E-way Bill Login

If you are a business owner in India, you have done your GST Registration you have heard of the new e-way bill , its linked to your gstin number . The e-way bill is an electronic way of tracking goods as they move from one place to another. It was introduced to reduce tax evasion and make it easier for businesses to comply with tax laws. The e-way bill is now mandatory for all shipments in India, so if you haven’t already registered for an account, now is the time to do so. This blog post will explain how to log in to the e-way bill and create your first shipment. Stay tuned!

What is the e-way bill , and what is it used for?

The e-way bill is a new system introduced by the Indian government to streamline the movement of goods across the country under GST Laws. It is an electronic way of tracking shipments and helps businesses to comply with tax laws.

How to register into the E-way bill portal?

You must first compete GST Registration as your GSTIN (Goods and Services Tax Identification Number) would be used to create a user ID and password. After successful registration, you can log in to the e-way bill and start creating shipments.

Documents required for registration :

To register for a consolidated e-way bill account, you will need the following documents:

1. GSTIN (Goods and Services Tax Identification Number)

2. User ID and password

3. Bank account details

4. PAN (Permanent Account Number)

5. Address proof

6. Email address

7. Registered Mobile number

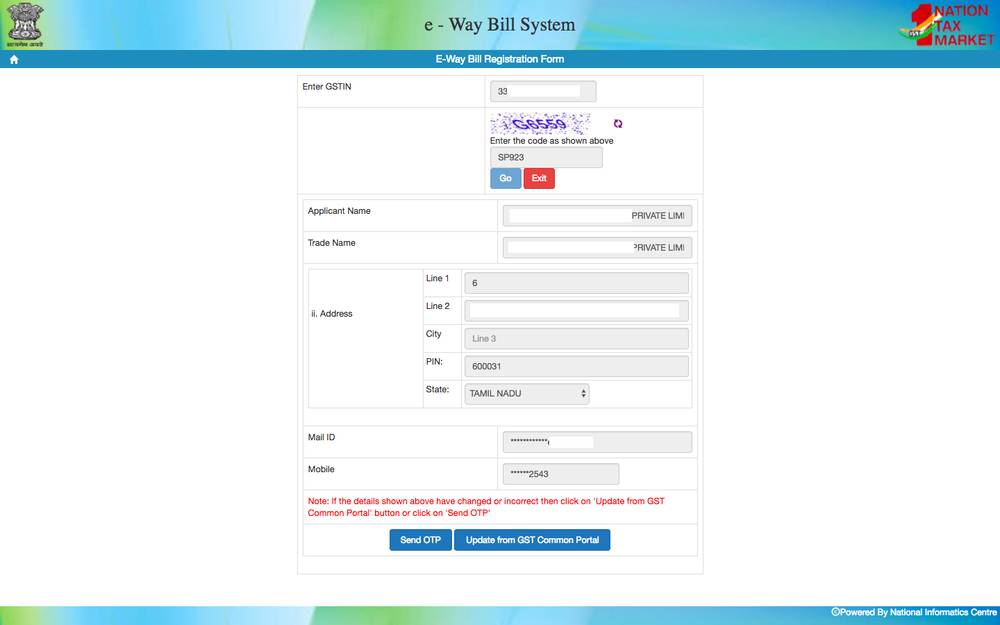

How to get E-way bill registration for registered suppliers?

You can log in to the e-way bill using your GSTIN and user ID if you are a registered supplier. After successful login, you can generate e-way bills for your shipments.

How to get E-way bill registration for unregistered suppliers?

You can apply for registration on the GST portal if you are an unregistered supplier. You must furnish your GSTIN and create a user ID and password. After successful registration, you will be able to log in to the eway bill portal and start generating e way bill for your shipments.

