中国公司在印度的投资解决方案 国的外国人如何在印度创办和注册公司 ( Company Registration in India for Chinese nationals and Chinese Companies) 来自印度的投资者在印度迅速和出色的组合设置 中国,台湾和香港,我们经验丰富且经验丰富的特许会计师事务所(CA)提供以下广泛的支持服务,以及专家建议 过了 1)允许印度的外国直接投资入境结构, 2)投资者类别, 3)最方便的入口结构的选择和企业的位置 4)符合外商直接投资的政策,规章和打点,印度证券交易委员会的规定, FEMA等。 5)完全支持获取以下文件 数字签名 证书(DSC); 主任识别号码(DIN); 备忘录 (MOA); 公司章程(AOA); 永久帐号(PAN); 税收减免申请号(TAN); 银行A / C开放等; 中国公司在印度的投资解决方案 希望在中国设立印度公司和投资者的中国公司可以随时联系我们:手机 +91 9962 287 333或 + 91 9962 230 333或 +91 9962 260 333 / 044 48560333只需发送电子邮件 于:[email protected] 来自中国的外国人可以在印度开办和注册公司(外国公民/外国公司可以通过下面提到的任何进入战略在印度组建公司(印度子公司注册) 作为印度公司(印度子公司) 1.全资子公司(100%印度子公司) 2.如果不允许100%的外国直接投资,与其他印度公司合资 […]

Author Archives: CA Viswanathan V , FCA,CS,CFE, REGISTERED VALUER (S&FA)

UNDERSTANDING NOTICE OF STRIKE OFF(LLP) AND REMEDIES AVAILABLE You have started your LLP and have started running it, without fully understanding the compliance requirements and one fine day you receive a NOTICE OF STRIKE OFF(LLP) for your LLP Do you know how many LLP’s have received notice of NOTICE OF STRIKE OFF(LLP)? Well, more than 3000 […]

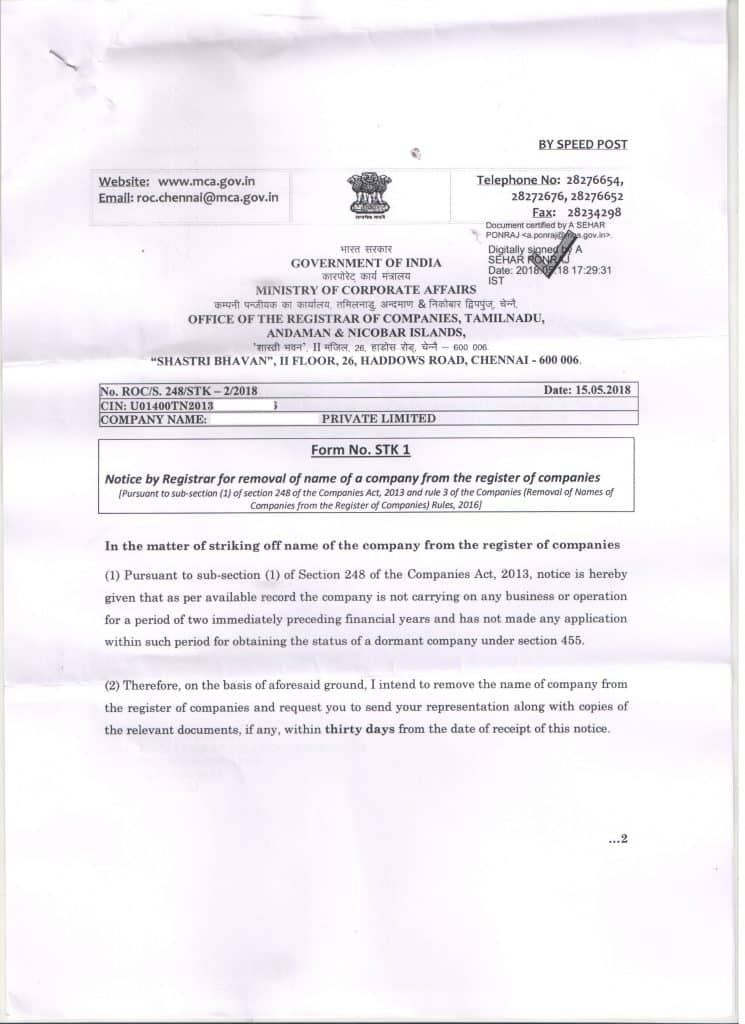

HOW TO REPLY TO STRIKE OFF NOTICE ISSUED BY ROC? You have started a private limited company and started your business or you were thinking about executing a project in the future, suddenly one fine day you receive a letter and mail captioned STRIKE OFF NOTICE u/s 248(1) from ROC Do you know how many […]

Understand Director Disqualification and ways To Become A Director Again Before You Regret. Guess how many Companies were struck off by RoC (Registrar of Companies) and how many director disqualification actions were taken Any ideas? Well, Ministry of Corporate Affairs has disqualified more than 3 lakh directors from acting as directors in a company and […]

CHANGES IN FOREIGN DIRECT INVESTMENT: FDI REPORTING ( FC-GPR) Have foreign investment, do you need to allot shares to NRI/ Foreign shareholders? Understand about the changes in FDI reporting Initially, the filing of forms ARF ( Advanced Reporting forms) & FC GPR (Reporting of allotment of shares) used to file manually forms used for filing under FDI […]

3 TIPS FOR AVOIDING PENALTY FOR NON FILING OF INCOME TAX RETURNS ON TIME How many have of us have considered Income tax returns filing as a burden and a secondary and do not keep it on our to-do list? Here are the HOW TO AVOID PENALTY BY FILINGS INCOME TAX RETURNS WITHIN THE DUE […]

3 REASONS NOT TO MISS FILINGS ANNUAL RETURN There is old idiom “Prevention is better than cure” the same analogy applies to Annual Return flings to ROC ( Registrar of Companies) The Government of India is very keen to eliminate all private limited companies which are shell companies and do not comply with annual return […]