GST Registration Online: Quick, Affordable, and Reliable

✨ Simplify your business compliance with our online GST registration service! ✨

☎️ call us at Call us at 770089597 to discuss your specific needs and find out why we are the preferred choice for GST registration services.

➡️ Choose us for:

✅ Instant GST registration

✅ Affordable GST registration fees

✅ Professional GST registration help by CAs

✅ Service available in Mumbai, Bangalore, and Chennai

⭐ Streamline your business operations with our GST Registration Online service and focus on growing your enterprise!

☎️ Or call us at Call us at 770089597 to discuss your specific needs and find out why we are the preferred choice for GST registration services.

Get Started with GST Registration Online

Effortless GST Registration Online: Expert Support at Affordable Prices

✨ Take the complexity out of GST compliance with our online GST registration service tailored to your business needs! ✨

➡️ Why choose our GST Registration Online service?

✅ Instant GST registration: Get your GST registration done quickly and efficiently.

✅ Affordable GST registration fees: Our services come at competitive prices without compromising on quality.

✅ Professional GST registration help by CAs: Receive expert guidance from experienced Chartered Accountants.

✅ Service available in Mumbai, Bangalore, and Chennai: Our GST registration service caters to businesses across multiple cities.

✅ Outsourced GST Registration: Save time and resources by outsourcing your GST registration to our skilled team.

✅ Fast GST Registration: We understand the importance of speed in business and work diligently to complete your registration in the shortest time possible.

⭐ Opt for our GST Registration Online service and focus on scaling your business while we take care of your GST compliance needs!

How Our GST Registration Process Works

We strive to make the GST registration process as seamless as possible for you. Here’s an overview of our simple, hassle-free process:

- Fill out a short online form with your business details.

- Our team of experts will review your information and reach out to you for any additional requirements.

- Once all the necessary documents are submitted, we will file your GST registration application.

- Upon successful registration, you will receive your GSTIN, enabling you to conduct business operations in compliance with GST regulations.

Contact Us Today!

Ready to experience the benefits of our GST Registration Online service? Don’t hesitate!

☎️ Call us at Call us at 770089597 to discuss your specific requirements and discover why we are the preferred choice for GST registration services.

GST Registration Online

The Ultimate Guide to Simplifying Your GST Registration Online and Business Tax Filing , In the world of ever-evolving tax systems, the Goods and Services Tax (GST) has emerged as a game-changer for businesses in many countries. To keep up with this change, it’s crucial to register for GST and maintain compliance. Enter the world of GST Registration Online! In this article, we’ll walk you through the ins and outs of online GST registration, providing you with a step-by-step guide and answering all your burning questions.

Table of Contents

- Introduction

- GST Registration Online: A Blessing for Businesses

- Who Should apply for New GST Registration?

- Breaking Down the Online GST Registration Process

- The Nitty-Gritty of GST Registration

- Benefits of GST Registration

- Keeping Your Business Compliant

- GST Registration Fees

- Timeline for Obtaining GST Registration

- How to Check GST Registration Status

- Common Errors to Avoid in GST Registration

- FAQs on GST Registration Online

- Conclusion

GST Registration Online: A Blessing for Businesses

GST registration has never been more accessible, thanks to the advent of online platforms.

Why Choose Online Registration?

Gone are the days of tedious paperwork and long queues at government offices. Opting for GST Registration Online has several advantages, including:

- Time-saving: The online process is quicker and more efficient than traditional methods.

- Convenience: Register from the comfort of your home or office, 24/7.

- Error reduction: Electronic submission of documents helps minimize errors and omissions.

- Real-time tracking: Easily track the status of your application and receive updates.

What Do You Need to Register?

Before starting your online GST registration, ensure you have the following documents and information:

- Business registration details, such as the company name, address, and registration number.

- Tax Identification Number (TIN) or VAT registration number, if applicable.

- PAN (Permanent Account Number) of the business owner or company.

- Bank account details, including the IFSC code.

- Email address and contact number.

- Digital signature for electronic verification.