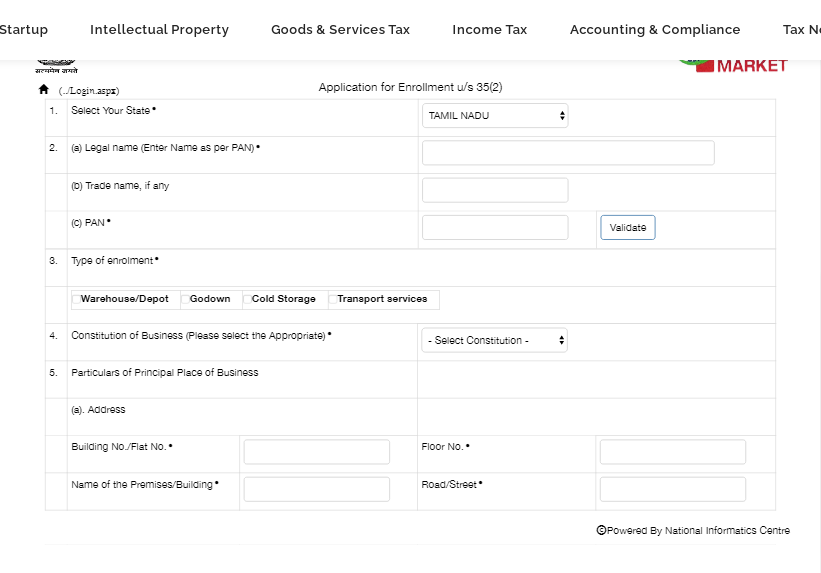

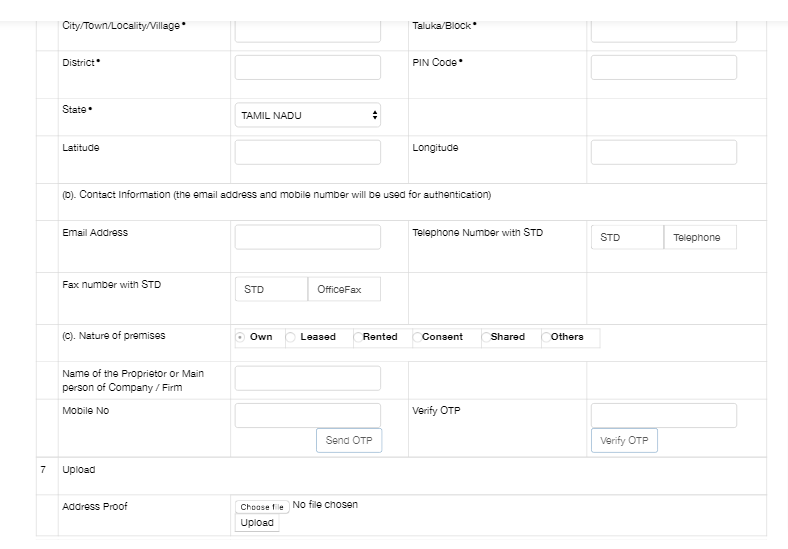

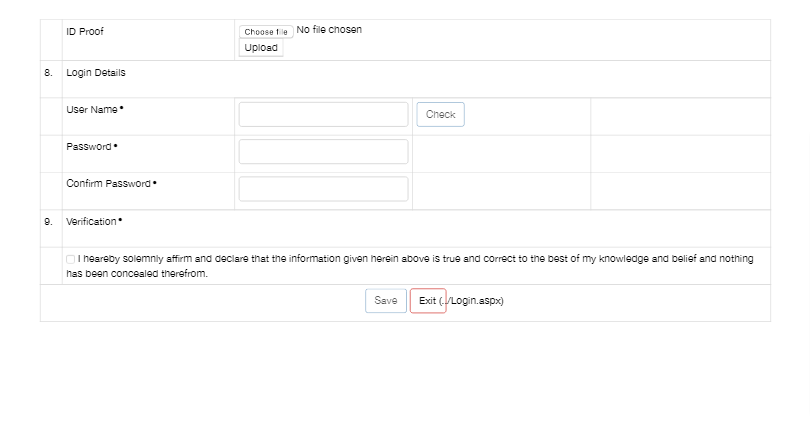

Steps for E-way bill registration of unregistered suppliers:

Visit the e-way bill website and then select registration.

1. enrolment for registration

During registration, the transporter must provide the following information:

2. upload copies of the above mentioned documents for your account registration.

3. after uploading documents, select submit on the portal.

Finally, a transporter identity including vehicle number will be generated along with e-bill portal access.

