GSTR 3B is mandatory for all those who have registered for the goods and services, it is simple tax introduced by the central board of excise and customs.

What is GSTR 3B?

This form is based on a monthly return. All regular taxpayer needs to file this return till March 2019. It is a simple tax return introduced by a central board of excise and custom.

Who must file GSTR 3B?

It has to be filed by everyone, who has registered under GST goods and services, This file has to be separated for each good and Services.

Late fee payable tax

A taxpayer who has not filed any return till the due date, Will have to pay the fee regarding supplier financial turnover.

Apart from that, interest department can also initiate a penalty in case of non-filing return. Kindly file your return on a regular base to reduce the liability at the earliest.

What are the advantage of GST

Let’s talk about the advantage of GSTR 3B,

- The unorganized sector is regulated under GST.

- Simple and easy online procedure.

- The number of compliances is lesser.

- Improved efficiency of logistic.

- Removing the cascading tax effect.

What are the disadvantages of GST

- GST came into effect in the middle of the financial year.

- It is an online taxation system.

- GST compliance

What are the components of GST?

There are three component taxes applicable in GST are:

- CGST- Central Government on Inter-state Sale

- SGST- State Government on Inter-state Sale

- IGST- Central Government for Inter-state Sale

Let us start the procedure

- Login to GST portal http://www.gst.gov.in

- Enter the details, and click on login.

- Click on Return Dashboard.

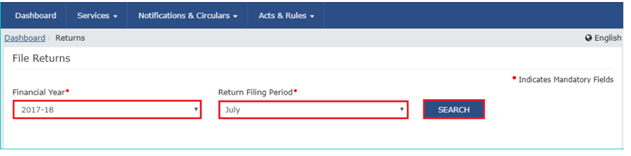

4. This will take you to the file return page. Select the “financial year” and “Return Filing period” for which you has to file.

