E-0Form Active INC 22A (Active Company Tagging Identities and Verification )Geo-Tagging of the registered office of the companies

E-Form Active INC 22A a new form to file to the verity register office, the form has been issued, start filing to avoid penalties and avoid disqualification and other consequences

After the DIR 3 KYC drive for every Director, the Ministry of Corporate Affairs has introduced Active Identities And and verification in eForm ACTIVE INC 22 A form for Geo-tagging of the registered office for every Company

WHAT IS ACTIVE COMPANY TAGGING IDENTITIES AND VERIFICATION IN eFORM ACTIVE INC 22A?

Hence, You are aware of Directors KYC Updation in E-From DIR 3 and strict penalties that followed, now the all the companies required to submit the KYC for their Registered office, in E-FORM ACTIVE INC 22A which need to file by 25th April 2019, and avoid penalty of Rs 10,000 and penal action by Registrar of Companies

Therefore, Notification to the effect has been issued by Ministry of Corporate affairs Companies (Incorporation) Amendment Rules,2019 ACTIVE COMPANY TAGGING IDENTITIES AND VERIFICATION IN eFORM ACTIVE INC 22A dated 21st Feb 2019.

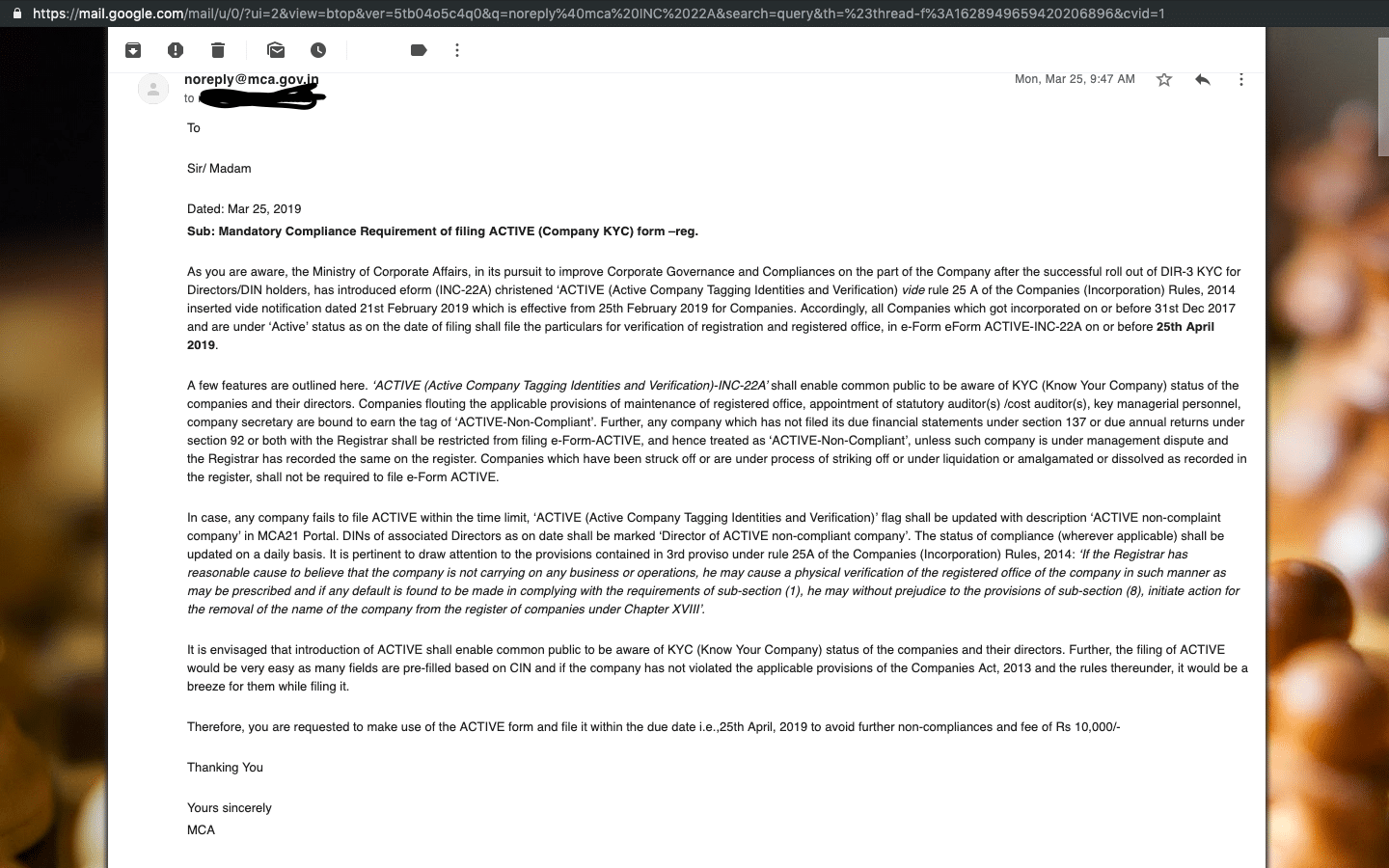

Mail Received From Ministry of Corporate Affairs to all Companies Intimating About E-form (INC-22A) ‘ACTIVE (Active Company Tagging Identities and Verification) (Company KYC)

As you are aware, the Ministry of Corporate Affairs, in its pursuit to improve Corporate Governance and Compliances on the part of the Company after the successful rollout of DIR-3 KYC for Directors/DIN holders, has introduced E-form (INC-22A) christened ‘ACTIVE (Active Company Tagging Identities and Verification) vide rule 25 A of the Companies (Incorporation) Rules, 2014 inserted vide notification dated 21st February 2019, which has effective from 25th February 2019 for Companies. Accordingly, all Companies which has got incorporated on or before 31st Dec 2017 and under ‘Active’ status as on the date of filing has to file the particulars for verification of registration and registered office, in eForm ACTIVE-INC-22A on or before 25th April 2019.

Features of ‘ACTIVE (Active Company Tagging Identities and Verification)-INC-22A (Company KYC)

A few features have outlined here. ‘ACTIVE (Active Company Tagging Identities and Verification)-INC-22A (Company KYC)’ shall enable the common public to be aware of KYC (Know Your Company) status of the companies and their directors. Therefore, Companies flouting from the applicable provisions of maintenance of registered office, the appointment of a statutory auditor(s) /cost auditor(s), key managerial personnel, and company secretary has bound to earn the tag of ‘ACTIVE-Non-Compliant’.

