How to Comply with The Banning of Unregulated Deposit Schemes Ordinance 2019 ! Unsecured loans in the Books of account

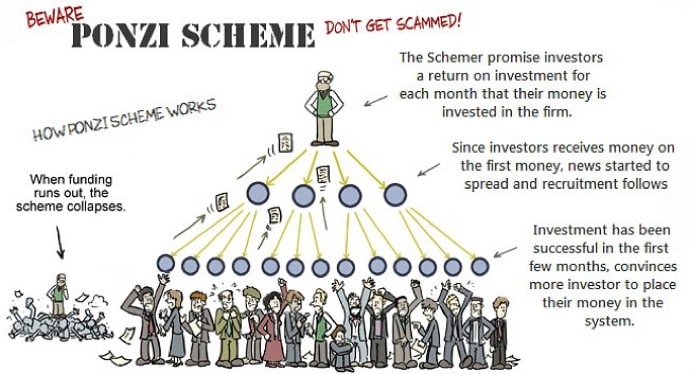

Banning of Unregulated Deposit Schemes Ordinance 2019 is a new compliance mechanism introduced by Government of India to curb black money generation and distribution and help small investor from Ponzi schemes

Do you have Unsecured loans in the Books of account received from third parties ?

If the answer is affirmative yes, then you need to worry and understand How to comply with new diktat the Banning of Unregulated Deposit Schemes Ordinance 2019 !

The Government has issued The Banning of Unregulated Deposit Schemes Ordinance 2019 on 21.02.2019 to stop Ponzi schemes. Pursuant to this ordinance now any Individual or group of individuals can’t take any deposit or loan from any person other than relatives and Partnership firm can take deposit or loan from relatives of partner or partners only.

Types of Ponzi Schemes

Why was Banning of Unregulated Deposit Schemes Ordinance 2019 ?

The Ordinance was to curb black money flow and to stop the mechanism of Money Laundering conversion of Black Money into to white by bring into the legal Channels ,

First Step taken was loan taken by companies as on 22nd January 2019 is to be reported in eFrom DPT 3

What are the silent features of The Unregulated Deposit Schemes Ordinance 2019 ?

The Unregulated Deposit Schemes Ordinance 2019 silent features

1) It extends to the whole of India except J& K..It shall be regulated by the concerning State Governments/ UTs..

(2) It shall come into force with the immediate effect..

(3) It is aimed only to ban Unregulated Deposit Schemes..

(4) Deposit would NOT include

- (i)loan from scheduled banks or Co- operative Banks;

- (ii) loan from Public Financial Institutions ;(iii) loan from Government;

- (iv)Loans from foreign Banks or foreign Governments

- (v)PARTNERS CAPITAL

- (vi) amount payable on purchase of any goods or immovable property and very importantly

- (vii) ANY AMOUNT RECEIVED ,genuinely, IN THE COURSE OF OR FOR THE PURPOSE OF BUSINESS ..

5) It will apply only and only with prospective effect and that too in respect of deposits taken under the Unregulated Deposit Schemes either by way of advertisement or otherwise..

(6)The Government shall appoint an authority n a Designated Court . The details of deposits taken would be required to be furnished n the Court shall be competent to attach

the properties acquired through such Unregulated Deposit

(7) Any violation may attract imprisonment for a term of 1 to 10 years with fine .

How can business or companies without borrowing unsecured loans are all unsecured loans banned ?

Section 2(4)(l) of The Unregulated Deposit Schemes Ordinance 2019 defines the exemption for it , indicating that its for business and bearing a genuine connection then it shall not fall under the preview of the The Unregulated Deposit Schemes Ordinance 2019 , the content context is reproduced below

l) an amount received in the course of, or for the purpose of, business and bearing a genuine connection to such business including—

(i) payment, advance or part payment for the supply or hire of goods or provision of services and is repayable in the event the goods or services are not in fact sold, hired or otherwise provided;

(ii) advance received in connection with consideration of an immovable property under an agreement or arrangement subject to the condition that such advance is adjusted against such immovable property as specified in terms of the agreement or arrangement;

(iii) security or dealership deposited for the performance of the contract for supply of goods or provision of services; or

(iv) an advance under the long-term projects for supply of capital goods except those specified in item (ii):

Provided that if the amounts received under items (i) to (iv) become refundable, such amounts shall be deemed to be deposits on the expiry of fifteen days from the date on which they become due for refund:

Provided further that where the said amounts become refundable, due to the deposit taker not obtaining necessary permission or approval under the law for the time being in force, wherever required, to deal in the goods or properties or services for which money is taken, such amounts shall be deemed to be deposits.

Explanation.— For the purposes of this clause,—

(i) in respect of a company, the expression “deposit” shall have the same meaning as assigned to it under the Companies Act, 2013;

(ii) in respect of a non-banking financial company registered under the Reserve Bank of India Act, 1934, the expression “deposit” shall have the same meaning as assigned to it in clause (bb) of the section 45-I of the said Act;

(iii) the expressions “partner” and “firm” shall have the same meanings as respectively assigned to them under the Indian Partnership Act, 1932;

(iv) the expression “partner” in respect of a limited liability partnership shall have the same meaning as assigned to it in clause (q) of section 2 of the Limited Liability Partnership Act, 2008;

(v) the expression “relative” shall have the same meaning as assigned to it in the Companies Act, 2013;

What are Consequences of Non Compliance and what are the penalties ?

Section 21 of the The Unregulated Deposit Schemes Ordinance 2019 defined the penalties for non compliance

21. (1) Any deposit taker who solicits deposits in contravention of section 3 shall be punishable with imprisonment for a term which shall not be less than one year but which may extend to five years and with fine which shall not be less than two lakh rupees but which may extend to ten lakh rupees.

(2) Any deposit taker who accepts deposits in contravention of section 3 shall be punishable with imprisonment for a term which shall not be less than two years but which may extend to seven years and with fine which shall not be less than three lakh rupees but which may extend to ten lakh rupees.

(3) Any deposit taker who accepts deposits in contravention of section 3 and fraudulently defaults in repayment of such deposits or in rendering any specified service, shall be punishable with imprisonment for a term which shall not be less than three years but which may extend to ten years and with fine which shall not be less than five lakh rupees but which may extend to twice the amount of aggregate funds collected from the subscribers, members or participants in the Unregulated Deposit Scheme.

Conclusion

In the back drop of Sahara Scam, Sharada scam, Naradha Scam , and many Companies Like the PACL have taken underscore loans Given the harsh Penalties and imprisonment it is a step in the right steps and directors , every business need to be aware of the same entering into sort some contracts where high returns are promised by Individuals and companies without and then they suddenly go bust and and they cannot sustain the cash flow without adding new members .

If this is implemented in the true sprit and fear of the being caught under this law comes to the mind of fraudsters who promise high returns say 10% every month which is not possible in any business these are termed as Ponzi Schemes