HOW TO REPLY TO STRIKE OFF NOTICE ISSUED BY ROC?

You have started a private limited company and started your business or you were thinking about executing a project in the future, suddenly one fine day you receive a letter and mail captioned STRIKE OFF NOTICE u/s 248(1) from ROC

Do you know how many companies, has struck off for non-compliance of Companies Act 2013, to eliminate shell companies?

It’s a whopping 2.09 lakh companies deregistered in October 2017 and that figure was about 2.26 lack companies till December 2017 and the worst part is that you begin a director of these companies will face action for it

Now as a part of the second-round process for deregistering the company roc has issued notice captioned “STRIKE OFF NOTICE u/s 248(1)” to 1.20 lack companies

ROC Strike Off notice list under the caption PUBLIC NOTICES (STK-5) U/S 248(1)-CA,13 is available on Ministry of Corporate Affairs website which is due to non-filing of Annual Compliance & Fillings.

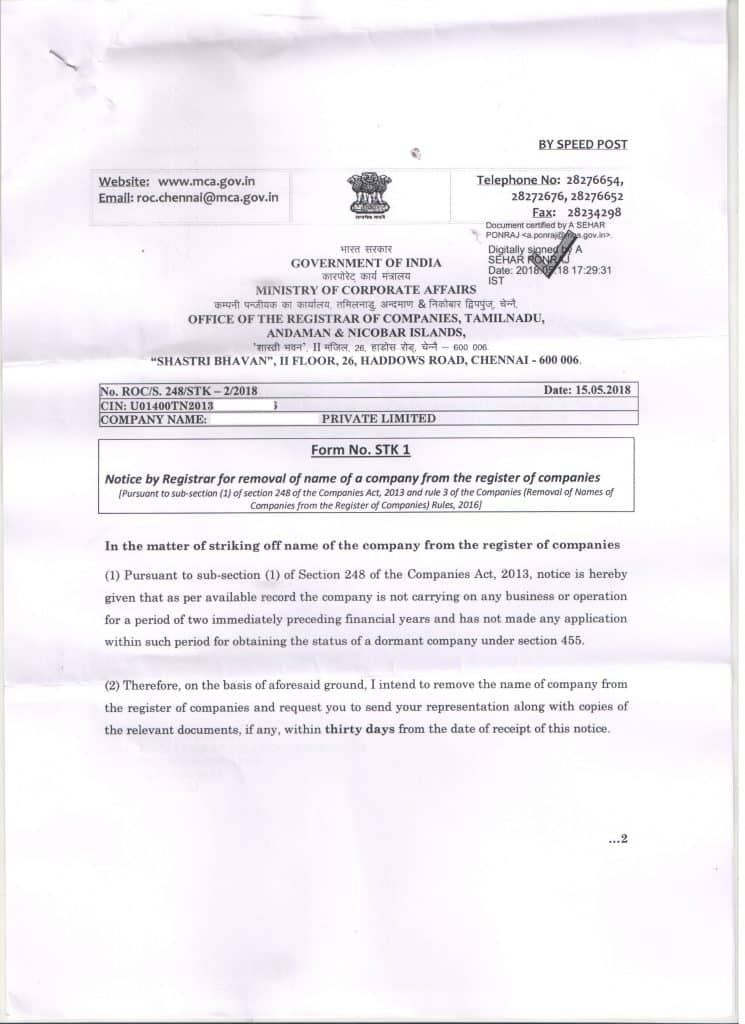

How to identify ROC Strike Off Notice?

How to Reply to Strike off notice u/s 248(1)?

Strike off Notice reply to ROC Format

Full Contents of the letter

Date: 05/06/2018

To,

The Registrar of Companies, << MENTION STATE>>

Registrar Of Companies

<< FULL ADDRESS>>

Dear Sirs,

Sub: Reply to strike off notice u/s 248(1) of the Companies Act 2013 in form STK -1

Ref: ROC/S.248/STK -2/2018 dated 15.05.2018

With reference to the above mentioned subject, we hereby inform you that the board of XYZ LTD (“Company”) (CIN: U01400TN2013PTCXXXX) having, its registered office situated at <<< OFFICE ADDRESS>> has commenced the business and but have due inadvertence lapse failed in filing of the returns under the Companies Act 2013,

It is further required to be noted that both the directors have agreed and state on record that the company would comply with the provisions of the Companies Act and will the requite returns within the next 15 days

We request your good office to kindly accept the letter and not to proceed with the Strike off the company under the companies act 2013, and we will file the requite returns within the next 15 days

Kindly, acknowledge the receipt of these documents and help us by giving time for filing the returns and by not striking off of the company

Thanking you.