Further, any company which has not filed its due financial statements under section 137 or due annual returns under section 92 or both with the Registrar shall be restricted from filing e-Form-ACTIVE, and hence treated as ‘ACTIVE-Non-Compliant’. Therefore, unless such company is under management dispute and the Registrar has recorded the same on the register. In case Companies which have struck off or has under the process of striking off or under liquidation or amalgamated or dissolved as recorded in the register, shall not be required to file e-Form ACTIVE.

Warning Mail Received From Ministry of Corporate Affairs to all Companies Intimating About form (INC-22A) ‘ACTIVE (Active Company Tagging Identities and Verification) (Company KYC)

In case, any company fails to file ACTIVE within the time limit, ‘ACTIVE INC 22A (Active Company Tagging Identities and Verification)’(Company KYC) flag has to updated with description ‘ACTIVE non-complaint company’ in MCA21 Portal. Therefore, DINs of associated Directors date has marked on the ‘Director of the active non-compliant company’. The status of compliance (wherever applicable) has updated on a daily basis.

It is pertinent to draw attention to the provisions contained in 3rd proviso under rule 25A of the Companies (Incorporation) Rules, 2014: ‘If the Registrar has reasonable cause to believe that the company is not carrying on any business or operations, he may cause a physical verification of the registered office of the company in such manner as may be prescribed and if any default is found to be made in complying with the requirements of sub-section (1), he may without prejudice to the provisions of sub-section (8), initiate action for the removal of the name of the company from the register of companies under Chapter XVIII’.

Penalty Warning intimation Received From Ministry of Corporate Affairs to all Companies Intimating About form (INC-22A) ‘ACTIVE (Active Company Tagging Identities and Verification) (Company KYC)

It is envisaged that the introduction of ACTIVE INC 22A (Company KYC) shall enable the common public to be aware of KYC (Know Your Company) status of the companies and their directors. Further, the filing of ACTIVE

INC 22A (Company KYC) would be very easy as many fields are pre-filled based on CIN and if the company has not violated the applicable provisions of the Companies Act, 2013 and the rules thereunder, it would be a breeze for them while filing it

Therefore, you are requested to make use of the ACTIVE INC 22A (Company KYC) form and file it within the due date i.e.,25th April 2019 to avoid further non-compliances and a fee of Rs 10,000/-

