TDS Return Filing a Complete Guide!

The TDS Return Filing the preview must hold a valid TAN and it should be registered for E-filing

Your TDS statement should be prepared using the Return Preparation Utility (RPU) and Validate using File Validation Utility (FVU

You can prepare your Return Using clear TDS

What is TDS?

Tax Deducted at Source or TDS is a source of collecting tax, from the government of India, where transactions take place. It has to file by the assessee who has deducted the TDS.

It will file only after some specific detail as TAN no., TDS payment, the amount deducted, type of payment, PAN no., etc.

What are the details required to file TDS

It is compulsory for all the deductors to submit the TDS on time. The quarterly statement has to give to the IT department< the details required for TDS are followed

- PAN of the deductor and deductee.

- Amount of tax paid to the government.

- TDS challan information.

- Others, If any

What are the Return Forms of TDS

- TDS Form 24Q – TDS on salary

- Form 27Q – TDS where deductee is a non-resident, foreign company

- TDS Form 26QB – TDS on payment of transfer of immovable property

- Form 26Q – TDS in any other case

TDS Due Date

TDS has to be filed before duedates< in case if you have not deposited TDS on the correct date, the following are the penalties which are applicable

- Late filing fee

- Interest

- Penalties

Late filing fee for TDS

If you are filing Return, on Due Date, It means you will subject to a late filing fee of Rs. 200 every day. The fee will charged after the due date. You have to pay fine for every day of Rs. 200/-.

Until the return has filed, It will delay until a fine amount is equal to the amount you supposed to pay as TDS.

Let us start the procedure for filing TDS

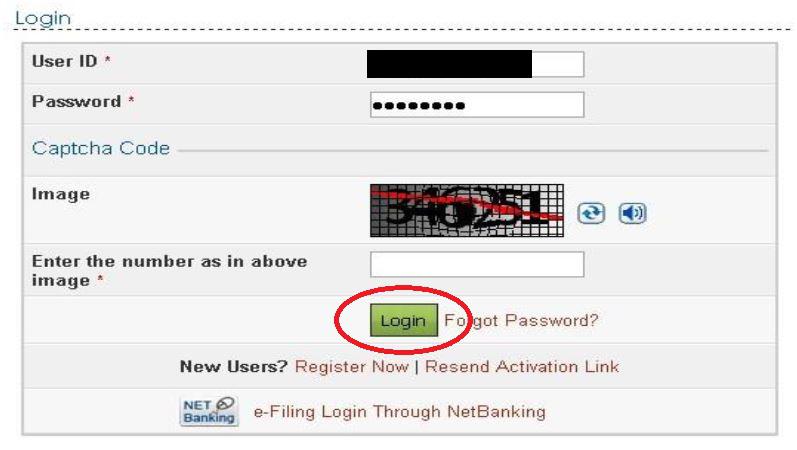

step-1: The first and foremost step is to visit the “Income Tax Department” website http://incometaxindiaefiling.gov.in/ and click on Login.

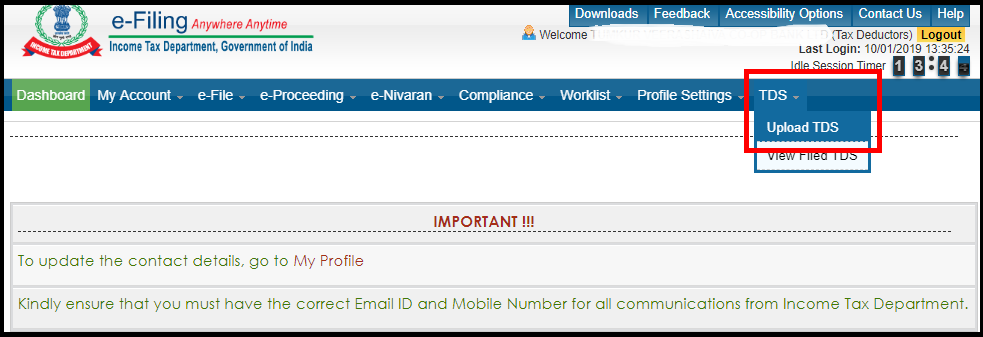

step-2: After login, go to TDS and click on upload TDS.