Yours sincerely,

For and on behalf of XYZ LTD

| DIRECTOR 1 (Promoter holding XXXX equity shares) | DIRECTOR (Promoter holding XXX equity shares) |

Replying to the notice is the first step, you need to decide and be clear with 3 important factors before determining the type of reply

QUESTIONS TO ANSWERED BEFORE REPLY TO STRIKE OFF NOTICE

- Do you want to run the company as the company has an existing business operation and wants to continue further?

- Do you want the company to be dormant (without any activity) (Company has not commenced the business operation but have future business plans)

- Therefore, Your company does not, do any future plans and wants to discontinue business and shut down

OPTION 1: The company has an existing business operation and wants to continue further and want to active

Firstly prepare all the documents required for annual filings

Prepare and submit your company’s balance sheet, profit & loss account along with audit report and directors report in the following forms

- E form AOC-4 ( Financial Statements)

- E Form MGT-7 (Annual Returns)

- ADT-1 Appointment of Auditors

Please note, that the filing has to do all years if default that is starting from the year filling was not done till current year along with the additional fee 13 times of the original fee till June 30th, 2018 + 100 per day per from

Once the filing is completed, the default of the Company becomes gets resolved and the Company would not be Strike off by the RoC.

OPTION 2: Do you want the company to be dormant (without any activity) (Company has not commenced the business operation but has future business plans)

Firstly, prepare all the documents required for annual filings

Prepare and submit your companies NIL balance sheet, NIL profit & loss account along with audit report and directors report in the following forms

- E form AOC-4 ( Financial Statements)

- E Form MGT-7 (Annual Returns)

- ADT-1 Appointment of Auditors

Please note, that the filing has to be done for all years if the default (i.e) starting from the year, the filling was not done till current year along with the additional fee, 13 times of the original fee till June 30th, 2018+100 per day per. from thereafter,

Hence, Post Completion of successful filing with RoC, the default of the Company becomes resolved and the Company would not be Strike off by the RoC.

Option 3: Your company does not any future plans and wants to discontinue business and shut down?

There are two possible alternatives under this option,

- File For closure of company voluntarily under Form STK-2

- Apply for Doormat company status with the approval of RoC ( If the RoC agrees and approves)

- Therefore, Comply with all the forms mentioned in option 1 above,

- File the relevant forms AOC-4, MGT-7, ADT-1, starting from the year. the filling has not done till current year.

- the additional fee 13 times of the original fee till June 30th, 2018 + 100 per day per from thereafter

Consequences for INACTION on the STRIKE OFF NOTICE?

Hence, If directors fail to reply and do not take action suggested above the consequences are devastating, full list of actions that RoC can take is mentioned below

1. Director Disqualification

Therefore, You will be disqualified as Director and stripped from the post of director for a period of 5 years or permanent

2. De-activation of DIN

Your Director Identification Number (DIN) could be deactivated, on account of disqualification. Once, your DIN is deactivated, it has lead to non-filling in other Companies, in which you are a director and you may be personally liable if RoC deems fit (Provided Central Government so notifies)\.

Once, your DIN is blocked you cannot float a new company or be a director, in any other company.

Conclusion:

Directors must reply, to the notice and opt for the solutions mentioned above and file. The requisite documents within 30 days from the date of publication of the notice. To save the Company and you the director from any strike off, penalty and other legal actions.

Given, the consequence of noncompliance and strictness of ROC you have received. the notice needs to file the reply and save the company.

An inadvertent lapse in filing does happen to all companies, make sure that you use this last opportunity to keep the company compliant and active