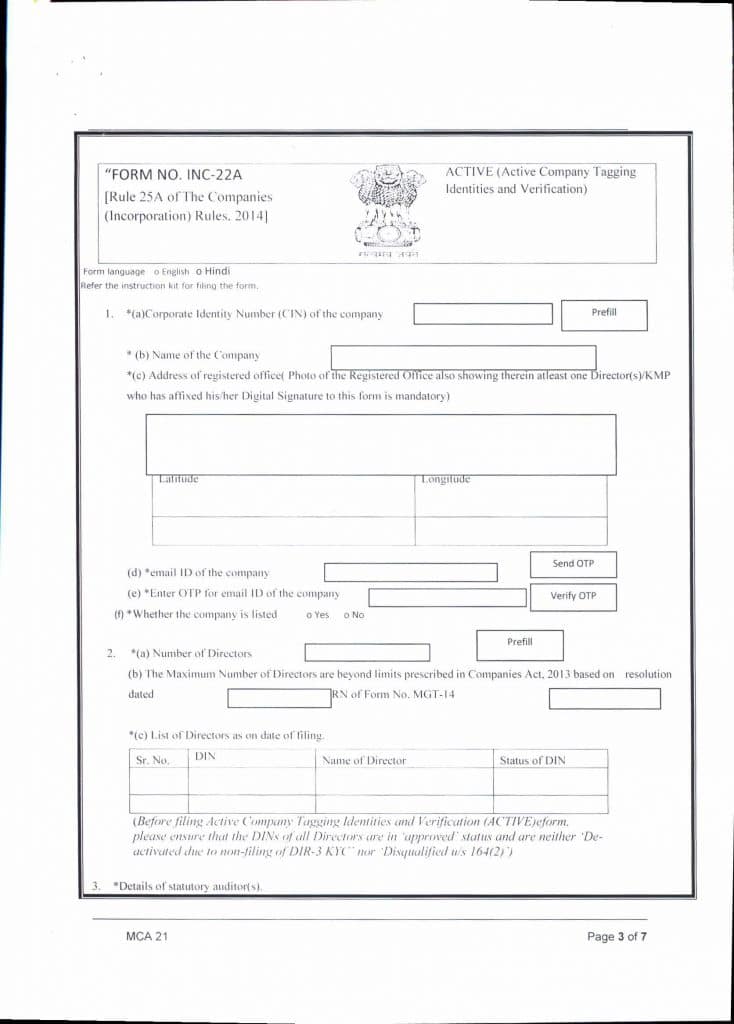

WHAT ARE THE DETAILS TO BE SUBMITTED IN ACTIVE COMPANY TAGGING IDENTITIES AND VERIFICATION IN eFORM ACTIVE INC 22A?

Major details of the ACTIVE COMPANY TAGGING IDENTITIES & VERIFICATION IN eFORM ACTIVE INC 22A

