as compulsory holiday.Where an employee works in any establishment for extra hours in any day or any week, he shall in respect of such overtime work to be entitled to wages at twice the rate of normal wages.

Every employee shall be entitled to preserve earned leave for 40 days.Every employee shall be entitled to encash unavailed earned leaves.

An employee, removed or dismissed shall have a right of appeal to jurisdiction officer on the ground that there was no reasonable cause for the removal or dismissal.Where an employee has been removed or dismissed without reasonable cause or without proof of misconduct is proved, the employee shall be entitled to get compensation as one month’s pay for every year of service.

APPLICATION OF OTHER ACTS:

1.Wage payment act of 1936

2.Minimum wage act 1948

3.The workmen’s compensation act 1923

4.Industrial dispute act of 1947

5.Grachuity payment act of 1970(Only when there is more than 10 employees)

6.Bonus payment act of 1965(Only when there is more than 10 employees )

MINIMUM WAGES:

Minimum wages to the labours working in shops and commercial establishment has been fixed by the Karnataka state Government; first time in the year 1988.Time to time revision is done. Presently 2003 revised notification is in force. For more information view the department website. www.labour.kar.nic.in

AUTHORITY TO IMPLIMENT THE ACT:

To enforce this act labour commissioner will be the “Chief Inspector”. It is notified that Inspector/Senior Inspector as “Inspector” and all department level authorities as “Additional Inspector”.

POWER DEVOLUTION:

Responsibilities are delegated among the department administration hierarchy.

1.Labour/Senior Labor Inspector: Authority for registration/Renewal of establishment.

2.Assistant Labour Commissioner: Appealing Authority to enquire the employee dismissal case.

3.Deputy Labour Commissioner: Authority for Weekly holiday exemption, Woman working hour exemption.