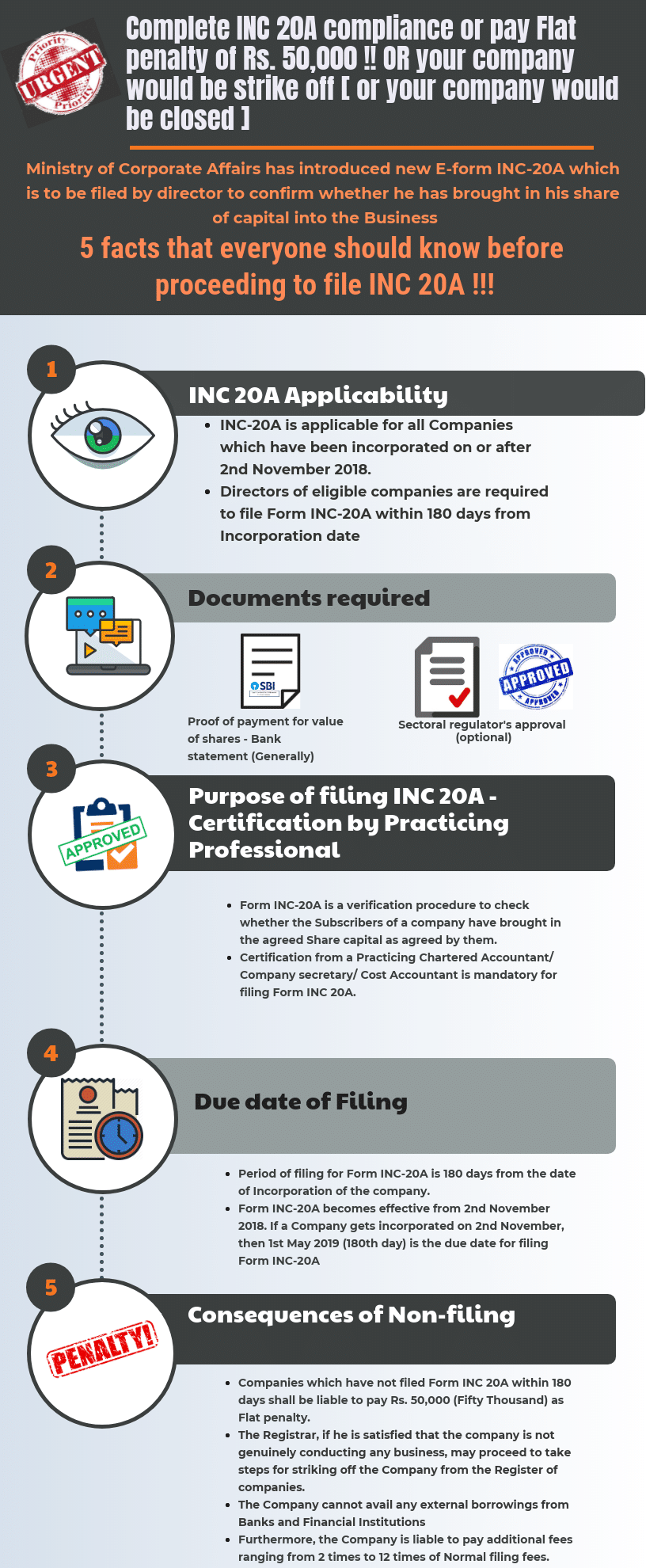

CERTIFICATE OF COMMENCEMENT OF BUSINESS FORM INC 20A

Certificate of Commencement of Business is introduced back by Ministry of Corporate Affairs has added a new form Form INC 20A after the company Registration file Form INC 20A form specified to obtain Certificate of Commencement of Business, by declaring that the paid up share capital has been brought in to the Companies Bank Account,

File the forms to avoid heavy penalties

Form INC 20A has issued pursuant to Companies Amendment Ordinance 2018 and Subsequent ordinance in Companies Amendment Ordinance 2019, which has the following objectives.

