GST Registration Fees by CA : A Comprehensive Guide to Costs and Benefits

GST Registration Fees by CA , Are you considering hiring a Chartered Accountant (CA) for your GST registration process? In this article we will walk you through the ins and outs of GST registration fees by CA in the Indian context. We will cover the benefits of hiring a CA, the costs involved, and other essential details, ensuring that you make an informed decision for your business. Keep reading to discover how engaging a CA can make your GST registration process a breeze.

Table of Contents

- Benefits of Hiring a CA for GST Registration

- Fees Charged by CAs for GST Registration

- Factors Affecting CA Fees

- Alternatives to Hiring a CA

- Tips for Choosing the Right CA

- Frequently Asked Questions

- Conclusion

Benefits of Hiring a CA for GST Registration

Hiring a CA for your GST registration process comes with several advantages:

Expertise: CAs are well-versed in tax laws and regulations, ensuring that your GST registration is accurate and compliant with the latest guidelines.

Time-saving: A CA will handle the entire registration process on your behalf, allowing you to focus on your core business activities.

Error minimization: CAs are skilled in identifying and rectifying errors, reducing the chances of penalties or fines due to incorrect filings.

Ongoing support: A CA can provide continuous support and guidance regarding GST-related updates, helping you maintain compliance throughout your business journey.

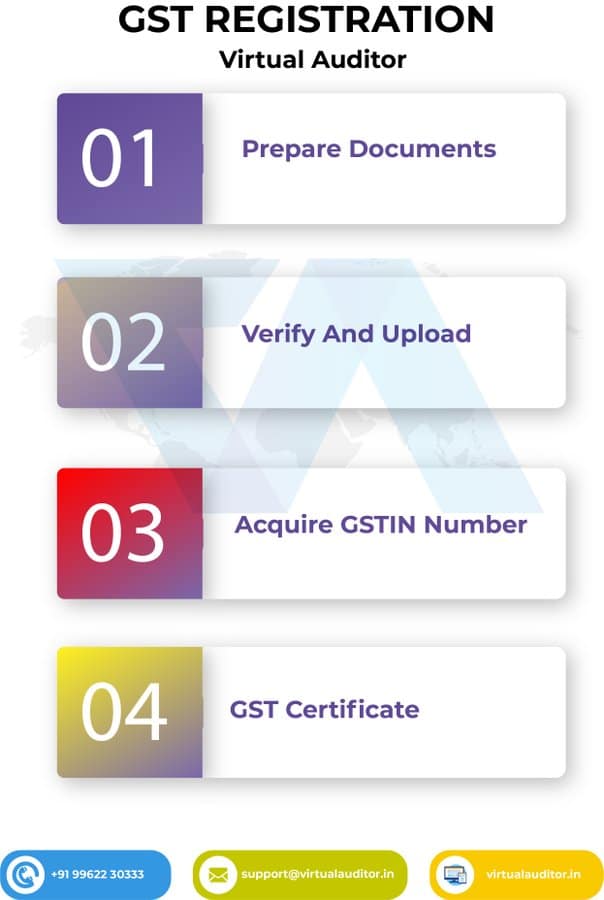

For more on GST Registration fees follow the steps provided below

Fees Charged by CAs for GST Registration

The fees charged by CAs for GST registration vary widely, depending on several factors, such as the CA’s experience, location, and the complexity of your business. Generally, you can expect to pay anywhere between INR 1,500 and INR 10,000 for GST registration services.

Factors Affecting CA Fees

Several factors influence the fees charged by CAs for GST registration:

Experience: CAs with more experience and expertise in GST registration may charge higher fees than their less experienced counterparts.

Location: CAs operating in metro cities or tier-1 cities tend to charge more compared to those in smaller towns or tier-2 cities.

Complexity: Businesses with complex tax structures, multiple locations, or unique GST requirements may incur higher fees due to the additional work involved.

Additional services: If you require ongoing support, such as monthly GST return filing, annual audits, or tax consulting, the CA may charge an additional fee for these services.

Alternatives to Hiring a CA

While hiring a CA can be beneficial, there are other cost-effective alternatives available for GST registration:

Self-registration: Business owners can register for GST themselves using the government’s online portal. However, this option may require a considerable time investment and a solid understanding of GST laws and regulations.

Online service providers: Several online platforms offer GST registration services at competitive prices. While these providers may not have the same level of expertise as a CA, they are generally more affordable and user-friendly.

Tips for Choosing the Right CA

To find the right CA for your GST registration, consider the following tips:

Seek recommendations: Ask your friends, family, or business associates for referrals, as they may have firsthand experience working with a reputable CA.

Check credentials: Verify the CA’s qualifications and memberships with professional bodies, such as the Institute of Chartered Accountants of India (ICAI).

Assess experience: Evaluate the CA’s experience in handling GST registration for businesses similar to yours. This will ensure they have the necessary expertise to address your specific needs.

Discuss fees: Obtain a clear understanding of the CA’s fee structure, including any additional charges for ongoing support or other services. Compare fees with other CAs to ensure you are getting a fair deal.

Communication and availability: Ensure the CA is easily accessible and responsive to your queries. A CA who communicates effectively can help you better understand the GST registration process.

Frequently Asked Questions

-

- Is GST registration mandatory for all businesses?

GST registration is mandatory for businesses with an annual turnover exceeding INR 20 lakhs (INR 10 lakhs for special category states). However, some businesses, such as e-commerce operators and interstate suppliers, must register for GST regardless of their turnover. - How long does it take to complete the GST registration process?

The GST registration process typically takes 3-7 working days. However, this timeline may vary depending on the accuracy of your submitted documents and the efficiency of the GST department. - Can I cancel my GST registration?

Yes, you can apply for cancellation of your GST registration if your business has ceased operations, merged with another entity, or falls below the turnover threshold for mandatory registration. - What penalties are levied for non-compliance with GST registration?

Failure to register for GST can result in penalties of up to INR 25,000. Additionally, non-compliant businesses may face interest charges on unpaid taxes and other penalties for non-adherence to GST laws. - How much does a CA charge for GST registration The fees charged by a CA for GST registration may vary based on the complexity of the registration process and the services included. It is best to inquire about the fees directly with the CA.

- How much does a CA charge monthly?

The fees charged by a CA may vary based on the services required and the complexity of the accounting work. It is best to inquire about the fees directly with the CA.

- Is GST registration mandatory for all businesses?

Conclusion

Hiring a CA for your GST registration process can provide invaluable expertise and peace of mind, ensuring that your business remains compliant with tax laws. While CA fees may vary, considering the benefits they offer, engaging a CA is a worthwhile investment. Be sure to weigh your options carefully, and choose a CA who meets your specific needs and budget. By following the tips and guidelines outlined in this article, you can navigate the GST registration process with confidence and set your business on the path to success.

For More guides check this out