Who Should apply for New GST Registration?

GST Registration, Under the GST Laws, (CGST Act 2017) traders/service providers/ manufacturers whose turnover exceeds Rs. 40 lakhs for Goods (Rs 10 lakhs for NE and hill states) ( New Rate listed below is required to register as a normal taxable person.

| Nature of supply | Turnover or Receipts | Registration | Composition scheme | Rate of tax for composition scheme |

| Goods | Up to 40 Lakhs | – | – | – |

| More than 40 but up to 1.5 crore | ✓ | ✓ | 1% of the turnover | |

| More than 1.5 crore | ✓ | – | – | |

| Restaurant Services | Up to 20 Lakhs | – | – | – |

| More than 20 Lakhs but up to 1.5 crore | ✓ | ✓ | 5% of the turnover | |

| More than 1.5 crore | ✓ | – | – | |

| Other services | Up to 20 Lakhs | – | – | – |

| More than 20 Lakhs but up to 50 Lakhs | ✓ | ✓ | 6% of the turnover | |

| More than 50 Lakhs | ✓ | – | – |

In terms of Section 22(1) of the CGST Act, every supplier making taxable supplies is liable for registration if his aggregate turnover in a financial year exceeds twenty lakh rupees ( Now amended as per rates provided in the table above) or ten lakh rupees in special category States as the case may be.

This process of registration is called GST Registration.

Example 1: A person located in Delhi having a turnover of Rs. 15.00 Lakh of taxable goods or services or both and Rs. 7 Lakh of exempted goods or services or both is required to get himself to get GST Registration?

Ans: Yes, he has to get himself registered because his aggregate turnover exceeds Rs. 20 Lakh and he has to apply for registration mandatorily within 30 days of becoming so liable

Example 2 : A salaried person drawing a salary of Rs. 30 lakh per annum. He sells his old car for Rs. 40 lakh. Would he be liable for registration? Would this one-time transaction of selling off old car be treated as a business?

Answer: No he not liable for GST Registration, The term ‘business’ is defined by section 2(17) of the CGST Act.

The above transaction does not fall under any of the transactions listed under this definition. So, he would not be required to obtain registration for the said purpose of selling his old car.

Breaking Down the Online GST Registration Process

Step-by-Step Guide

Now that you’re ready to dive into GST Registration Online, follow these steps to complete the process:

- Visit the official GST portal.

- Click on ‘Register Now’ under the ‘Taxpayers’ section.

- Fill in the required details, such as your business type, PAN, and contact information.

- Verify your details through an OTP sent to your registered email address and mobile number.

- You’ll receive a Temporary Reference Number (TRN). Use this to log in and complete the registration process.

- Upload the required documents and fill in the remaining details.

- Validate the information using a digital signature or EVC (Electronic Verification Code).

- Submit the application and receive an Application Reference Number (ARN) for tracking purposes.

- Once your application is approved, you’ll receive your GSTIN (GST Identification Number).

