IBBI Registered Valuer in Mumbai: A Comprehensive Guide to Business and Share Valuation

Are you a business owner or startup founder in Mumbai looking for a reliable valuation of your shares, property, or assets? Look no further! In this blog post, we will walk you through the importance of choosing an IBBI Registered Valuer in Mumbai, the process, and how to find the right valuer for your business needs.

Table of Contents

- Why Do You Need an IBBI Registered Valuer in Mumbai?

- When is a Valuation by an IBBI Registered Valuer Required?

- How to Find a Reputable IBBI Registered Valuer in Mumbai?

- Valuation Process by an IBBI Registered Valuer

- Benefits of Hiring an IBBI Registered Valuer in Mumbai

- FAQs about IBBI Registered Valuers

Why Do You Need an IBBI Registered Valuer in Mumbai?

As per the regulations set by the Insolvency and Bankruptcy Board of India (IBBI), only Registered Valuers holding a valid certificate of practice under Securities and Financial Assets (S&FA) can conduct valuations under the applicable provisions of the Companies Act, 2013. Choosing an IBBI Registered Valuer ensures that your business valuation is accurate, transparent, and compliant with the latest regulatory requirements.

When is a Valuation by an IBBI Registered Valuer Required?

There are several situations when a valuation by an IBBI Registered Valuer is necessary, such as:

- Issuing shares under private placement

- Merger and acquisition deals

- Corporate debt restructuring

- Employee stock option plans

- Selling or purchasing assets involving company directors

How to Find a Reputable IBBI Registered Valuer in Mumbai?

Finding a reputable IBBI Registered Valuer in Mumbai can be a daunting task. Here are some tips to help you:

- Check the IBBI website for a list of Registered Valuers in Mumbai

- Seek recommendations from your business network, friends, or family members

- Conduct online research to find valuers with positive reviews and testimonials

- Look for valuers with relevant industry experience and expertise

- Contact multiple valuers to compare their services, fees, and availability

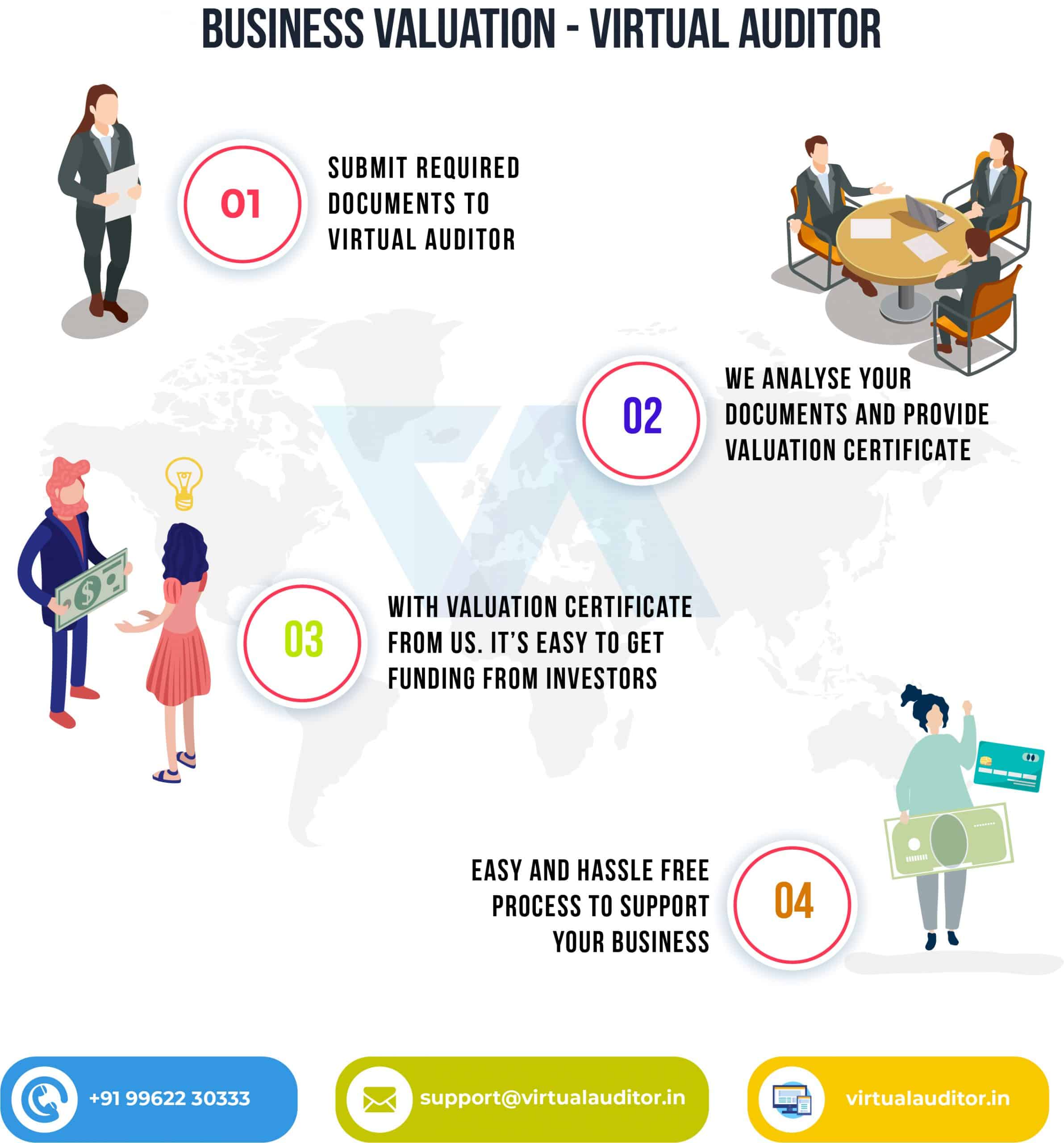

Valuation Process by an IBBI Registered Valuer

The valuation process by an IBBI Registered Valuer typically includes the following steps:

- Understanding your business and the purpose of the valuation

- Collecting financial and non-financial data related to your business

- Selecting an appropriate valuation method, such as discounted cash flow, market multiples, or asset-based approach

- Analyzing the data and making necessary adjustments

- Arriving at a fair valuation figure

- Preparing a detailed valuation report that complies with regulatory requirements

Benefits of Hiring an IBBI Registered Valuer in Mumbai

There are several benefits of hiring an IBBI Registered Valuer, such as:

- Accurate and unbiased valuation: Registered valuers are trained to provide an accurate and unbiased valuation of your business or assets, ensuring you have a fair market value.

- Compliance with regulatory requirements: IBBI Registered Valuers adhere to the latest regulatory requirements, ensuring your valuation is compliant with the Companies Act, 2013, and other applicable laws.

- Enhanced credibility: A valuation report from an IBBI Registered Valuer adds credibility to your business, making it more attractive to investors, lenders, and potential acquirers.

- Expertise in various valuation methods: Registered valuers have expertise in various valuation methods, ensuring that the most appropriate method is used for your business or assets.

- Access to a network of professionals: Registered valuers often have a network of professionals, including chartered accountants, company secretaries, and lawyers, who can provide additional support for your business.

FAQs about IBBI Registered Valuers

1. What is the cost of hiring an IBBI Registered Valuer in Mumbai?

The cost of hiring an IBBI Registered Valuer in Mumbai depends on various factors, such as the complexity of your business, the size of your assets, and the valuer’s experience. It is recommended to contact multiple valuers and compare their fees and services before making a decision.

2. How long does it take to complete a valuation by an IBBI Registered Valuer?

The time taken to complete a valuation depends on the complexity of your business, the availability of data, and the valuer’s workload. On average, a valuation may take anywhere between two weeks to a month.

3. Can I rely on a valuation report prepared by an IBBI Registered Valuer for legal proceedings?

Yes, a valuation report prepared by an IBBI Registered Valuer is considered credible and can be used as evidence in legal proceedings, as long as it complies with the regulatory requirements and valuation standards.

4. Can I hire an IBBI Registered Valuer from another city?

Yes, you can hire an IBBI Registered Valuer from another city. However, it is recommended to hire a local valuer as they have better understanding of the local market conditions and can provide more accurate valuation.

In conclusion, hiring an IBBI Registered Valuer in Mumbai can be a valuable investment for your business. By ensuring an accurate and compliant valuation, you can confidently navigate various business situations and make informed decisions. Follow our guide to find the right valuer and enjoy the benefits that come with professional valuation services. For Useful service choose the services listed below

IBBI Registered Valuer in Bangalore

IBBI Registered Valuers in India

Registered Valuer for Valuation of Shares>