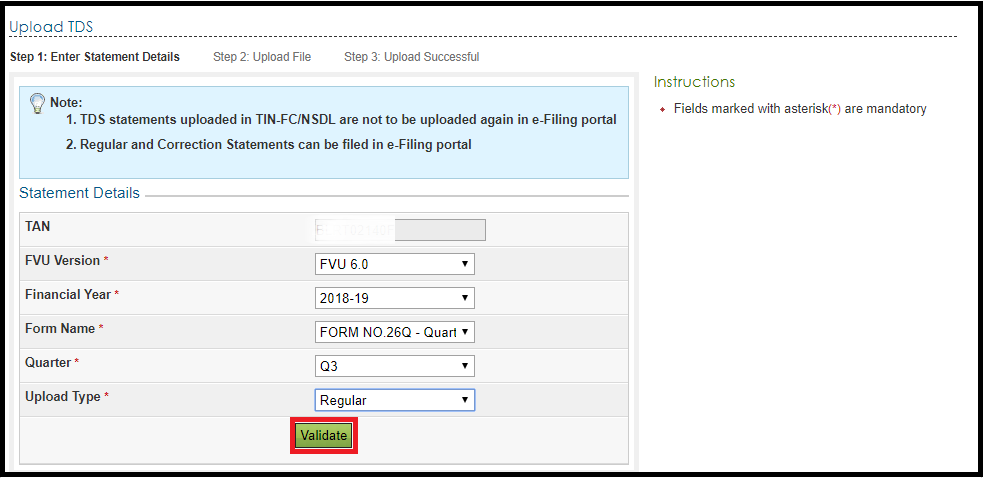

step-3: After clicking on upload TDS, you will be providing a form, Where you have to fill the correct details.

step-4: details Entered and Selected, click on the validate.

step-5: Note, TDS can be uploaded only on the regular statement.

step-6: The Returns has validated only through following modes.

step-7: TDS has to done using, DSC or Digital Signature Certificate.

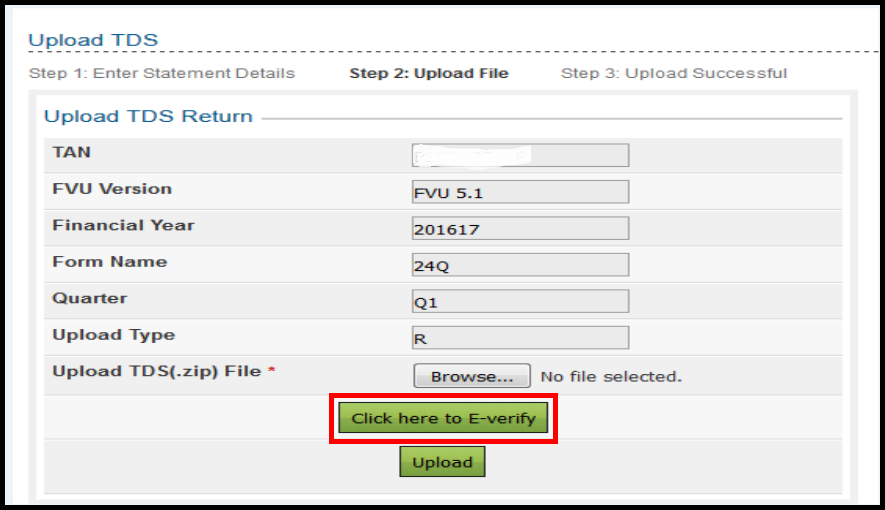

step-8: To upload TDS using DSC, you have to attach TDS file and digital signature certificate, and click on upload.

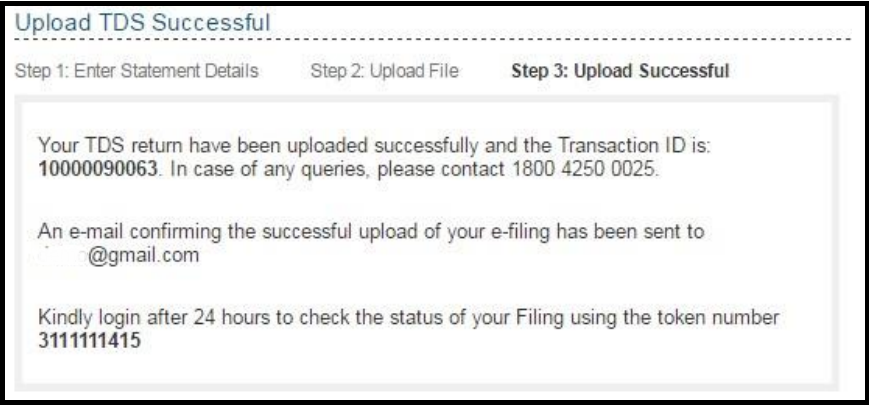

step-9: TDS has uploaded, a successful message will appear on the screen and the confirmation mail will send to the registered person.

step-10: If you have generated DSC, you will be able to validate TDS by using EVC (Electronic Verification Code).

step-11: Click on E-verify.

step-12: After clicking on E-verify, it will show you three options

step-13: Select on the relevant option.

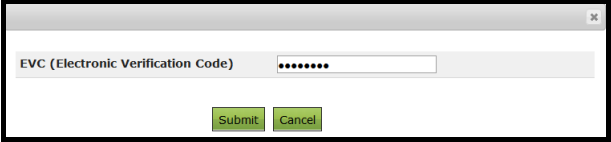

step-14: Enter the EVC code, and

step-15: Click submit, it uploaded successfully.

TDS Return Filing

TDS Return Filing

In case of any help or assistance in filing your TDS Returns in Chennai, TDS Returns in Mumbai, TDS Returns in Bangalore contact Virtual auditor support team on 9962 230 333/9513 93 9333/044- 48560333 /mail us support@virtualauditor.in, our team will guide through the entire process and help you comply