5. Click the Search button.

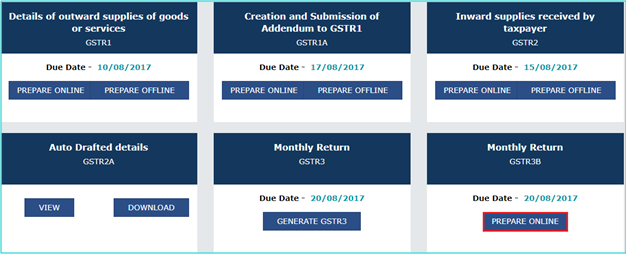

6. This will take you to the File return page, Where you have to select monthly return, and

7. Click on Prepare Online.

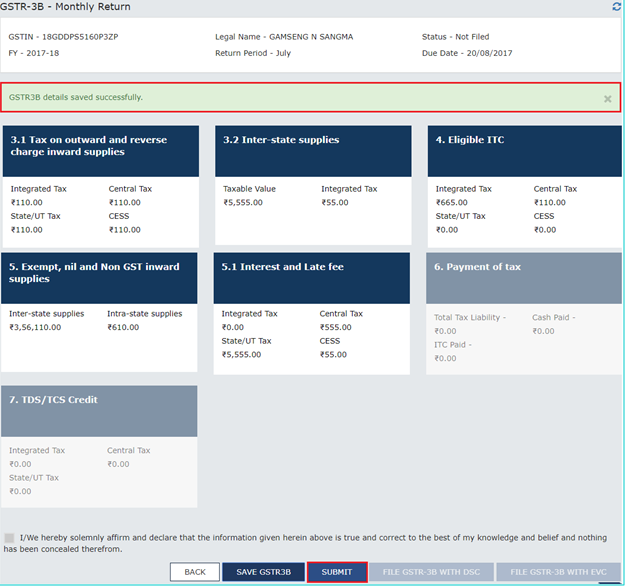

8. Enter each value in tile, Late fee filing is applicable.

9. Click “Save”, a successful message is displayed on the top.

10. Once, the detail is entered, click the “Submit” button.

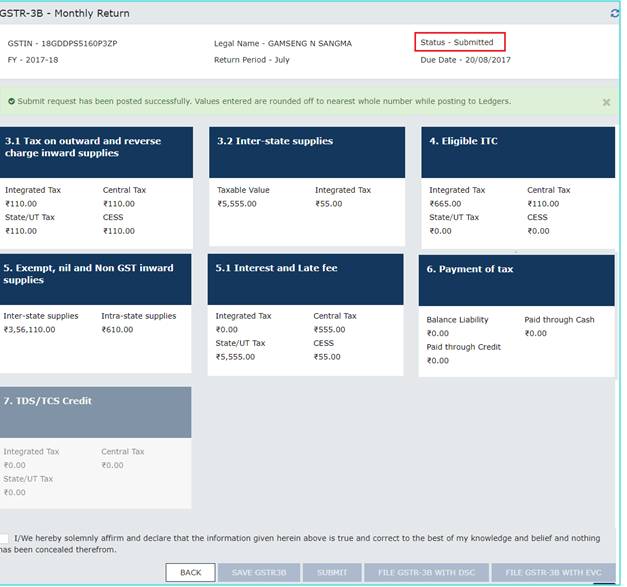

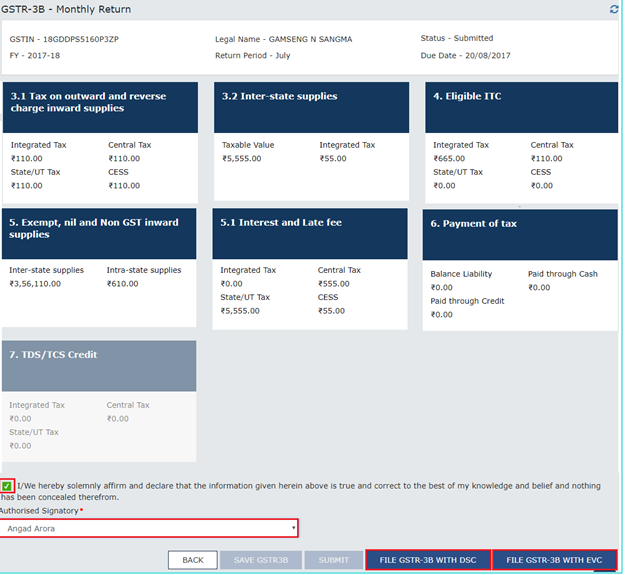

11. The status for monthly return will change to submitted.

12. Select the checkbox for the declaration, select the “authorized signatory”. Click on “File GSTR 3B with DSC” or “File GSTR 3B with EVC”.

13. Click on proceed button.

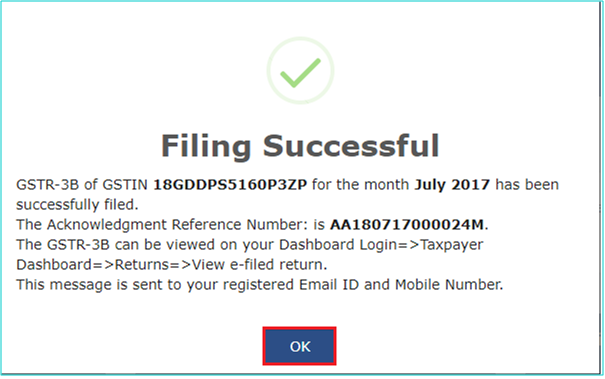

14. On successful filing, a message will display on the screen.

The status will change to “Filed”. you can click on the view button to view the returns.

In case of any help or assistance in filing your GSTR 3B in Chennai, GSTR 3B in Mumbai, GSTR 3B in Bangalore contact Virtual auditor support team on 9962 230 333/9513 93 9333/044- 48560333 /mail us support@virtualauditor.in, our team will guide through the entire process and help you comply