IBBI Registered Valuer in Bangalore: A Comprehensive Guide to Business and Share Valuation

If you are a start-up or an established business in Bangalore looking for a reliable valuation of your shares, property, or assets, you need an IBBI Registered Valuer to assist you. In this blog post, we will guide you through the importance of choosing an IBBI Registered Valuer in Bangalore, the process, and how to find the right valuer for your business.

Table of Contents

- Why Do You Need an IBBI Registered Valuer in Bangalore?

- When is a Valuation by an IBBI Registered Valuer Required?

- How to Find a Reputable IBBI Registered Valuer in Bangalore?

- Valuation Process by an IBBI Registered Valuer

- Benefits of Hiring an IBBI Registered Valuer in Bangalore

- FAQs about IBBI Registered Valuers

Why Do You Need an IBBI Registered Valuer in Bangalore?

As per the regulations set by the Insolvency and Bankruptcy Board of India (IBBI), only Registered Valuers holding a valid certificate of practice under Securities and Financial Assets (S&FA) can conduct valuations under the applicable provisions of the Companies Act, 2013. Choosing an IBBI Registered Valuer ensures that your business valuation is accurate, transparent, and compliant with the latest regulatory requirements.

When is a Valuation by an IBBI Registered Valuer Required?

There are several situations when a valuation by an IBBI Registered Valuer is necessary, such as:

- Issuing shares under private placement or further issue of shares

- Non-cash transactions involving directors

- Corporate debt restructuring

- Mergers or amalgamations

- Exit opportunity for minority shareholders

- Voluntary winding up of the company

How to Find a Reputable IBBI Registered Valuer in Bangalore?

To find a reputable IBBI Registered Valuer in Bangalore, follow these steps:

- Check the IBBI’s official website for a list of registered valuers in Bangalore.

- Seek recommendations from business associates or industry peers who have experience working with registered valuers.

- Research online reviews and testimonials to understand the reputation of the valuer.

- Compare the fees and services offered by different valuers.

- Interview potential valuers to assess their knowledge, experience, and communication skills.