- Eliminate shell companies

- To facilitate the ease of doing business.

- To enhance the scope of corporate compliance.

What is Certificate of Commencement of Business and Form INC 20A?

Once the company is formed with the agreed Share capital, the Promoters/ entrepreneurs need to bring in their agreed share capital into the companies Bank account and Filed for form INC 20A with 180 days to obtain the certificate of commencement of Business.

Now, the Subscribers to the Memorandum of Association of the Company cannot delay their investing money in the bank account of the company as share capital in respect of the shares subscribed by them, as it has become mandatory to get Certificate of Commencement of Business in Form INC 20A otherwise the company risks being struck off/ dissolved by the Registrar of Companies

To know more about terms Authorised Capital and Paid-up Capital, click here

ARE ALL COMPANIES REQUIRED TO FILE FORM INC 20A TO OBTAIN CERTIFICATE OF COMMENCEMENT OF BUSINESS?

FORM INC 20A to obtain Certificate of commencement of business need to file.

- Private Limited Companies/One Persson Company/Public Limited registered on or after 2nd November 2018 need to mandatorily file FORM INC 20A and Obtain Certificate of Commencement of Business.

- Companies Registered prior to 2nd November 2018 it’s not mandatory to comply, that is any company registered till 1st November 2018 need not comply.

- Companies cannot borrow money without obtaining the certificate of Commencement of Business by filing INC 20A.

WHAT ARE THE TIMELINES TO FILE FORM INC 20A TO OBTAIN CERTIFICATE OF COMMENCEMENT OF BUSINESS?

FORM INC 20A to obtain Certificate of commencement of business need to file within

- Private Limited Companies/One Persson Company /Public Limited registered on or after 2nd November 2018 need to mandatorily file FORM INC 20A and Obtain Certificate of Commencement of Business within 180 Days from the Date of Registration

- The Only Other Condition is that the company Should have filed forms for verification of Registered office address in form INC 22 under section 12(2) of the Companies Act 2013 in case the option to verify registered office is selected as “No” In incorporation form SPICE INC 32

WHAT ARE THE MANDATORY DOCUMENTS TO BE ATTACHED TO FORM INC 20 A FOR CERTIFICATE OF COMMENCEMENT OF BUSINESS, IS PRACTISING PROFESSIONAL CERTIFICATE MANDATORY?

FORM INC-20A HAS TO BE FILED FOR THE FOLLOWING:

- Subscribers Proof of Payment for the value of shares.

- Certificate of Registration issued by RBI in case of NBFC companies

- Copy of Board Resolution

- Certificate form a practicing professional (CA/CS/CMA) stating the said the capital amount has been brought in

What is the Government fees to be paid for filing INC 20A to obtain Certificate of Commencement of Business?

Fee for filing e-Form 20A:

1. In case of the company have share capital

| Nominal Share Capital | Fee applicable |

| Less than 1,00,000 | Rupees 200 |

| 1,00,000 to 4,99,999 | Rupees 300 |

| 5,00,000 to 24,99,999 | Rupees 400 |

| 25,00,000 to 99,99,999 | Rupees 500 |

| 1,00,00,000 or more | Rupees 600 |

2. In case of company do not have share capital: Rupees 200

Additional fee after 180 days from the date of Incorporation

| Period of delays | Fees |

| Up to 30 days | 2 times of normal fees |

| More than 30 days and up to 60 days | 4 times of normal fees |

| More than 60 days and up to 90 days | 6 times of normal fees |

| More than 90 days and up to 180 days | 10 times of normal fees |

| More than 180 days | 12 times of normal fees |

What are the Penalties for Non-Compliance of Form INC 20A and failure to obtain Certificate of Commencement of Business?