- Latitude & Longitude Details

- email id of the company

- verification of email id of the company by way of OTP

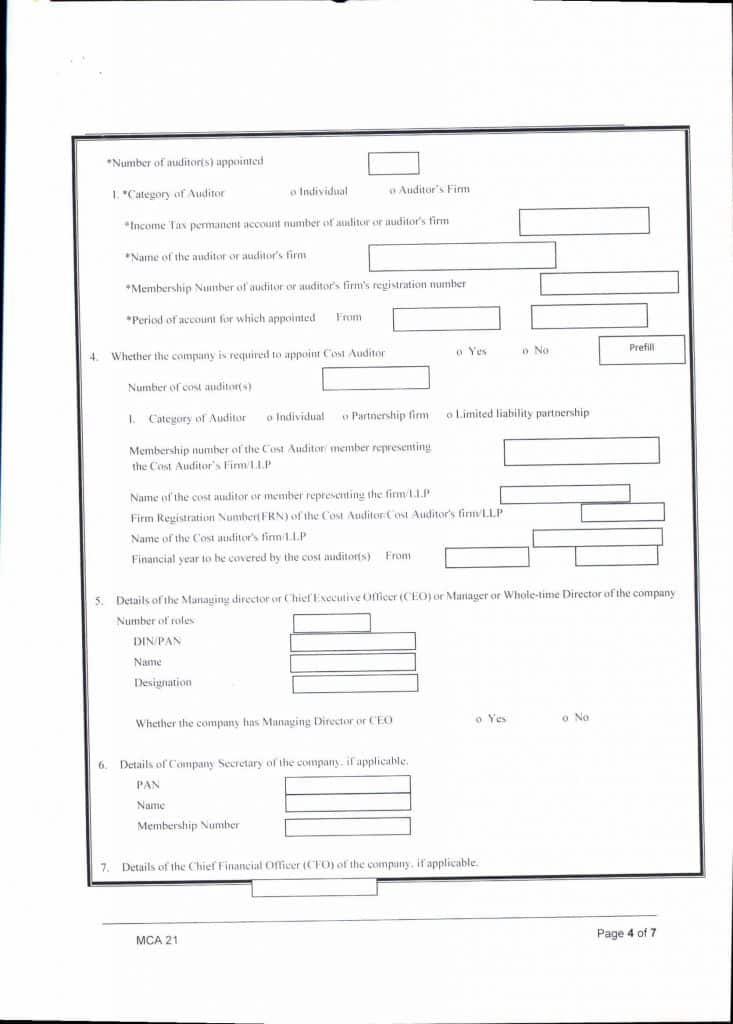

- Details of the Statutory Auditor along with their Details

- Details of the Key Managerial persons

- And, Details of the Last Annual Return/RoC Returns filed for the Year 2017-18

- Photograph of the office (Both Exterior and Interior) along with the director to be attached

