Valuation Certificate: A Comprehensive Guide for Indian Businesses

Ever wondered how a company’s worth or an asset’s value is accurately determined? The answer lies in a Valuation Certificate. Let’s dive into the intricate world of valuation and understand its significance in the Indian context.

Table of Contents

- Introduction

- What is a Valuation Certificate?

- The Importance of Valuation Certificate

- The Valuation Process

- Who issues a Valuation Certificate?

- Legal Requirements in India

- How to Obtain a Valuation Certificate?

- Conclusion

- Frequently Asked Questions

Introduction

Picture this. You’re an entrepreneur with a thriving business. You’ve nurtured it from a fledgling startup to a profitable venture. Now, you’re planning to take the next big leap—maybe bring in investors, merge with another company, or even sell. But before any of that, you need to answer one critical question: “What is the value of your business?” This is where a Valuation Certificate comes into play.

What is a Valuation Certificate?

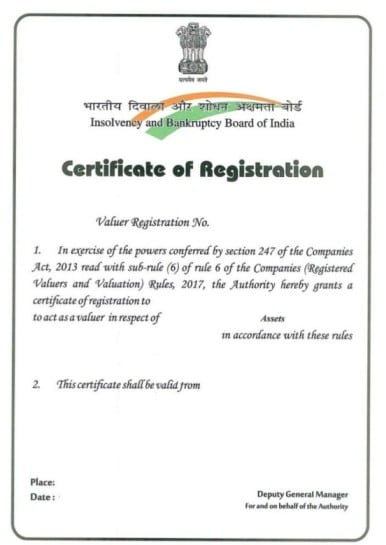

In its simplest terms, a Valuation Certificate is a document that establishes the worth of a company or an asset. It is issued by a registered valuer after conducting a thorough valuation process. The certificate provides an authoritative and unbiased estimate of the value, often used as a statutory requirement under the Companies Act and RBI Laws in India.

The Importance of Valuation Certificate

Whether you’re negotiating with potential investors, planning a merger or acquisition, or even during statutory reporting—knowing the accurate value of your company is crucial. And the Valuation Certificate does just that. It not only presents the financial health of your business but also helps determine future strategic decisions.

The Intricacies of the Valuation Process

The process to obtain this important document is meticulous and requires the expertise of a qualified valuer. It begins with an in-depth analysis of the company’s financial statements, including assets, liabilities, income, and expenses.

The valuer also takes into consideration the market conditions, industry trends, and the company’s operational efficiency. They may also consider intangible aspects such as brand value, customer loyalty, and market positioning.

Upon completion of this thorough evaluation, the valuer provides the company with a detailed report, which includes the value of the company or asset in question.

Choosing the Right Valuer

Not all valuers are created equal. When choosing a valuer, businesses should consider their qualifications, experience, reputation, and the methodologies they use for valuation. An effective valuer should be able to offer a clear and detailed explanation of the valuation process and provide a comprehensive and understandable report.

Who issues a Valuation Certificate?

In India, only registered valuers—professionals who have passed the Valuation Standards of ICAI (Institute of Chartered Accountants of India) or equivalent—can issue a Valuation Certificate. They bring a wealth of experience, knowledge, and expertise, ensuring the valuation is conducted objectively and professionally.

Impact of Valuation Certificates on Businesses

The relevance of a Valuation Certificate in a business context cannot be overstated. The certificate’s primary function is to provide an authoritative evaluation of a company’s worth. However, its impact extends far beyond this basic function.

When a business seeks funding or investment, the valuation figure plays a crucial role. It helps investors to understand the worth of the company, guiding their decision-making process. The certificate can provide the necessary confidence for investors to commit their resources to a venture.

Additionally, the certificate can influence strategic decisions within the company. For instance, it can guide leadership in matters of mergers and acquisitions, helping to determine whether such moves are financially feasible or beneficial.

Legal Requirements in India

As per Indian law, especially under the Companies Act and RBI regulations, a Valuation Certificate is a must for various transactions. These include share buyback, mergers and acquisitions, capital gains tax computation, and more.

How to Obtain a Valuation Certificate?

Securing a Valuation Certificate in India is a meticulous process that requires careful planning and preparation. Here are the steps you need to follow:

- Select a Registered Valuer: The first step is to find a valuer who is registered under the Companies Act, 2013. A list of registered valuers can be found on the official website of the Ministry of Corporate Affairs.

- Provide Necessary Information: The valuer will need information about your company’s financial health, assets, liabilities, market conditions, and other pertinent data. Ensure that you provide accurate and complete data.

- Valuation Process: The valuer will then conduct the valuation using appropriate methodologies. This process can take time, depending on the complexity of your company’s financial structure.

- Issue of Valuation Certificate: Upon successful completion of the valuation, the valuer will issue a Valuation Certificate stating the estimated value of your company or asset.

Conclusion

The Valuation Certificate is an essential document for businesses in India, considering the stringent regulatory requirements under the Companies Act and RBI Laws. From facilitating strategic business decisions to meeting statutory requirements, the certificate plays a significant role in the Indian business landscape. Therefore, it’s essential for entrepreneurs to understand its value, the process involved, and the importance of working with registered valuers.

Frequently Asked Questions

1. What is a Valuation Certificate?

A Valuation Certificate is a document issued by a registered valuer that determines the worth of a company or asset. It’s often used to meet statutory requirements under the Companies Act and RBI Laws in India.

2. Why is a Valuation Certificate important?

A Valuation Certificate is crucial for several reasons. It helps determine the value of a company or asset, which is essential during negotiations with potential investors, mergers and acquisitions, and statutory reporting.

3. Who can issue a Valuation Certificate?

In India, a Valuation Certificate can be issued by registered valuers, who have passed the Valuation Standards of ICAI (Institute of Chartered Accountants of India) or equivalent.

4. How can I obtain a Valuation Certificate?

To obtain a Valuation, you need to engage a registered valuer, provide necessary information about your company or asset, and allow the valuer to conduct the valuation process. Upon completion of the valuation, the valuer will issue the certificate.

5. Is a Valuation Certificate mandatory under Indian law?

Yes, a Valuation Certificate is a statutory requirement under the Companies Act and RBI regulations for various transactions such as share buyback, mergers and acquisitions, capital gains tax computation, and more.

Final Thoughts

As we have seen, the Valuation Certificate plays a significant role in the business world. It provides a credible reference point for a company’s worth, impacting investment decisions, strategic planning, and compliance with statutory requirements. By understanding its importance and the process involved in obtaining it, businesses can better navigate their financial landscape.