GST Registration in Bangalore

Are you seeking GST registration in Bangalore? Look no further! Our team of experts has compiled a thorough guide to help you through every step of the process. This article covers everything you need to know about GST registration in Bangalore, from eligibility criteria to required documents, online application process, and more. Let’s dive in!

Table of Contents

- Introduction to GST Registration

- Who Needs GST Registration in Bangalore?

- Documents Required for GST Registration

- Step-by-Step Process for GST Registration in Bangalore

- Benefits of GST Registration in Bangalore

- Penalties for Non-Compliance

- FAQs

Introduction to GST Registration

Goods and Services Tax (GST) is a comprehensive, indirect tax levied on the supply of goods and services in India. It has replaced various indirect taxes like VAT, Service Tax, and Excise Duty. GST registration is mandatory for certain businesses in India, and obtaining it is a crucial step to ensure compliance with the law.

Who Needs GST Registration in Bangalore?

The following entities are required to obtain GST registration in Bangalore:

- Businesses with a turnover exceeding INR 20 lakhs (INR 10 lakhs for North-Eastern States, Himachal Pradesh, and Uttarakhand).

- Non-resident taxable persons.

- Casual taxable persons.

- E-commerce operators and suppliers.

- Input service distributors.

- Persons liable to pay tax under reverse charge.

- Agents of a supplier and aggregator.

Documents Required for GST Registration

To apply for GST registration in Bangalore, you will need to provide the following documents:

- PAN card of the business or applicant.

- Aadhaar card of the proprietor, partner, or director.

- Address proof of the principal place of business (e.g., electricity bill, rent agreement, etc.).

- Bank account details and canceled cheque.

- Digital signature or e-signature of the authorized signatory.

- Passport-sized photographs of the proprietor, partner, or director.

- Letter of Authorization or Board Resolution for authorized signatories.

Step-by-Step Process for GST Registration in Bangalore

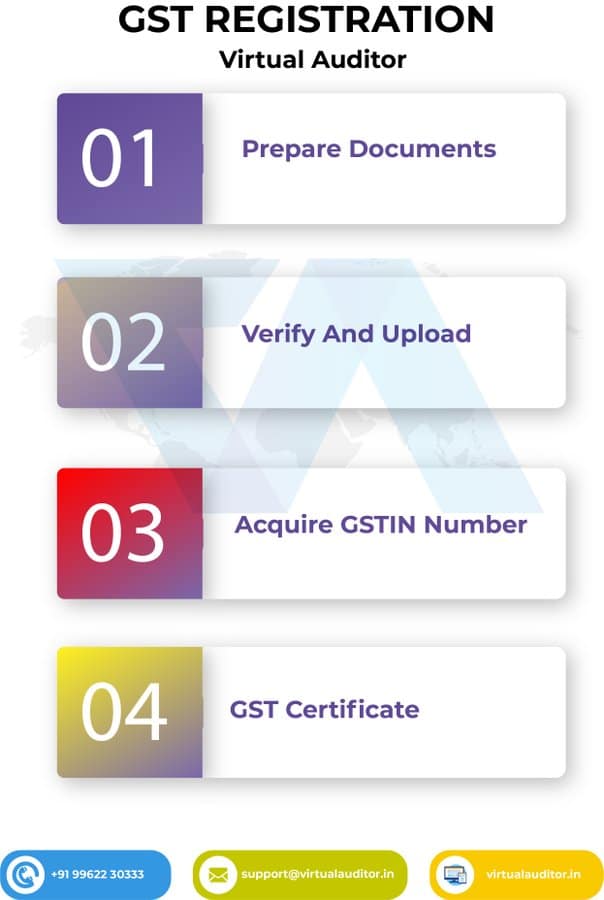

Follow these steps to apply for GST registration in Bangalore:

- Visit the official GST portal at https://www.gst.gov.in/.

- Click on “Services” in the top menu, followed by “Registration” and “New Registration.”

- Complete the “Part A” section by providing your PAN, email, and mobile number. You will receive a One Time Password (OTP) for verification.

- After verifying the OTP, you will receive a Temporary Reference Number (TRN) via email and SMS.

- Use the TRN to log in and complete the “Part B” section by providing the required details and uploading the necessary documents.

- Submit the application after completing the “Part B” section.

- Once your application is successfully submitted, you will receive an Application Reference Number (ARN) via email and SMS.

- Track your application status using the ARN on the GST portal.

- Upon approval, you will receive your GST Registration Certificate (Form GST REG-06) on the portal.

Benefits of GST Registration

Obtaining GST registration in Bangalore offers several benefits, including:

- Legal recognition as a supplier of goods and services.

- Eligibility to claim Input Tax Credit (ITC) on the purchase of goods and services, which can be utilized to offset GST liability.

- Ability to collect GST from customers and contribute to the government’s revenue.

- Access to a streamlined and simplified taxation system that reduces the burden of multiple indirect taxes.

- Enhanced credibility and trustworthiness among customers and suppliers.

Penalties for Non-Compliance

Failure to obtain GST registration or comply with GST laws can lead to severe penalties, including:

- A penalty of 10% of the tax amount due or INR 10,000, whichever is higher, for not registering or providing false information during registration.

- A penalty of 100% of the tax amount due for deliberate tax evasion or fraud.

- A late fee of INR 25 per day for regular taxpayers and INR 10 per day for taxpayers under the Composition Scheme, subject to a maximum of INR 5,000.

It’s essential to maintain compliance with GST laws to avoid such penalties and safeguard your business.

FAQs

Q: Can I apply for GST registration offline?

A: No, the GST registration process is entirely online. You need to visit the official GST portal (https://www.gst.gov.in/) to apply for registration.

Q: How long does it take to obtain GST registration in Bangalore?

A: The processing time for GST registration in Bangalore usually takes around 7-10 working days from the date of submitting the application.

Q: What is the validity period of GST registration?

A: GST registration is valid indefinitely, as long as you comply with the GST laws and file returns regularly. However, for casual and non-resident taxable persons, the registration is valid for 90 days from the date of issuance and can be extended upon request.

Q: Is it mandatory to file GST returns even if there are no transactions during a particular period?

A: Yes, it is mandatory to file GST returns, known as ‘Nil returns,’ even if there are no transactions during a specific period. Failure to file returns can result in penalties.

We hope this comprehensive guide helps you navigate the process of obtaining GST registration in Bangalore with ease. Remember to maintain compliance with GST laws to avoid penalties and safeguard your business.

Key Takeaways

By now, you should have a clear understanding of the GST registration process in Bangalore, its benefits, and the importance of compliance. Here are some key takeaways:

- Ensure that you obtain GST registration if your business falls under the eligibility criteria.

- Keep the required documents handy while applying for GST registration.

- Regularly file your GST returns to maintain compliance and avoid penalties.

- Update your GST registration details in case of any changes in your business information.

- File your annual GST return to provide a summary of your business transactions for the financial year.

With this knowledge at your disposal, you can confidently navigate the GST registration process and maintain compliance, ensuring the smooth functioning of your business .