Annual Return (FLA return) on Foreign Liabilities and Assets of Foreign Investments (FDI) under the FEMA Act 1999.

RBI vide notification no- RBI/2010-11/427 A.P. (DIR Series) Circular No. 45 is introduced the concept of Foreign Assets & Liabilities Return which is an annual return of all investments made by the company during a financial year, Which has to be submitted directly by the Company to the RBI.

Introduction

The concept of Annual return on foreign assessment was notified under the regulation of FEMA act 1999. There, are four important points to known about FLA return includes a due date, non-compliance, exemptions and compounding for the delay in filing.

How to file FLA Returns

FLA stands for (Foreign Liabilities and Assets), Annual Return on Foreign Liabilities and Assets has to be filed by every Indian companies and LLPs that have received FDI. Hence, any company or LLP that holds foreign assets and liabilities required to file FLA returns.

Annual Return (FLA return) on Foreign Liabilities and Assets of Foreign Investments (FDI) Applicability

The annual return on Foreign Liabilities and Assets required to submit directly by all Indian companies which have received FDI (foreign direct investment) and/or made FDI abroad (i.e. overseas investment) in the previous year(s) including the current year i.e. who holds foreign Assets or Liabilities in their Balance Sheets, even If the company has not ‘received any fresh FDI and/or ODI (overseas direct investment)’ in the latest year the company has outstanding FDI and/or ODI, that company required to submit the FLA Return every year by July 15.

It’s Important to note that Shares issued by reporting company to non-resident on Non-Repatriable basis should not be considered as foreign investment. therefore, the company has issued the shares to non-resident only on Non-Repatriable basis. Where not required to submit the FLA Return.

If the Indian company does not have any outstanding investment in respect of inward and outward FDI as on end-March of the reporting year, the company need not submit the FLA Return.

Information Required to report in FLA return

the company accounts not audited before the due date of submission. Then it has to submit based on unaudited accounts. And, if the accounts closing period is different from the reference period of the company. Then the information has given based on the internal assessment.

Procedure for Submission of the Annual (FLA Return) to RBI

Annual FLA returns have mandatory under the FEMA 1999. The company required to submit the same return based on the audited/unaudited account by July 15 every year.

What are the latest changes in Annual Return (FLA return)?