GST REGISTRATION PROCEDURE

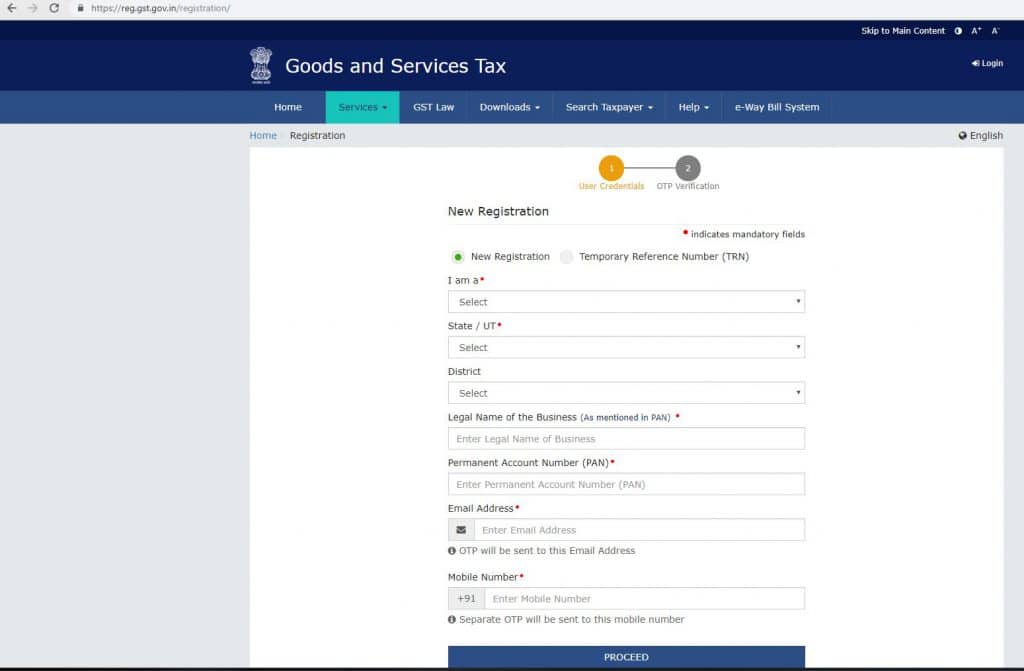

Step 1: Create an account in GST website E-Portal https://reg.gst.gov.in/registration/

GST Registration Step 2: Fill the Basic details and Name as per PAN card Data base

Step 3: Get E-Mail and Mobile OTP , verify and login to the account

Step 4: Flll up Part A & Part B of FORM GST REG01 , along with business details and documents thar are nessary

Step 5: An acknowledgment will be generated in Form GST REG-02.

Step 6: In case of any information sought from you and intimated to you in Form GST REG-03, you may need to visit the department and clarify or produce the documents within 7 working days in Form GST REG-04.

Step 7: Certificate of registration will be issued to you by the department after verification and approval in Form GST REG-06.

GST Number is a 15 digit Alpha numeric number (i) two characters for the State code; (ii) ten characters for the PAN or the Tax Deduction and Collection Account Number; (iii) two characters for the entity code; and (iv) one checksum character.

The Nitty-Gritty of GST Registration

Types of GST Registrations

There are several types of GST registrations, including:

- Regular GST Registration: For businesses that supply taxable goods or services.

- Composition Scheme: For small businesses with an annual turnover of up to a specified threshold.

- Non-Resident Taxable Person: For foreign businesses supplying taxable goods or services in a country where GST applies.

- Casual Taxable Person: For individuals or businesses engaged in seasonal or occasional taxable supplies.

Determining Your Business Category

Understanding your business category is essential to ensure accurate GST registration. Factors to consider include:

-

- Location: If you have operations in multiple states, you may need separate GST registrations.

- Annual turnover: This determines your eligibility for the Composition Scheme.

- Nature of your business: Your business type (e.g., manufacturer, trader, or service provider) can affect your registration requirements.

Benefits of GST Registration

Registering for GST offers numerous benefits, such as:

- Legal recognition: Operate your business without fear of legal repercussions.

- Increased credibility: Boost your business’s reputation and trustworthiness.

- Access to input tax credit: Claim tax credits for GST paid on purchases.

- Streamlined business operations: Simplify tax filing and maintain better records.

Keeping Your Business Compliant

Filing GST Returns

Stay compliant by filing your GST returns on time. Depending on your registration type, you may need to file monthly, quarterly, or annual returns.

Common Mistakes to Avoid

Keep an eye out for these common mistakes when filing GST returns:

- Incorrect GSTIN: Always double-check your GSTIN before filing.

- Mismatched invoices: Ensure the information in your purchase and sales invoices matches.

- Late filing: Penalties can be imposed for late filing, so make sure to submit your returns on time.

- Incorrect tax rates: Stay updated with the latest tax rates to avoid errors in tax calculation.

- Not claiming input tax credit: Remember to claim tax credits on eligible purchases to reduce your tax liability.

GST Registration Fees

Good news for businesses and taxpayers – there is no fee for GST Registration Online. The government offers this service free of charge, making it even more convenient and cost-effective for businesses to register for GST and stay compliant.

