Form DIR-3 KYC – KYC of Directors: Application Procedure As a director of a company in India, it’s essential to be aware of your compliance responsibilities. One such crucial obligation is the filing of the Form DIR-3 KYC, a mandatory Know Your Customer (KYC) process for company directors. In this blog post, we’ll delve into […]

Category Archives: Companies Act Ammendment

Director Disqualification Relief by Madras High Court Are you one the director whose DIN was disqualified by MCA, as part of Director Disqualification exercise ? Are you looking for Director Disqualification Relief ? Are you looking for relief form Director disqualification? Are you not able to form a new company registration or get appointed as director in […]

CERTIFICATE OF COMMENCEMENT OF BUSINESS FORM INC 20A Certificate of Commencement of Business is introduced back by Ministry of Corporate Affairs has added a new form Form INC 20A after the company Registration file Form INC 20A form specified to obtain Certificate of Commencement of Business, by declaring that the paid up share capital has […]

UNDERSTANDING MOA & AOA OF A PRIVATE LIMITED COMPANY All entrepreneurs/startups when they registered a new company are bombarded with gorgons like MOA & AOA ( Memorandum of Association & Articles of Association) Lets get into the legalities of the both the terms , for startups we support them and handhold them as to the […]

eForm MSME 1 Government (MCA) releases a compliance schedule to ensure MSME payments MSME 1, ( eForm MSME Form 1) the new tool to crack on defaults to small companies The government has decided to crack down on companies delaying payments to small businesses by insisting that all defaulting entities mandatory provide it details of […]

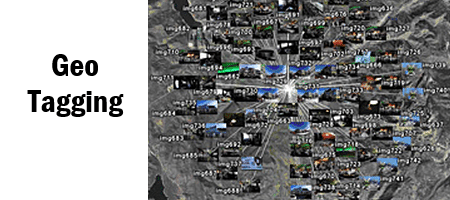

E-0Form Active INC 22A (Active Company Tagging Identities and Verification )Geo-Tagging of the registered office of the companies E-Form Active INC 22A a new form to file to the verity register office, the form has been issued, start filing to avoid penalties and avoid disqualification and other consequences After the DIR 3 KYC drive for […]

Loan to Directors In Private Limited Company (Amendments) Companies are formed by the promoters who intern become the directs understanding Loans to Directors under the companies act is very cirtical Loans to Directors is governed by Section 185 of the Companies Act 2013, which was amended by the Companies ( Amendment ) Act 2017. This […]

RoC Filing changes in disclosures latest amendments The Ministry of corporate affairs vide CIRCULAR DATE 31ST JULY 2018, has introduced RoC Filing changes in disclosures latest amendments for Small companies and One person companies in their Boards Report the complete changes are discussed below in detail What is RoC filing ( Annual Filings)? RoC filing is the process of […]