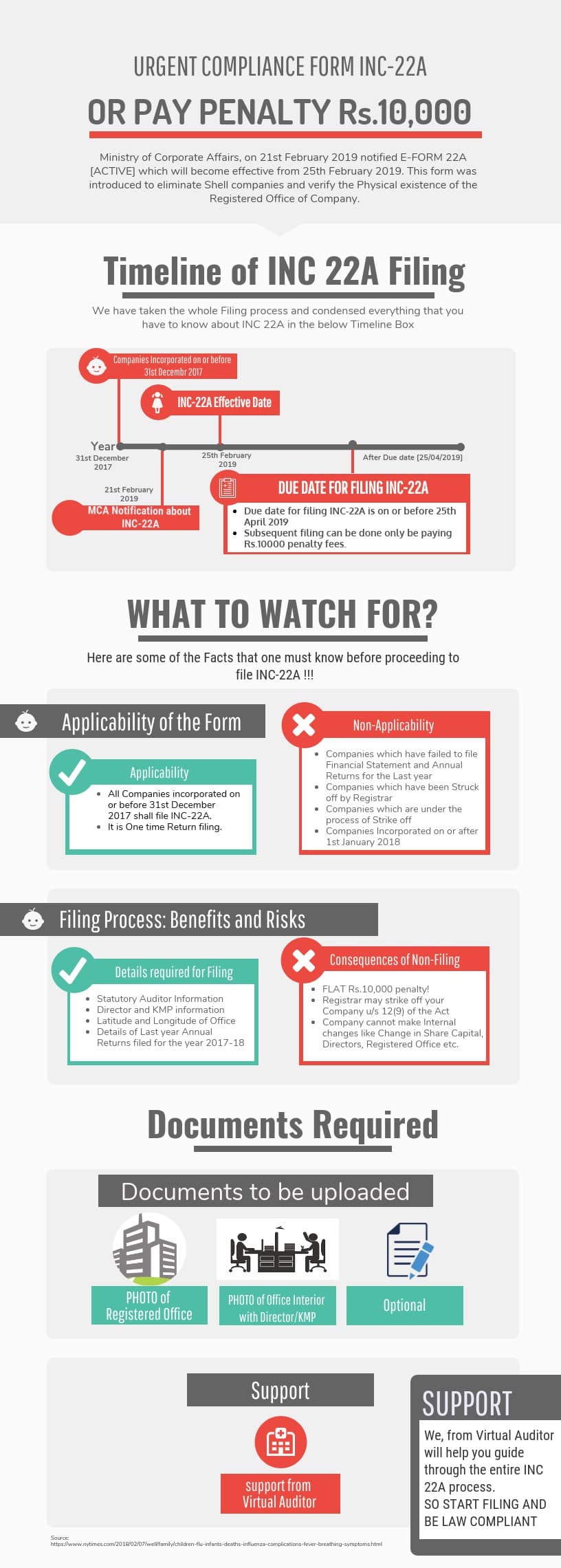

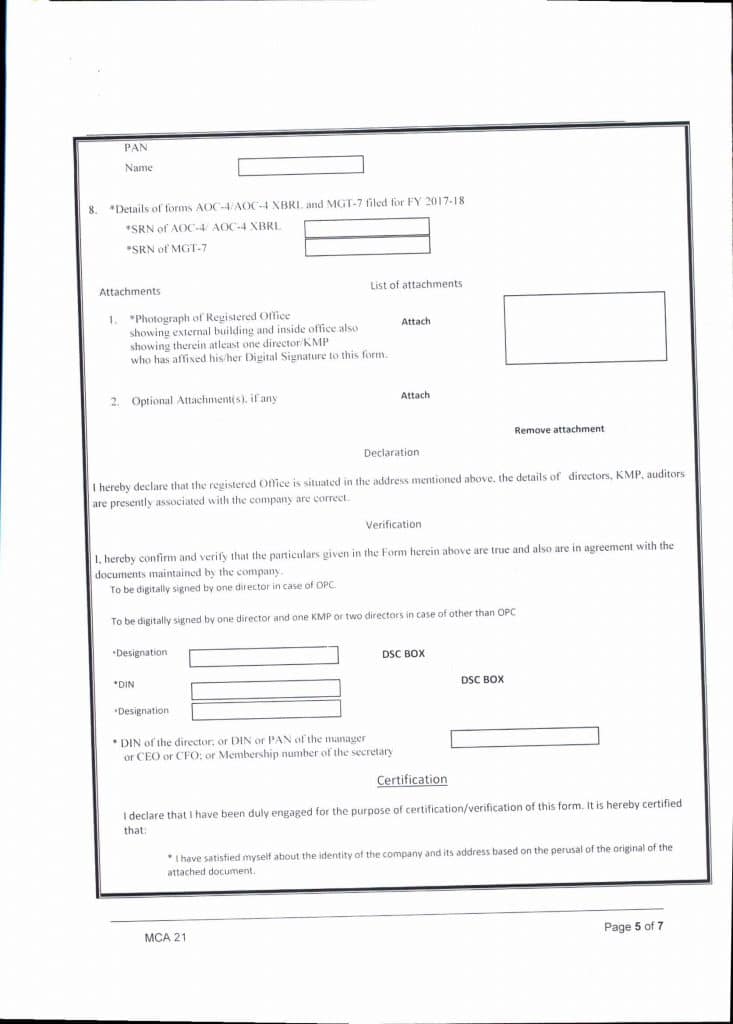

GRAPHICAL REPRESENTATION ON eFORM ACTIVE INC 22A

WHICH COMPANY CANNOT FILE ACTIVE COMPANY TAGGING IDENTITIES& VERIFICATION IN eFORM ACTIVE INC 22A?

The following company cannot file ACTIVE COMPANY TAGGING IDENTITIES AND VERIFICATION IN eFORM ACTIVE INC 22A

- Companies which have not filed the Annual return/RoC returns for the Financial Year 2017-18 (MGT 7 & AOC 4) under section 92 of the Companies Act 2013.

- Companies which are struck off either by Registrar Suo-moto or in case of the voluntary filing of strike off

- Therefore, Companies which are under the process of Strike off (Applied for Strike off but Order is not passed)

WHICH COMPANY ARE NOT MANDATED TO FILE ACTIVE COMPANY TAGGING IDENTITIES AND VERIFICATION IN eFORM ACTIVE INC 22A?

On a close reading of the Commencement date mentioned in the notification relating to ACTIVE COMPANY TAGGING IDENTITIES AND VERIFICATION IN eFORM ACTIVE INC 22A indicates that

- COMPANIES REGISTERED AFTER 31 DECEMBER 2017, that is registered on or after 1st January 2018

Which technically means all companies registered and active as on 31st December 2017 need to file this form

What is the Government fees to be paid for the eFrom ACTIVE INC 22A?

Therefore, it has no government fees, and the filing has done up to 25th April 2019, In which the penalty would be Rs 10,000 and company status would be changed to “ACTlVE-non-compliant”

What are the Consequences of Non Filing of eForm ACTIVE INC 22A?

If you intend not to file eForm ACTIVE INC 22A then you would be liable for a penalty of Rs 10,000/-. Hence, the following forms cannot be filed by the company restricting the normal business and disclosure filings

(i) SH-07 (Changes in Authorised Capital);

(ii) PAS-03 (Changes in Paid-up Capital);

(iii) DIR- 12 (Changes in Director except for cessation);

(iv) INC-22 (Changes in Registered Office)

(v) INC-28 (Amalgamation, de-merger)

Therefore, The Company could be Struck off by the Registrar of Companies by exercising the power conferred under Section 12(9) of the Companies Act if it deems that the company has not been carrying on any business or operations.

How to give pictures of registered office if Office is a “virtual office” without any physical space with virtual office provider?

