eForm MSME 1 Government (MCA) releases a compliance schedule to ensure MSME payments

MSME 1, ( eForm MSME Form 1) the new tool to crack on defaults to small companies The government has decided to crack down on companies delaying payments to small businesses by insisting that all defaulting entities mandatory provide it details of outstanding money with reasons by April or face action that could result in imprisonment up to 6 months or fine of not less than Rs 25,000 up to Rs 3 lakh.

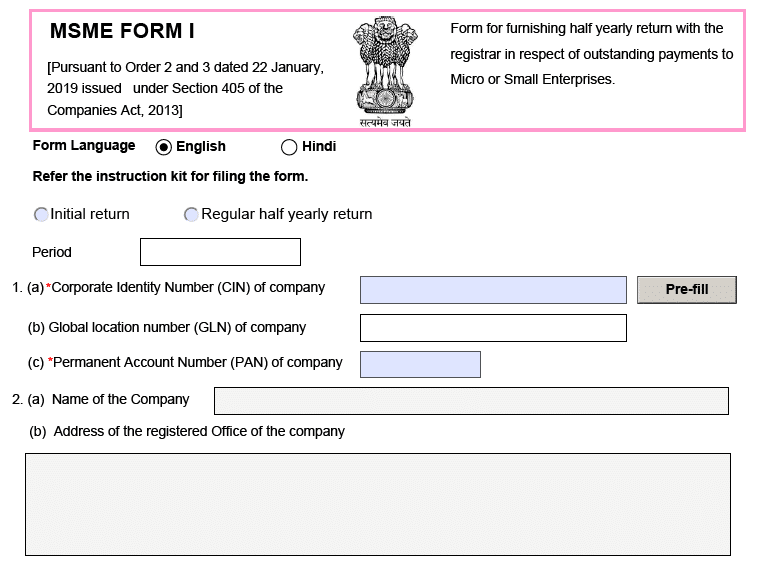

The MSME form was introduced by the government on the Order dated 22 January 2019 issued under Section 405 of the Companies Act, 2013, to support the Micro and Small Enterprises in receiving their payments due from their beneficiaries, without any default. However, the form is not applicable to Medium Enterprises.

Applicability of the Form MSME 1

This form requires the specified companies (Companies which availed goods/services from the MSMEs) to state the details of payments which have been outstanding to the MSEs for more than 45 days from the date of acceptance.

Micro and Small enterprise Classification for the Purpose of Form MSME 1

A micro and small enterprise may include a HUF, an AOP, a co-operative society, a partnership firm or a public/private company. The classification of Micro or Small Enterprise depends upon their investment in Plant & Machinery in case of Manufacturing Sector or in Equipment in the case of Service sector.

| MICRO | SMALL | |

| Manufacturing Enterprises | Rs 2,500,000 | Less than Rs 50,000,000 |

| Service Enterprises | Less than Rs 10,00,000 | Less than Rs 20,000,000 |

Required details for Form MSME 1

The specified companies have to inspect if his supplier falls under the MSE and is registered. If so, then the particulars of the liability needs to be filled which shall include:

- The total amount due to the MSEs as on 22nd of January, 2019

- Name of the suppliers

- PAN of the suppliers

- Dates on which the payment became due

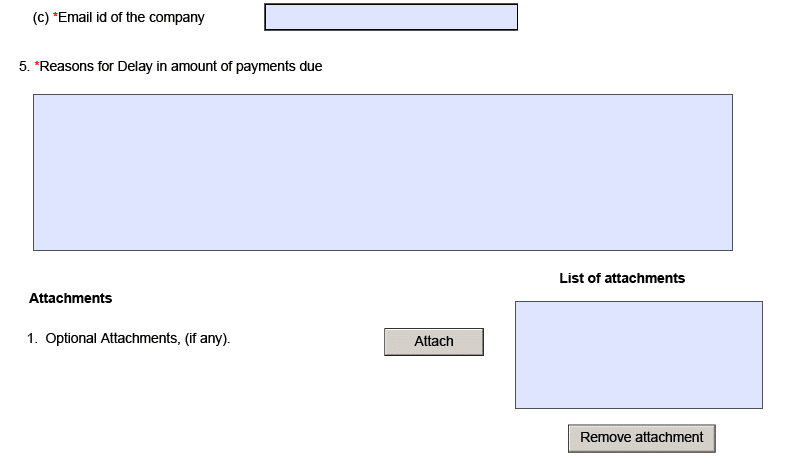

- Reasons for such delay in payment

Due Dates for eform MSME 1

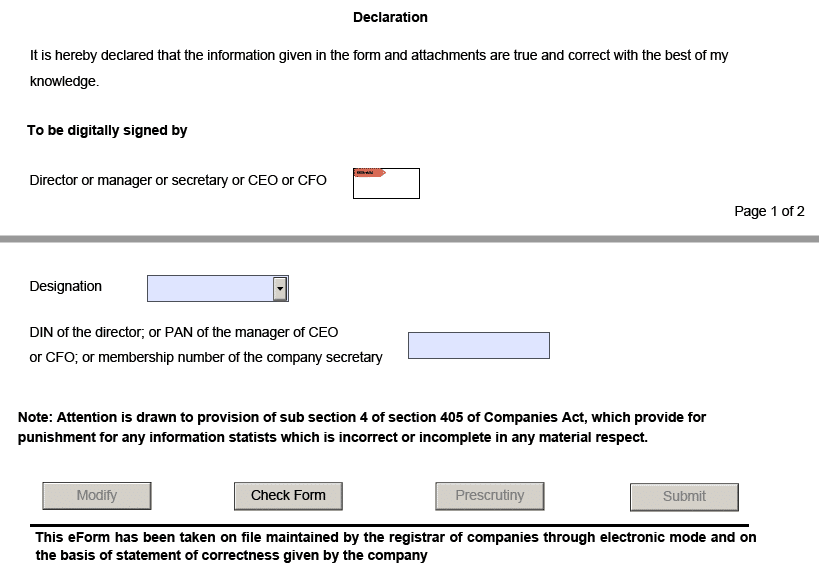

The filing of the returns comprises of two parts, for initial returns and half yearly returns.

The initial return form needs to be filed as a one-time return, and the due date for which is 30 days from the date of form made available by the MCA, which make the current due date as 31st of May, 2019.

The half yearly return needs to be filed in regular half year intervals by the companies for which the due date is 30 days from the end of half year, which are 30th April and 31st October.

Penalty for Non compliance of Forms MSME 1

In case of default to comply with the provisions above, the penal fee will be applicable as follows:

For companies – A maximum of Rs. 25,000

For the office in default (Director/CEO/CS) – Rs. 25,000 to Rs. 30,000 or imprisonment up to 6months or both

Conclusion

Given the strictness of the government, The tightening of the noose around the companies comes after a major crackdown by the government on directors and shell companies through DIR 3 KYC and INC 22A, this is a good move considering the interest of MSME segment has been ignored and large companies delay the payment without any reason , this would benefit all MSME registered in India,

Call it an election gimmick or real transformation, this step was necessary to protect the small and marginal MSME entrepreneurs