What does Authorised Capital and Paid Capital mean? Confused between authorised capital and paid up capital in the process of your company registration , in this we will try and understand the difference between Authorised Capital and Paid Up Capital What does Authorised Capital and Paid Capital mean In Company Law, the “Capital” is the share […]

Category Archives: Company Law Compliance

Company Law

Post incorporation compliance for a private limited company You have successfully completed your company registration now its time to comply with applicable regulation and the law of the land, Post incorporation compliance for private limited company cannot be ignored or taken lightly the consequences and the penalties are high In civil jurisprudence, the term used […]

Companies Fresh start scheme 2020, How to save penalties! Companies Fresh start scheme 2020 COVID 19 has brought in some major changes to way compliance happen in the country this the best chance to get all the compliance in order The penalty for not Fling of RoC Returns/Annual Returns is running from Rs 100 per […]

SBO (Significant Beneficial Owner) Introduction SBO BEN 2, Form BEN 2, The Ministry of Corporate Affairs has issued the companies amendment (Significant Beneficial Owner) rule 2019. The new law not only provides a clearer definition for an individual or entity as the significant Business Owner of the company. But also lays down a detailed and elaborate procedure for […]

Procedure for Appointment of Director Director Appointment as Per Companies Act 2013 Director Appointment also referred to an appointment of a director in private limited company, as per company act 2013, is applicable. in the case where a company is already registered and you are being appointed to the Board Process […]

E-0Form Active INC 22A (Active Company Tagging Identities and Verification )Geo-Tagging of the registered office of the companies E-Form Active INC 22A a new form to file to the verity register office, the form has been issued, start filing to avoid penalties and avoid disqualification and other consequences After the DIR 3 KYC drive for […]

Loan to Directors In Private Limited Company (Amendments) Companies are formed by the promoters who intern become the directs understanding Loans to Directors under the companies act is very cirtical Loans to Directors is governed by Section 185 of the Companies Act 2013, which was amended by the Companies ( Amendment ) Act 2017. This […]

RoC Filing changes in disclosures latest amendments The Ministry of corporate affairs vide CIRCULAR DATE 31ST JULY 2018, has introduced RoC Filing changes in disclosures latest amendments for Small companies and One person companies in their Boards Report the complete changes are discussed below in detail What is RoC filing ( Annual Filings)? RoC filing is the process of […]

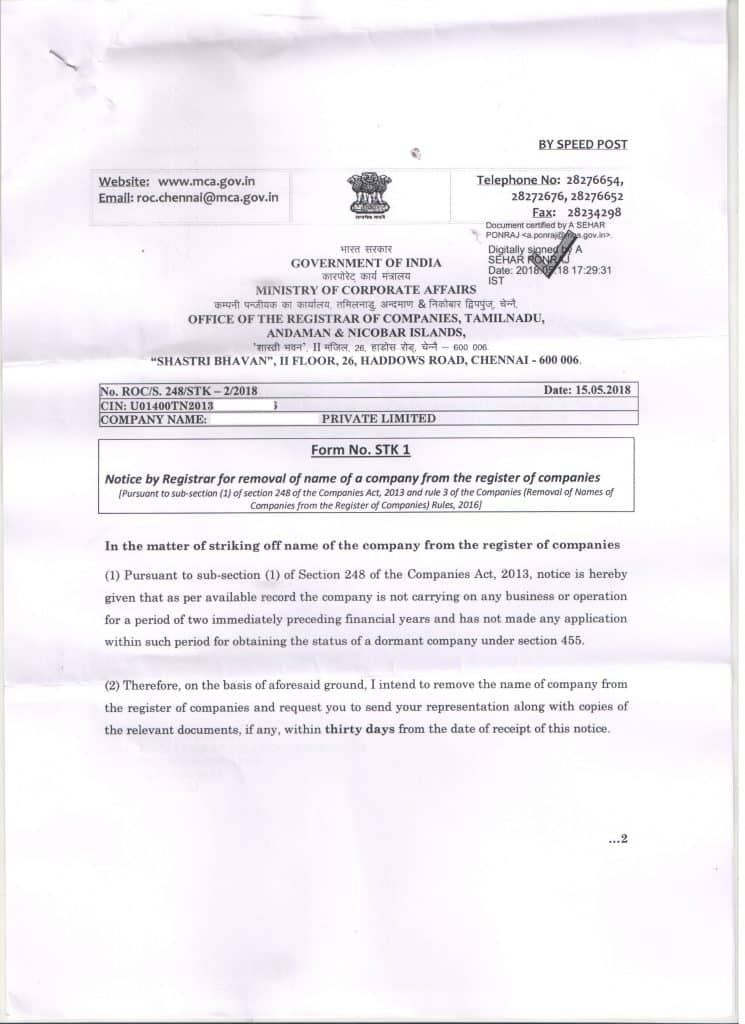

UNDERSTANDING NOTICE OF STRIKE OFF(LLP) AND REMEDIES AVAILABLE You have started your LLP and have started running it, without fully understanding the compliance requirements and one fine day you receive a NOTICE OF STRIKE OFF(LLP) for your LLP Do you know how many LLP’s have received notice of NOTICE OF STRIKE OFF(LLP)? Well, more than 3000 […]

HOW TO REPLY TO STRIKE OFF NOTICE ISSUED BY ROC? You have started a private limited company and started your business or you were thinking about executing a project in the future, suddenly one fine day you receive a letter and mail captioned STRIKE OFF NOTICE u/s 248(1) from ROC Do you know how many […]