Till this notification mandating ACTIVE COMPANY TAGGING IDENTITIES AND VERIFICATION IN eFORM ACTIVE INC 22A Section 12(9) of the Companies Act 2013 did not mandate Pictures of the Registered office (Both Interior and Exterior), only a NOC by owner bill in the name of the company would be sufficient

Given the new procedure to verify the registered office, Therefore, it’s not possible for a company, registered with virtual office space providers to submit the photos and proof, you may need to consult with space providers going forward registered in virtual office space would be tough.

What is the applicability of E-FORM ACTIVE INC 22A for the Companies Incorporated Under the Companies Act 1956?

Similarly, On a plain reading of the Notification and based on the definition of the company as defined under Section 2(20) of the Companies Act 2013. Therefore, “a Company means a company incorporated under this act or any previous company law;”

Further Notification uses the words “Company” which by definition means companies incorporated under the this or any other previous companies act, thus this is applicable to all companies whether incorporated under the Companies Act 2013 or the previous laws.

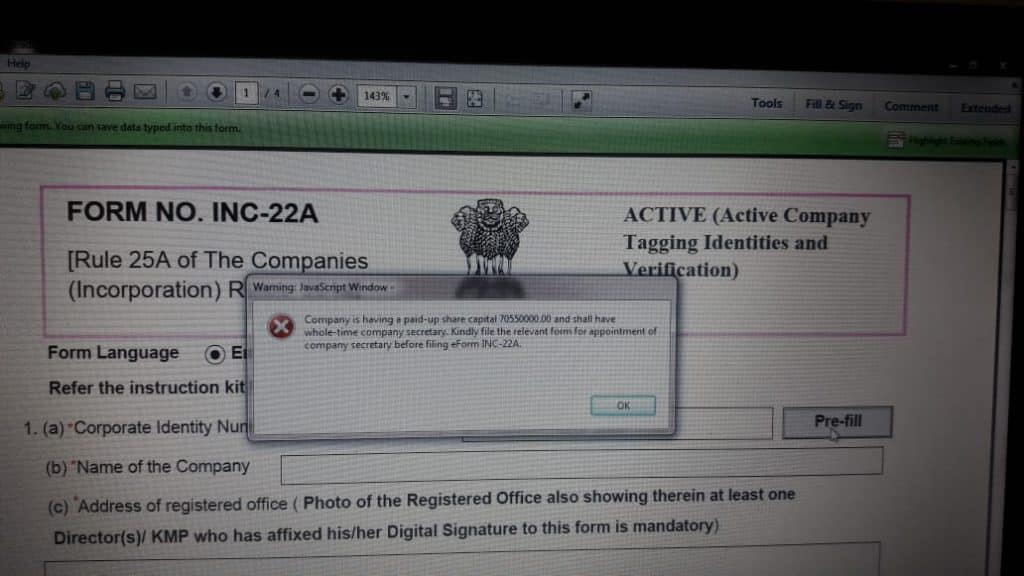

What if the Company has a paid-up Capital of Rs 5 Crores and not appointed whole Time Company Secterary?

Therefore, All Those Companies Whose Paid Up Capital Is 5 Crore Or Above, who have not appointed the Whole Time Company Secretary cannot file the Form INC 22A, which effectively means that all companies will Have to Appoint a Whole Time Company Secretary Within 2 Months To Keep The Status Active Of The Company.

SUMMARY OF ACTIVE COMPANY TAGGING IDENTITIES AND VERIFICATION IN eFORM ACTIVE INC 22A

| Sl. No. | Particulars | Details |

| 1. |

Form No. |

eFORM ACTIVE INC 22A |

| 2. | Date of deploying the new form | Feb 25th, 2019 |

| 3. | Frequency of filing | One Time Filing |

| 4. | Applicability of form | Every Company who have Certificate of Registration on or before 31/12/2017 (only for this FY) |

| 5. | Due date for filing form | On or before 25th April after 25th April – Late fee will be INR 10,000/- |

| 6. | Requirements for filing the form | Company Email id. These are mandatory for generating the OTP for verification purposes.

|

| 7. | Signature requirements | Signed using director’s own DSC (Both Directors DSC is Mandatory)

Certified by practicing professional (CA/CS/CMA) |

| 8. | Consequences of non-filing |

Non Filing of Active INC 22A (i) SH-07 (Changes in Authorised Capital); (ii) PAS-03 (Changes in Paid-up Capital); (iii)DIR- 12 (Changes in Director except for cessation); (iv) INC-22 (Changes in Registered Office) (v) INC-28 (Amalgamation, de-merger) The penalty of Rs 10,000/- And the company has Struck off by Registrar of Companies under Section 12(9) of the Companies Act 2013.

|

MAIL RECEIVED FROM MCA RECEIVED TO ALL DIRECTORS AND KEY MANAGERIAL PERSONS

EXTRACT OF THE NOTIFICATION DATED 21ST FEB 2019 eFORM ACTIVE INC 22A

WHAT IS GEO-TAGGING?