How to activate the account:

After the e-way bill system account is created, the account needs to be activated. The activation can be done in two ways:

1. By using the OTP (One Time Password) method: In this method, an OTP will be sent to your registered mobile number and email address. Enter the OTP on the login page to activate your account.

2. By using the Digital Signature Certificate (DSC): In this method, you need to log in to the e-way bill system using your DSC. After successful login, your account will be activated.

E-way bill login process:

The E-way bill login process is very simple. All you need is your pan number, invoice number, and journey date. Once you have these three things, you can go to the e-way bill website and log in. After you log in, you will be asked to complete basic information about yourself and the goods you are transporting.

Once you have filled all the details , you will be given a unique e-way bill number. You must print out this e-way bill and carry it on your journey. If you are stopped by the authorities, they will ask to see your e-way bill. If everything is in order, they will allow you to continue your journey. If you do not have an e-way bill, they may confiscate your vehicle carrying multiple consignments or impose a fine. Therefore, you must ensure that you have an eway bill login portal and obtain an e-way bill before undertaking any journey.

Documents required for e-way bill generation:

To generate an e-way bill, you will need the following documents:

1. Invoice or Bill of Supply

2. Transport document (Waybill/LR/CR)

3. E-way bill number (if applicable)

4. Goods description

5. HSN code (if applicable)

6. Value of goods

7. Quantity of goods

8. Weight of goods (if applicable)

9. Distance to be covered

Vehicle number

How to log in to the e-way bill ?

Once you have registered for an account, you can log in to the e-way bill using your user ID and password. After successful login, you can access all the system’s features. You can create shipments, view reports, track shipments, and more.

1. Visit the e-way bill website at

2. Enter your user ID, password, and captcha code.

3. Click on the “Login” button.

4. You will be redirected to the e-way bill dashboard.

5. From here, you can create shipments, view reports, and track goods movement.

How to generate an e-way bill:

1. log in to the e-way bill system using your user ID and password.

2. Click on the “Generate E-way Bill” button.

3. Enter the required information such as Invoice or Bill of Supply number, consignment value, transport document number, vehicle number, etc.

4. Click on the “Submit” button.

5. Your e-way bill will be generated, and you will be given a unique e-way bill number.

6. Print out the e-way bill and carry it with you on your journey.

7. If you are stopped by the authorities, they will ask to see your e-way bill.

8. If everything is in order, they will allow you to continue your journey.

9. If you do not have an e-way bill, they may confiscate your goods or impose a fine

What are the features of the e-way bill system?

The e-way bill system has several features that make it easy for businesses to comply with tax laws. Some of the key features are listed below:

1. Generate bills for transportation of goods within or outside the state.

2. Track goods movement and verify tax payments.

3. Login using user ID and password.

4. Create shipments, view reports, and track goods movement.

5. Save multiple shipping addresses for easy reference.

6. Print e-way bills and carry them on your journey.

7. View e-way bill status and history.

8. Receive SMS and email alerts for status updates.

9. Access the system 24×7 from anywhere in the world.

Conclusion:

The e-way bill is a critical component of the GST regime in India. It enables businesses to generate bills for the transportation of goods within or outside of the state. It also allows for tracking of goods movement and verification of tax payments. In this article, we provided a step-by-step guide on how to log in to the e-way bill system and generate an e-way bill. We also highlighted some of the key features of the system. So, if you are engaged in transporting goods, log in to the e-way bill system and obtain an e-way bill before undertaking any journey.

FAQs:

How to check the status of your e-way bill?

You can check the status of your e-way bill by logging into the system and clicking on the “View Status” button.

What to do if you forget your password?

If you forget your password, click on the “Forgot Password” link on the login page. You will be asked to enter your user ID and registered email address. A reset password link will be sent to your email address. Click on the link and follow the instructions to reset your password.

How to cancel an e-way bill?

You can cancel an e-way bill by logging into the system and clicking on the “Cancel E-way Bill” button. Enter the e-way bill number and reason for cancellation. The e-way bill will be canceled.

Who can generate an e-way bill?

Any registered person who causes the movement of goods of value exceeding fifty thousand rupees in a vehicle can generate an e-way bill.

Is vehicle number mandatory for E-way bill generation?

Yes Vehicle number is mandatory for e-way bill generation