- Company shall be liable to a penalty of fifty thousand rupees (Rs.50,000)

- Every officer (Directors of the Company) who is in default shall be liable to a penalty of one thousand rupees for each day during which such default continues but not exceeding the number of one lakh rupees. (Rs .1000 Per day of Default up to a maximum of Rs Rs 1,00,000/-)

- Where no Declaration is filled with 180 days and Registrar has reasons to believe that the company is not carrying on any business the company may be struck off and directors would be disqualified

RELEVANT SECTION AND RULES UNDER THE COMPANIES ACT 2013 GOVERNING INC 20A, CERTIFICATE OF COMMENCEMENT OF BUSINESS

eForm INC-20A is required to be filed pursuant to Section 10A(1)(a) of the Companies Act, 2013 and Rule 23A of the Companies (Incorporation) Rules, 2014, which has reproduced for your reference.

Section 10A:

(1) A company incorporated after the commencement of the Companies (Amendment) Ordinance, 2018 and having a share capital shall not commence any business or exercise any borrowing powers unless—

(a) a declaration is filed by a director within a period of one hundred and eighty days of the date of incorporation of the company in such form and verified in such manner as may be prescribed, with the Registrar that every subscriber to the memorandum has paid the value of the shares agreed to be taken by him on the date of making of such declaration, and

(b) The company has filed with the Registrar a verification of its registered office as provided in sub-section (2) of section 12.

(2) If any default is made in complying with the requirements of this section, the company shall be liable to a penalty of fifty thousand rupees and every officer who is in default shall be liable to a penalty of one thousand rupees for each day during which such default continues but not exceeding the number of one lakh rupees.

(3) Where no declaration has been filed with the Registrar under clause (a) of sub-section (1) within a period of one hundred and eighty days of the date of incorporation of the company and the Registrar has reasonable cause to believe that the company is not carrying on any business or operations, he may, without prejudice to the provisions of sub-section (2), initiate action for the removal of the name of the company from the register of companies under Chapter XVIII.]

Rule 23A: Declaration at the time of commencement of business.-

The declaration under section 10A by a director shall be in Form No, lNC-20A and shall be filed as provided in the Companies (Registration Offices and Fees) Rules, 2014 and the contents of the said form shall be verified by a company Secretary or a Chartered Accountant or a Cost Accountant. in practice: Provided that in the case of a company pursuing objects requiring registration or approval from any sectoral regulators such as the Reserve Bank of India, Securities and Exchange Board of India, etc., the registration or approval, as the case may be from such regulator shall also be obtained and attached with the declaration.

Purpose of the eForm INC 20A

- Declaration prior to the commencement of business or exercising borrowing powers

For support relating to filing of INC 20 A, please contact your expert’s Virtual auditor at +91 99622 30 333 /95139 39 333 / 044 -485 60 333/ 080-619 35 527 mails us [email protected]

FULL TEXT OF THE RELEVANT NOTIFICATION

Companies (Incorporation) Fourth Amendment Rules, 2018 as notified by MCA vide notification dated 18th December 2018

GOVERNMENT OF INDIA

MINISTRY OF CORPORATE AFFAIRS

NOTIFICATION

New Delhi, 18th December 2018

G.S.R.1219(E)._ In exercise of the powers conferred by clause (41) of section 2, section 3, sub-section (1) of section 7, section 10A, section 14 and sub-sections (1) and (2) of section 469 of the Companies Act, 2013 (18 of 2013), the Central Government hereby makes the following rules further to amend the Companies (Incorporation) Rules, 2014, namely: –

1. (1) These rules may be called the Companies (Incorporation) Fourth Amendment Rules, 2018.

(2) They shall come into force on the date of their publication in the official Gazette.

2. In the Companies (Incorporation) Rules, 2014 (hereinafter referred to as the said rules), after rule 23, the following rule shall be inserted, namely:-

“23A. Declaration at the time of commencement of business.- The declaration under section 10A by a director shall be in Form No.INC-20A and shall be filed as provided in the Companies (Registration Offices and Fees) Rules, 2014 and the contents of the said form shall be verified by a Company Secretary or a Chartered Accountant or a Cost Accountant, in practice

Provided that in the case of a company pursuing objects requiring registration or approval from any sectoral regulators such as the Reserve Bank of India, Securities, and Exchange Board of India, etc., the registration or approval, as the case may be from such regulator shall also be obtained and attached with the declaration.”.