Hence, Geotagging has a process of tagging of Registered office by mentioning its specific geographical identification, including its latitude and longitude, on the portal where it has registered.

Hence, The intent of such geotagging is to bring in transparency in the system by providing an ocular portrayal of assets on top of the map or satellite visual. In doing so, the assets have better monitored, and leakages can be plugged.

Additionally, this helps in creating an online database for the government, which may, in turn, help the public obtain relevant information online. Therefore, Geo-tagging means providing data on the exact location of the office. Hence, The purpose seems to detect too many companies operating from a single location

Therefore, Geo-tagging of registered offices will be done at the time of statutory filings with the Registrar of Companies (RoC)

Hence, In simple terms, shell companies created primarily for tax evasion or money laundering activities do have a properly registered office and the same office has shared by many as witnessed in Satyam Scam and many other scams. Therefore, The government has weighed the option of ‘defining’ dubious companies in order that thorough investigations has not obstructed and prosecution can withstand legal challenges.

For any support relating to ACTIVE COMPANY TAGGING IDENTITIES AND VERIFICATION IN eFORM ACTIVE INC 22A GEO-TAGGING of company address and in case any assistance or help contact virtual auditor expert team @ 99 62260 333 +91 99622 30 333 + 91 95139 39 333or support@virtualauditor.in

FAQ of Filing of Form No INC-22A (Active Company Tagging Identities and Verification)

Which type of Companies has required to File Form INC-22A?

Rule 25A of Company Incorporation Rules 2019 is applicable to all the companies which have been incorporated on or before 31st December 2017.

Since, Following are the categories of companies which have been kept out of the requirement of filing Active Form No INC-22A.

- Struck Off Companies ( Company Closed by RoC)

- Under Process of Striking off by the ROC or NCLT

- Companies which are under Amalgamation

- Companies for which Liquidation Proceeding has begun

- Already closed or dissolved a company

What is the due date of filing Form INC-22A (Active Form)?

Form INC-22A is to file by 25th April 2019, for all companies incorporated on or before 31st December 2017.

Is there any Government Filing fee for Form 22A?

What is the List of Documents Required to attached with Form INC-22A (Active Company Form)?

In the eForm INC-22A, you have required to upload two photographs of the registered address of the company are,

- Therefore, External View Photo of the premises, where the registered address of the company has situated. And, Care must be taken to cover the nameplate/display board of the company in the image. otherwise, it shall violative of section 12 of the companies act, 2013

- Therefore, Internal View Photo of the registered office of the company has required to take from within the office. In such manner, that at least one director/kmp, who have signed the Active Form INC-22A is covered in the image.

Which directors shall sign the E-form INC-22A with Digital Signature?

- Company is a One Person Company then the form INC-22A shall be signed by only one director of such OPC

- Other Than OPC: The form INC-22A shall be signed by two directors of the company. Hence for filing Form INC-22A DSC of at-least two directors has required.

