Incorporation of Foreign Company in India as a Private limited Company

Foreign Companies looking for incorporation of Foreign Company in India as a Private limited Company these are the steps that they need to follow

Registering a Wholly Owned Subsidiary in India by foreign company step by step guide

Wholly owned subsidiary in India by the foreign company via, the FDI Route is the easiest way to enter into Indian Markets.

Foreign Direct Investment Rules in India are much liberalised, and it’s very easy to open, a Wholly Owned Subsidiary in India by a foreign company.

Please Contact us on 9513939333 or 9962260333 for complete free guidance on Registering a Wholly Owned Subsidiary

India is a Land of Opportunities and untapped potentials with a population of more than 1.3 billion people and counting, If you want to you are in the right place.

The entry Hub states in India are Mumbai, Delhi, Bangalore, Hyderabad, for setting up Wholly Owned Subsidiary in India by a foreign company.

Therefore, the company Registration process has made simple and easy after government improved ease of doing business, you must hire a CA (Chartered Account) or CS (Company Secretary) for getting the process done

Generally, it takes 3 to 10 Workings days to complete the company registration process in India.

Hence, If you want to invest in growth potential and interested in conducting business in India. Then you need to you establish your company’s legal presence in India by registering your business as a private limited company (Wholly Owned subsidiary in India by a foreign company )

How to register a Wholly Owned subsidiary in India by a foreign company?

Foreign nationals/ Foreign Companies can form a company in India through any of entry strategy mentioned below (India Subsidiary Registration)Wholly Owned Subsidiaries ( 100% Indian Subsidiary )

Section 2(42) of the Companies Act, 2013, defines a foreign company as a company or a body corporate incorporated outside India and which has a place of business whether by itself or through an agent, in this country.

Wholly Owned Subsidiary in India to be Registered as Private Limited Company Registration

Companies Act 2013 governs the registration of Private limited companies which lays down the procedure for registering and managing a company and its affairs, Ministry of corporate affairs through www.mca.gov.in which is its E-Portal manages the compliance under the companies act and all company formation related formalities must be done through this e portal

Steps for forming a Private Limited company

Wholly Owned Subsidiary in India Company Registration (Foreign company registration )

Here, Registering a private limited company requires the support of CA/CS/Lawyer as the legal procedures are involved in it, it’s a complicated process but does not worry our team of experts will take care of these issues

Steps for Wholly Owned Subsidiary in India Company Registration (Foreign company registration )

Registering a private limited company in Mumbai requires the support of CA/CS/Lawyer as the legal procedures are involved in it. it’s a complicated process but does not worry our team of experts will take care of these issues