Timeline for Obtaining GST Registration

The timeline for obtaining GST registration can vary depending on the tax authorities’ efficiency and the accuracy of the information provided. Generally, the entire process, from submission of the application to receiving your GSTIN, takes between 2 to 6 working days.

How to Check GST Registration Status

Monitoring your GST Registration Online status is a breeze. Follow these simple steps:

- Visit the official GST portal.

- Navigate to the ‘Services’ menu, then select ‘Registration’ and ‘Track Application Status.’

- Enter your Application Reference Number (ARN) or search using your PAN and other details.

- Click ‘Search’ to view the status of your application.

Common Errors to Avoid in GST Registration

To ensure a smooth GST registration process, be mindful of these common errors:

- Incorrect or incomplete information: Double-check your details before submitting your application.

- Missing documents: Ensure all required documents are uploaded in the correct format.

- Misclassification of business type: Accurately identify your business type to avoid complications.

- Failure to digitally sign or verify the application: Complete the process by using a digital signature or Electronic Verification Code (EVC).

By avoiding these common mistakes, you’ll be one step closer to successfully completing your GST Registration Online and enjoying the benefits it brings to your business.

FAQs on GST Registration Online

1. How long does it take to complete GST Registration Online?

The process usually takes between 2 to 6 working days, depending on the accuracy of the information provided and the efficiency of the tax authorities.

2. Can I apply for multiple GST registrations under one PAN?

Yes, you can apply for multiple GST registrations under one PAN if you have business operations in different states or operate multiple business verticals.

3. Is there a fee for GST Registration Online?

No, there is no fee for registering for GST online.

4. Can I amend my GST registration details after submission?

Yes, you can amend your GST registration details after submission. Log in to the GST portal and navigate to the ‘Amendment of Registration’ section.

5. What happens if I don’t register for GST?

Failing to register for GST can result in penalties, legal actions, and loss of input tax credits.

6. How often do I need to renew my GST registration?

GST registration does not require renewal, but you must file returns regularly and maintain accurate records to remain compliant.

7. Can a business having a turnover of fewer than 20 /40 Lakhs and not having transaction mentioned above can apply for New GST Registration online?

Yes , As per section 25(3) a person, though not liable to be registered under section 22 ( As turnover is less than 20 lakhs) may get himself registered voluntarily, and all provisions of this Act, as are applicable to a registered person, shall apply to such person.

8.What is the time limit for taking GST Registration?

Every person should take a GST registration, within thirty days from the date on which he becomes liable to registration. But casual taxable person or a non-resident taxable person shall apply for GST registration at least five days prior to the commencement of business.

9. If a person is operating in different States, with the same PAN, whether he can operate with a single registration?

Every person who is liable to take a registration will have to get registered separately for each of the States from where he is making taxable supplies and is liable to get registered in terms of Section 25(1) of CGST Act.

Conclusion

GST Registration Online has made the process of registering for the Goods and Services Tax much more straightforward, efficient, and accessible. By understanding the various aspects of GST registration, businesses can maintain compliance and enjoy the benefits it offers. So don’t wait – get started with your online GST registration today and simplify your tax filing experience!

If the voluntary registrant fails to commence business within 6 months from the date of registration, his registration may be cancelled by the proper officer.

The voluntary registrant cannot file an application for cancellation of registration before the expiry of a period of one year from the effective date of registration.

Voluntary registrant has to pay tax on his taxable supplies from the date of grant of registration and shall be eligible for input tax credit in respect of inputs held in stock, semi-finished and finished goods.

knowledgeable blog

Nice article on GST (goods and service tax) I really appreciate your hard work thank you for sharing this article with us.

doing good job.

Thanks

You have clearly mentioned everything in a good way. Your way of writing is superb. Keep writing such valuable blogs.

This article is very informative and useful.good job guys Keep it up Great!!!

I am a startup owner looking to register GST Online. This post helped me to register my GST for my business. Thanks for sharing an useful post.