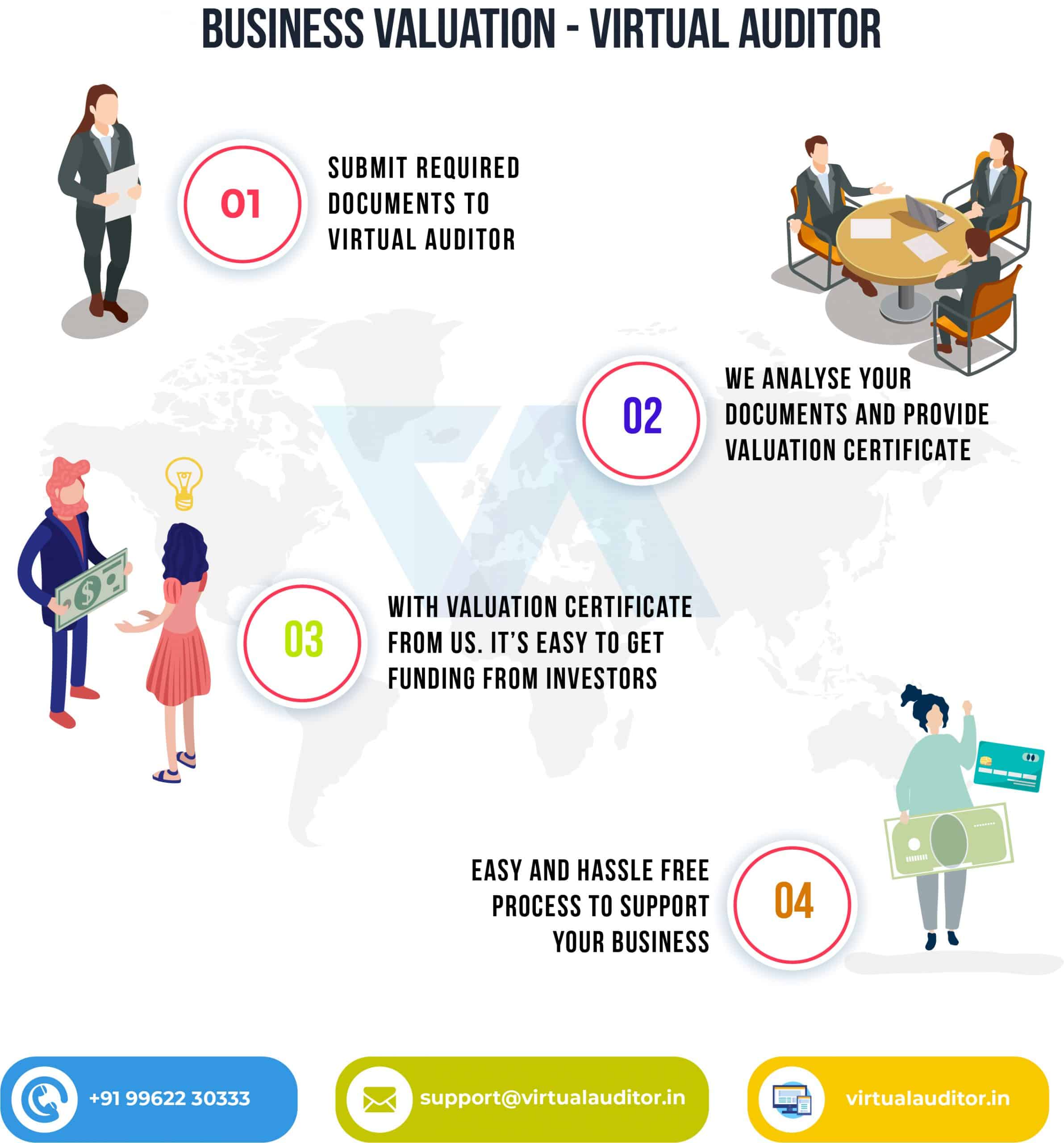

Valuation Process by an IBBI Registered Valuer

The valuation process by an IBBI Registered Valuer typically involves the following steps:

- Understanding the purpose of valuation and gathering relevant information about the company.

- Analyzing the company’s financial statements, assets, liabilities, and operations.

- Selecting the appropriate valuation method based on the purpose and nature of the business.

- Performing the valuation using the chosen method and considering market conditions, industry trends, and other relevant factors.

- Preparing a comprehensive valuation report that includes the rationale behind the valuation, assumptions made, and the final valuation.

- Presenting the valuation report to the client and answering any questions or concerns they may have.

Benefits of Hiring an IBBI Registered Valuer

There are several benefits of hiring an IBBI Registered Valuer in Bangalore for your business:

- Compliance with regulatory requirements, ensuring that your business valuation is legally valid.

- Accuracy and transparency in the valuation process, as registered valuers adhere to strict guidelines and follow best practices.

- Expertise in various valuation methods, which helps in selecting the most suitable method for your specific business needs.

- Professionalism and confidentiality, as registered valuers are bound by a code of conduct and maintain the highest standards of integrity.

- Assistance in negotiating transactions and making informed decisions, as a well-prepared valuation report can provide valuable insights into your business’s worth and potential.

FAQs about IBBI Registered Valuers

1. How much does it cost to hire an IBBI Registered Valuer in Bangalore?

The cost of hiring an IBBI Registered Valuer in Bangalore depends on various factors, such as the complexity of the business, the scope of work, and the valuer’s experience. It’s essential to discuss the fees and payment terms with the valuer before engaging their services.

2. How long does the valuation process take?

The duration of the valuation process depends on the complexity of the business, the availability of information, and the valuer’s workload. On average, a valuation process may take anywhere from a few weeks to a couple of months.

3. Can I rely on the valuation provided by an IBBI Registered Valuer?

Yes, you can rely on the valuation provided by an IBBI Registered Valuer, as they are trained and certified professionals who follow stringent guidelines and best practices in the industry. They are also subject to ongoing audits and quality reviews by the IBBI.

4. Do I need an IBBI Registered Valuer for small businesses or start-ups?

While it may not be mandatory for small businesses or start-ups to engage an IBBI Registered Valuer, it is highly recommended. A professional valuation can provide valuable insights into your business’s worth, help you negotiate transactions, and ensure compliance with regulatory requirements, if applicable.

5. Can an IBBI Registered Valuer help me with mergers and acquisitions?

Yes, an IBBI Registered Valuer can play a crucial role in mergers and acquisitions by providing an unbiased and accurate valuation of the companies involved. This information is essential in determining the fair exchange ratio for the transaction and ensuring that all parties receive a fair deal.

6. What are the qualifications of an IBBI Registered Valuer?

An IBBI Registered Valuer must hold a valid certificate of practice and meet the necessary educational and experience requirements as prescribed by the Insolvency and Bankruptcy Board of India (IBBI). They must also successfully complete the valuation examination conducted by the IBBI and adhere to a code of conduct and ethics.

7. How do I verify if a valuer is IBBI Registered?

You can verify if a valuer is registered with the IBBI by visiting the IBBI website and searching for the valuer’s name or registration number in the registered valuers directory.

In conclusion, hiring an IBBI Registered Valuer in Bangalore is crucial for businesses seeking accurate and transparent valuation services. By understanding the importance, process, and benefits of engaging an IBBI Registered Valuer, you can make an informed decision and ensure that your business valuation complies with the regulatory requirements and reflects your business’s true value.

For Useful service choose the services listed below

IBBI Registered Valuer in Mumbai

IBBI Registered Valuers in India

Registered Valuer for Valuation of Shares>