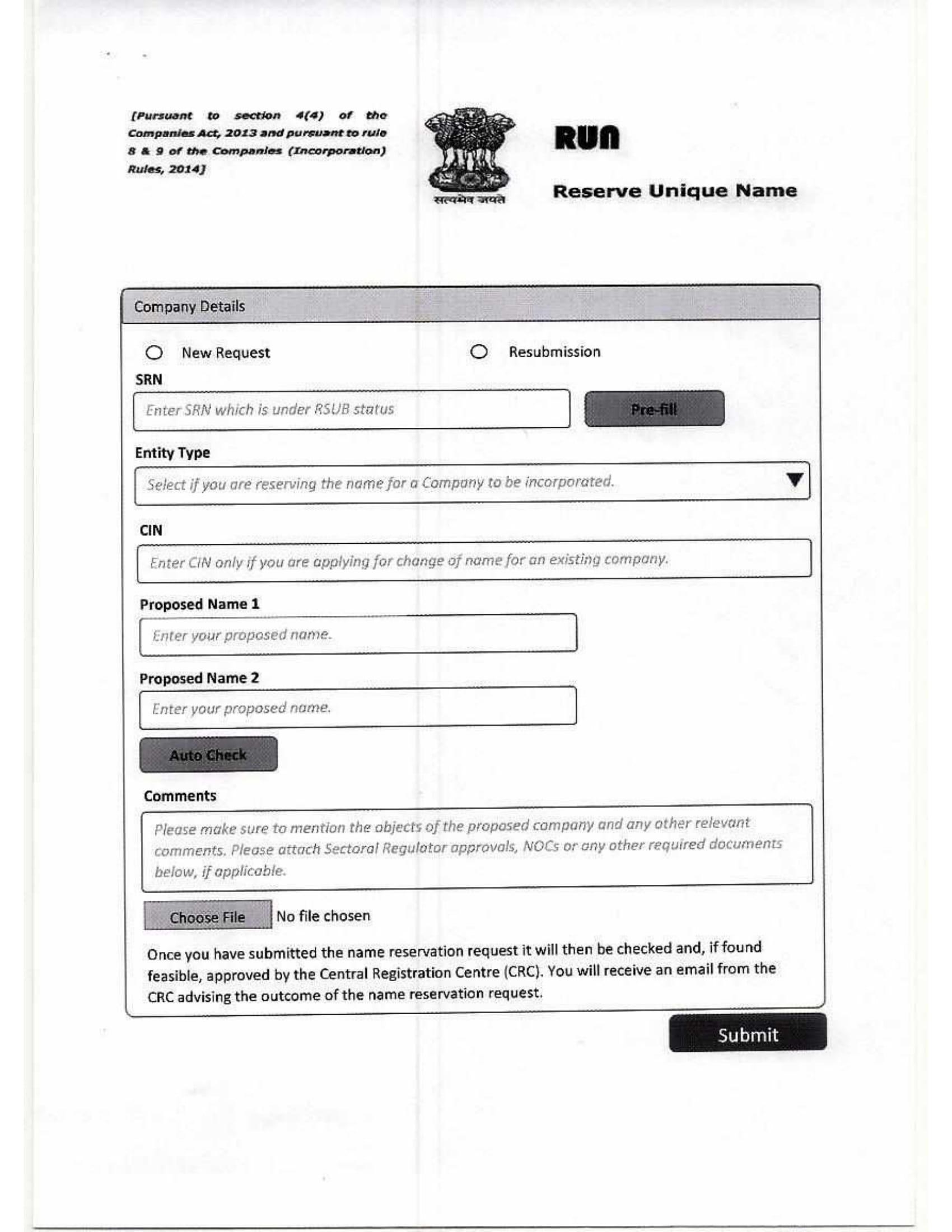

Step 1: Apply RUN ( Reserve Unique Name Form ) (Name Availability)

Step2: Obtain DSC and Form SPICE INC-32 (E Form used for Company Registration)

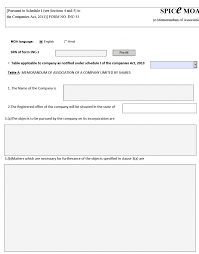

Step3: Drafting of MOA in SPICE INC – 33 and AOA In SPICE form company registration

Step4: PAN and TAN Application Along with Form SPICE INC -32 (E Form used for Company Registration)

Step5: After completion of the above-mentioned process of company registration, ROC Issues Certificate of Incorporation.

So, the next time someone you wonder how to register a company in India, you can easily log in to our website and use our services.

Now that you have understood the Steps involved. Hence, we will get into the intricate details of company registration and its procedures

We can choose any of the methods for name approval

- Approval through RUN form route

2. Direct SPICE Route

Method 1: Incorporating a Company via RUN (Reserve Unique Name) form:

RUN(Reserve Unique Name) form gives only Two (2) chance for applying one is original submission and the other is in resubmission mode. Therefore, You must ensure that the names should not be general and should be closely resembling with other companies detailed understanding of name availability guidelines

In one application we can apply for Two names in case of Resubmission. Hence, we can apply for the next two names You can check the names through this government portal link, or refer our detailed on company name selection

METHOD 2:

Apply Directly in SPICE INC -32 for company registration and get a direct certificate of incorporation, the only pitfall is that we can apply only one name and all legal documents must be fully prepared to proceed with this, if the name is rejected then we have to completely redo entire documents such as INC- 9 ( Affidavit), DIR -2 ( Director Concent) and all other documents including NOC from owner

Step 2: Form SPICe (INC-32) form used for Company Registration in Mumbai

DSC ( Digital Signature) in simple terms means your physical signature in a digital form. This does not mean your physical signature is copied and pasted. it’s all your data that is PAN number and other details are embedded in a file that can be downloaded in an e-token.

The e-token has password protected. Which will act as your digital signature for company formation, GST registration, PF Registration and for Income Tax filing. We have to use class 2 DSC provided by government-approved vendors such as e-mudra or Sify or N-Code

MCA (Ministry of Company Affairs) has introduced Form SPICe (INC-32) for easy and fast company registration

- Application for allotment of DIN (Director Identification Number)

- Reservation of company name

- Incorporation of a new company

- Application for PAN and TAN

Step 3: e-MoA(INC-33) and e-AoA (INC-34)

Therefore, e-MoA refers to an electronic Memorandum of Association and eAoA is electronic Articles of Association.