3. In the said rules, after rule 39, the following rules shall be inserted, namely:-

“40.An application under sub-section (41) of section 2 for change in a financial year

(1) The application for approval of concerned Regional Director under sub-section (41) of section 2, shall be filed in e-Form No.RD-1 along with the fee as provided in the Companies (Registration Offices and Fees) Rules, 2014 and shall be accompanied by the following documents, namely:‑

(a) grounds and reasons for the application

(b) a copy of the minutes of the board meeting at which the resolution authorizing such change was passed, giving details of the number of votes cast in favor and or against the resolution

(c) Power of Attorney or Memorandum of Appearance, as the case may be

(d) details of any previous application made within the last five years for a change in a financial year and outcome thereof along with a copy of the order.

(2) Where the Regional Director on examining the application, referred to in sub-rule (1), finds it necessary to call for further information or finds such application to be defective or incomplete in any respect, he shall give intimation of such information called for or defects or incompleteness, on the last intimated e-mail address of the person or the company, which has filed such application, directing the person or the company to furnish such information, or to rectify defects or incompleteness and to re-submit such application within a period of fifteen days, in e-Form No. RD-GNL-S.

Provided that a maximum of two re-submissions shall be allowed.

(3) (a) In case where such further information called for has not been provided or the defects or incompleteness has not been rectified to the satisfaction of the Regional Director within the period allowed under sub-rule (2), the Regional Director shall reject the application with reasons within thirty days from the date of filing application or within thirty days from the date of last re-submission made as the case may be.

(b) In case where the application is found to be in order, Regional Director shall allow and convey the order within thirty days from the date of application or within thirty days from the date of the last re-submission, as the case may be.

(c) where no order for approval or re-submission or rejection has been explicitly made by the Regional Director within the stipulated time of thirty days, it shall be deemed that the application stands approved and an approval order shall be automatically issued to the applicant.

(4) The order conveyed by the Regional Director shall be filed by the company with the Registrar in Form No.INC-28 within thirty days from the date of receipt of the order along with fee as provided in the Companies (Registration Offices and Fees) Rules, 2014.

41. An application under section 14 for the conversion of a public company into a private company. (1) An application under the second proviso to sub-section (1) of section 14 for the conversion of a public company into a private company, shall, within sixty days from the date of passing of the special resolution, be filed with Regional Director in e-Form No. RD-1 along with the fee as provided in the Companies (Registration Offices and Fees) Rules, 2014 and shall be accompanied by the following documents, namely:‑

(a) a draft copy of Memorandum of Association and Articles of Association, with proposed alterations including the alterations pursuant to sub-section (68) of section 2.

(b) a copy of the minutes of the general meeting at which the special resolution authorizing such alteration was passed together with details of votes cast in favor and or against with names of dissenters.

(c) a copy of Board resolution or Power of Attorney dated not earlier than thirty days, as the case may be, authorizing to file an application for such conversion.

(d) declaration by key managerial personnel that pursuant to the provisions of sub-section (68) of section 2, the company limits the number of its members to two hundred and also stating that no deposit has been accepted by the company in violation of the Act and rules made thereunder.

(e) declaration by a key managerial personnel that there has been no non-compliance of sections 73 to 76A, 177, 178, 185,186 and 188 of the Act and rules made thereunder, (f) declaration by a key managerial personnel that no resolution is pending to be filed in terms of sub-section (3) of section 179 and also stating that the company was never listed in any of the Regional Stock Exchanges and if was so listed, all necessary procedures were complied with in full for complete delisting of the shares in accordance with the applicable rules and regulations laid down by Securities Exchange Board of India:

Provided that in case of such companies where no key managerial personnel is required to be appointed, the aforesaid declarations shall be filed any of the directors.

(2) Every application filed under sub-rule (1) shall set out the following particulars, namely:‑

(a) the date of the Board meeting at which the proposal for the alteration of Memorandum and Articles has approved.