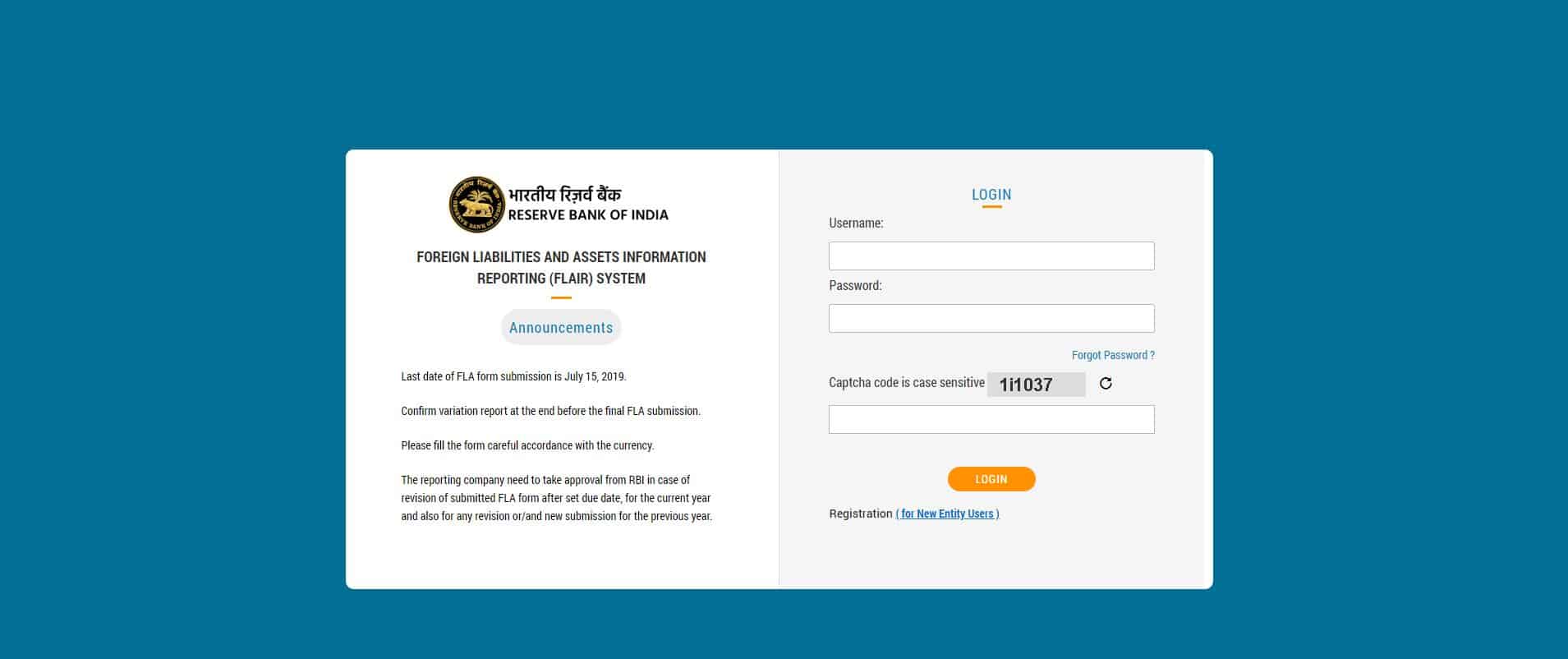

With the objective to enhance the security-level in data submission and further improve the data quality, the present email-based reporting system for submission of the FLA return will be replaced by the web-based system online reporting portal

Reserve Bank would provide a web-portal interface https://flair.rbi.org.in to the reporting entities for submitting “User Registration Form” (containing entity identification and business user details, where LLPs and AIFs will no longer require to use dummy CIN). The successful registration on web-portal will enable users to generate RBI-provided login-name and password for using FLA submission gateway and would include system-driven validation checks on submitted data.

You can get the latest form from the following link https://flair.rbi.org.in/fla/faces/pages/login.xhtml Annual return on Foreign Liabilities and Assets

Reserve Bank would provide a web-portal interface https://flair.rbi.org.in to the reporting entities. For submitting “User Registration Form” containing entity identification and business user details. The successful registration on web-portal will enable users to generate RBI-provided login-name and password for using FLA submission gateway and would include system-driven validation checks on submitted data.

The form will seek investor-wise direct investment and other financial details on a fiscal year basis as hitherto. Where all reporting entities are required to provide information on FATS related variables (it was mandatory only for subsidiary companies earlier). In addition, the revised form seeks information on the first year of receipt of FDI/ODI and disinvestment.

The provision to file a revised return is also provided, in case of error or lapse in the first submission. The system allows FLA Returns of Previous reporting period provided prior approval by RBI has obtained.

Email based submission has discontinued and only online submission has permitted.

CONSEQUENCES OF NOT FILING OF ANNUAL RETURNS (FLA RETURNS)

-

Non Compliance

Non-filing of the return before the due date will be treated as a violation of FEMA. And the penalty clause may be invoked for violation of FEMA. The penalty as prescribed under the FEMA has “THRICE” the sum involved in contravention or Rs. 2 lakh. if the offense has non-quantifiable and if the contravention is continuing every day, then Rs. Five Thousand for every day after the first day during which the contravention continues.

-

Compounding for the delay in the filing

The powers to compound the contraventions have delegated to all Regional Offices of RBI. As (except Kochi and Panaji) without any limit on the amount of contravention.

In case of any help or assistance in filing your FLA return in Chennai, FLA return in Mumbai, FLA return in Bangalore contact Virtual auditor support team on 9962 230 333/9513 93 9333/044- 48560333 /mail us support@virtualauditor.in, our team will guide through the entire process and help you comply