Memorandum of Association in Company registration represents the charter, indicating the lines of business its operation as the main business and other activities related to its main business activity

Hence, Articles of association used in company registration process define the powers, rights, and responsibilities of the directors and shareholders

Step 6: PAN and TAN Application

Through this single form SPICe, you have mandatory to apply for PAN and TAN by using forms 49A for PAN and 49B for TAN.

Hence, The system will auto-generate these forms after the submission of SPICe form.

Step 7 : Apply for Shop & Establishment Act Registration

Apply for Shop & Establishment Act Registration with local labour that you establishment is fully complaint with local labour laws of the state

Step 8 : Apply for Professional Tax Registration

Apply for Professional Tax Registration with local labour that you establishment is fully complaint with local labour laws of the state

Documents required for Private Limited Wholly Owned Subsidiary in India by foreign Company

Where director/subscriber is a foreign National

- Passport ( Notarised or Apostle in their country) and counter attested by the Indian embassy

- No Pan Declaration and counter attested by the Indian embassy

- INC -9

- Address proof: Driving license, Residence card, Government issued a form of identification containing an address

- Copies of utility bills ( Telephone Bill or Bank Statements), that are not older than two months ( Compulsory for the incorporation of companies)

- Therefore, Additional Documents required for Foreign Holding Company are

- Board Resolution for Investment in India.

- Incorporation Certificate of Foreign holding Company.

- INC 9 Declaration in the name of the company.

- All KYC document of Authorised Signatory.

NOTE: ALL THE ABOVE MENTIONED DOCUMENTS HAS TO NOTARIZED AND APOSTLE BY INDIAN EMBASSY

Hence, Rules to Complied for registering as Liaison Office/Representative Office/Project Office /Branch Office.

Under, the Companies Act 2013 Companies (Registration of Foreign Companies) Rules 2014 prescribes, the procedure to be followed for the registration of a foreign company.

RBI Compliances has to follow for Wholly-owned Subsidiary in India:

A two-stage reporting procedure has to follow when a company is raising funds from a foreign investor:

- On receipt of funds: The Company has to provide details in an “Advance Reporting Form” to the RBI within 30 days of receiving funds from a foreign investor(s).

- And, The company has to issue shares within 180 days from the date of receiving funds.

- On allotment of shares: The company has to report in the specified form (FC-GPR) to the RBI within 30 days from the date of issue of shares along with:

As a Certificate from the Company Secretary certifying that the company has complied with the procedure for issue of shares as laid down under the Foreign Direct Investment (FDI) Scheme, and

As a certificate from a Chartered Accountant indicating the manner of arriving at the price of the shares issued to the foreign investors.

Apart from the above, Annual return on Foreign Liabilities and Assets has to submit reports. As of all the investments received during the year.

FAQ ON Wholly Owned subsidiary in India by a foreign company

Q1: Do I need to be physically present during this process?

No, new company registration is a fully online process. As all documents has filed electronically and you would not need to be physically present at all. Therefore, You would need to send us scanned copies of all the required documents & forms.

Q2: How much time has needed for setting up a Wholly Owned Subsidiary in India as a private limited company?

If you have all the documents in order, it will take no longer than 15 days. Therefore, this is dependent on the workload of the registrar.

Q3 Can NRIs/Foreign Nationals become Director in a Private Limited Company?

Yes, an NRIs and Foreign National can become Directors in a Private Limited Company. They need to get a DIN from the Indian ROC. It also has a majority shareholder in the company. It Provides at least one Director on the Board of Directors has an Indian Resident.

Q4 Whether RBI (Reserve Bank of India) approval has for Company Registration?

No at the time of Company Registration there is no requirement of Obtaining RBI approval Expect in some cases

Q5 What is a subsidiary company?

, a subsidiary company is any company, whose interests has held and controlled, or held by another company or Paid up equity share capital and preference share capital of the subsidiary company has used to determine the holding company subsidiary company relationship between two companies.

In case of any help or assistance in registering Wholly Owned subsidiary in India by a foreign company, contact Virtual auditor support team on 9962 260 333/044- 48560333 /mail us support@virtualauditor.in, our team will guide through the entire process and help you comply