(b) the date of the general meeting at which the proposed alteration has approved.

(c) reason for conversion into a private company, the effect of such conversion on shareholders, creditors, debenture holders, deposit holders, and other related parties.

(d) details of any conversion made within the last five years and outcome thereof along with a copy of the order.

(e) details, whether the company has registered under section 8.

(3) There shall be attached to the application, a list of creditors, debenture holders, drawn up to the latest practicable date preceding the date of filing of an application by not more than thirty days, setting forth the following details, namely:‑

(a) the names and address of every creditor and debenture holder of the company.

(b) the nature and respective amounts due to them in respect of debts, claims or liabilities.

(c) in respect of any contingent or unascertained debt, the value, so far as can be justly estimated of such debt:

Provided that the company shall file an affidavit, signed by the Company Secretary of the company, if any, and not less than two directors of the company, one of whom shall be managing director, where there is one, to the effect that they have made a full inquiry into affairs of the company and, having done so, have formed an opinion that the list of creditors and debenture holders is correct, and that the estimated value as given in the list of the debts or- claims payable on contingency or not ascertained are proper estimates of the values of such debts and claims that there are no other debts, or claims against, the company to their knowledge.

(4) A duly authenticated copy of the list of creditors and debenture holders shall be kept at the registered office of the company and any person desirous of inspecting the same may, at any time during the ordinary hours of business, inspect, and take extracts from the same on payment of ten rupees per page to the company.

(5) The company shall, at least twenty-one days before the date of filing of the application_

(a) advertise in the Form No.1NC.25A, in a vernacular newspaper in the principal vernacular language in the district and in the English language in an English newspaper, widely circulated in the State in which the registered office of the company is situated.

(b) serve, by registered post with acknowledgment due, individual notice on each debenture holder and creditor of the company, and

(c) serve, by registered post with acknowledgment due, a notice to the Regional Director and Registrar and to the regulatory body, if the company is regulated under any law for the time being in force.

(6) (a) Where no objection has been received from any person in response to the advertisement or notice referred to in sub-rule (5) and the application is complete in all respects, the same may be put up for orders without hearing and the concerned Regional Director shall pass an order approving the application within thirty days from the date of receipt of the application.

(b) Where the Regional Director on examining the application finds it necessary to call for further information or finds such application to be defective or incomplete in any respect, he shall within thirty days from the date of receipt of the application, give intimation of such information called for or defects or incompleteness, on the last intimated e-mail address of the person or the company, which has filed such application, directing the person or the company to furnish such information, to rectify defects or incompleteness and to re-submit such application within a period of fifteen days in 0-Form No. RD-GNL-5:

Provided that the maximum of two re-submissions has allowed.

(c) In cases where such further information called, has not provided or the defects or incompleteness has not rectified to the satisfaction of the Regional Director within the period allowed under sub-rule (6), the Regional Director shall reject the application with reasons within thirty days from the date of filing application or within thirty days from the date of the last re-submission made, as the case may be.

(d) Where no order for approval or re-submission or rejection has explicitly made by the Regional Director within the stipulated period of thirty days, it has deemed that the application stands approved and an approval order has automatically issued to the applicant.

(9) (i) Where an objection has been received or Regional Director on examining the application has specific objection under the provisions of Act, the same shall be recorded in writing and the Regional Director shall hold a hearing or hearings within a period thirty days, as required and direct the company to file an affidavit to record the consensus reached at the hearing, upon executing which, the Regional Director shall pass an order either approving or rejecting the application along with reasons within thirty days from the date of hearing, failing which it shall be deemed that application has been approved and approval order shall be automatically issued to the applicant.

(ii) In case where no consensus is received for conversion within sixty days of filing the application while hearing or otherwise, the Regional Director shall reject the application within the stipulated period of sixty days:

Provided that the conversion has not allowed if any inquiry, inspection or investigation has been initiated against the company or any prosecution is pending against the company under the Act.