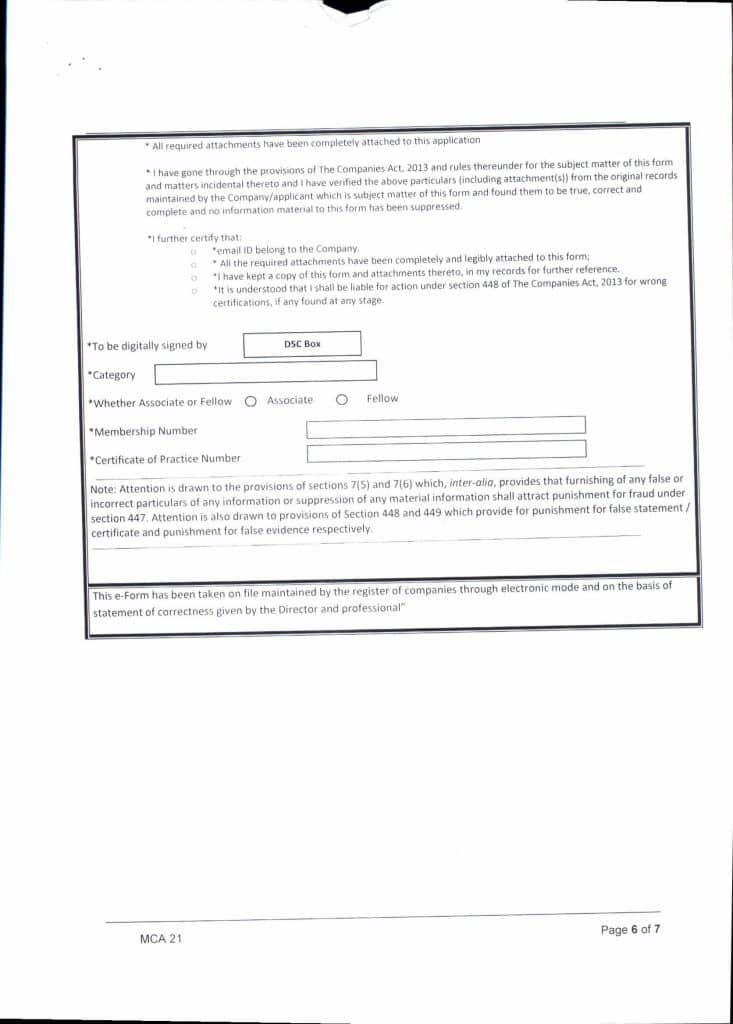

- Similarly, In all cases, the Form INC-22A shall be certified by a practicing professional (CA/CS/CWA)

Is it mandatory to file all pending annual return and balance sheet before filing the Form INC-22A?

Yes, a company must file all pending financial statements and annual returns for the financial year up to 2017-18 before filing the Form 22A. Therefore, The SRN number of AOC-4 and MGT-7 for the FY 2017-18 has required to be mentioned in Form INC-22A.

What is the consequence of Late filing of the Form INC-22A?

The due date for filing the form INC-22A is 25th April 2019, in case a company has not filed the required Active Form within its due date. the company will be marked as “Active – Non-Compliant” in the MCA Master data and such a company has not able to do any transaction.

However, the defect of non-filing of Form INC-22A can be rectified by filing the form after its due date with an additional government fee of Rs. 10,000/-

What is the consequence of non-filing of the Form INC-22A?

Hence, The consequences have not filed the form shall be very restrictive, and unless the Form INC-22A has filed the company apart from being marked as “Active – Non-Compliant”. Therefore, they shall not be able to file any of the below forms if the need arises.

- Change of Authorised Capital (SH-7)

- Change in paid-up Capital (PAS-03)

- Changes in Director except for cessation (DIR-12)

- Change in Registered Office (INC-22)

- Amalgamation or demerger (INC-28)

FORM INC 22A (ACTIVE) – Practical Difficulties

1. Compliance by Dormant Companies INC 22A

For dormant companies, while filing e-form INC-22A, the status of CIN entered has shown as ‘Dormant under section 455’ further stating that the form cannot be filed for this status. However, under the rule, Dormant Companies have not included in the list of companies exempted from filing of INC 22A

2. Details of Statutory Auditor in INC 22A

Therefore, It has to report that the Auditors details has prefilled in certain cases. It has noted that during the initial days of its introduction in 2014, Form ADT-1 has a physical form and filed as an attachment to Form GNL-2.

Later on, MCA had released e-Form ADT – 1 for subsequent years.

Since e-form INC-22A does not allow filling details of Auditor or SRN manually, companies are unable to complete the process.

Therefore, Appropriate arrangements or amendment in the form has made to fill the data related to Auditor with SRN number of GNL-2 manually.

3. Companies in Management Disputes INC 22A

First Proviso to Rule 25A reads that any company which has not filed its financial statements under section 137 or annual returns under section 92 or both with the Registrar shall be restricted from filing e-Form active unless such company is under management dispute and the Registrar has recorded the same on the register.

However, any company has to marked as being ‘Management dispute’. the same needs has to ordered by NCLT or High Court, which is a time-consuming process and may extend beyond the due date of this form.

4. Details of forms AOC-4/AOC-4 XBRL and MGT-7 filed for FY2017-18

Therefore, Issues has faced by corporates having a different financial year, i.e., other than 1st April to 31st March. SRNs of forms for such companies has not pre-filled automatically.

In case For any support with eFORM ACTIVE INC 22A ACTIVE (Active Company Tagging Identities and Verification)-INC-22A (Company KYC) contact 9962 260 333/ 9513 939 333 / 044 485 60 333 / 080 619 35 527