(10) On completion of such inquiry, inspection or investigation as a consequence of which no prosecution has envisaged or no prosecution is pending, conversion shall be allowed.

(11) The order conveyed by the Regional Director has filed by the company with the Registrar in Form No.INC28 within fifteen days from the date of receipt of approval along with fee as provided in the Companies (Registration Offices and Fees) Rules, 2014.”.

4. In the said rules, after ‘Form No.INC-20, in the annexure, the following forms shall be inserted, namely:-

FORM NO. INC.20A

Declaration for the commencement of business

[Pursuant to Section 10A(1)(a) of the Companies Act, 2013 and rule 23A of the Companies (Incorporation) Rules, 2014]**************

**************

5. In the said rules, after form No. INC-25, the following form shall be inserted, namely:-

“Form No. INC-25A

An advertisement has published in the newspaper for the conversion of a public company into a private company

Before the Regional Director, Ministry of Corporate Affairs

________________Region

In the matter of the Companies Act, 2013, section 14 of Companies Act, 2013 and rule 41 of the Companies (Incorporation) Rules, 2014

AND

In the matter of M/s ______________ (company name) having its registered office at ______________, Applicant

Notice has hereby given to the general public that the company intending to make an application to the Central Government under section 14 of the Companies Act, 2013 read with aforesaid rules and has desirous of converting into a private limited company in terms of the special resolution passed at the Annual General Meeting/ Extra Ordinary General Meeting held on to enable the company to give effect for such conversion.

Any person whose interest has likely affected by the proposed change/status of the company may deliver or causes has to delivered or send by registered post of his objections supported by an affidavit stating the nature of his interest and grounds of opposition to the concerned Regional Director (complete address of the Regional Director has given), within fourteen days from the date of publication of this notice with a copy to the applicant company at its registered office at the address mentioned below:

For and on behalf of the Applicant

………………………..

Director with DIN

Complete address of the registered office

Date………..

Place………

6. In the said rules, after form No, INC-34, the following form shall be inserted, namely:-

FORM NO.RD-1

Form for filing application to Regional Director.

(Pursuant to the Companies Act, 2013 and rule 40 and 41 of the Companies (Incorporation] Rules, 2014

**************

**************

FORM NO. RD GNL-5

Form for filing Addendum for rectification of defects or incompleteness

[Pursuant to rule 40 and 41 of the Companies(Incorporation) Rules, 2014**************

**************

[F. No. 1/13/ 2013 CL-V, part-I, Vol.II]K.V.R. M RTY, Joint Secretary.

Note: The principal rules have published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R. 250(E) dated 31st March 2014 and subsequently amended vide the following notifications:-

| Serial Number | Notification Number | Notification Date |

| 1. | G.S.R. 349 (E) | 01-05-2015 |

| 2. | G.S.R. 442 (E) | 29-05-2015 |

| 3. | G.S.R. 99 (E) | 22-01-2016 |

| 4. | G.S.R.336(E) | 23-03-2016 |

| 5. | G.S.R.743(E) | 27-07-2016 |

| 6. | G.S.R.936(E) | 01-10-2016 |

| 7. | G.S.R.1184 (E) | 29-12-2016 |

| 8. | G.S.R. 70 (E) | 25-01-2017 |

| 9. | G.S.R. 955 (E) | 27-07-2017 |

| 10. | G.S.R. 49 (E) | 20-01-2018 |

| 11. | G.S.R. 284 (E) | 23-03-2018 |

| 12. | G.S.R. 708 (E) | 27-07-2018 |

In case of any help or assistance in filing your CERTIFICATE OF COMMENCEMENT OF BUSINESS in Chennai, CERTIFICATE OF COMMENCEMENT OF BUSINESS in Mumbai, CERTIFICATE OF COMMENCEMENT OF BUSINESS in Bangalore contact Virtual auditor support team on 9962 230 333/9513 93 9333/044- 48560333 /mail us [email protected], our team will guide through the entire process and help you comply