Relative Valuation and Price Analysis

Relative Valuation and Price Analysis relies DCF(Discounted Cash Flow) is used to evaluate an asset’s value by taking into account the asset’s future cash flow, growth and risk. Value or price is determined in relative terms by comparing a specific asset or investment to the price of similar assets or investments in the current market. As a consequence, relative value has two components. Starting with a common variable, it is important to standardize prices into multiples of a common value.

Relative Valuation and Price Analysis Publicly traded equities often have this common variable expressed the bottom line, book value, and/or receipts; however, it may take on other forms depending on the investment. The second step is to look for other people who have made similar investments. Due to the rarity of two financial assets that are exactly the same, this is a challenging task. The price variations in the case of collectibles like antiques and baseball cards may be minimal and easily explained.

Thus difficulties are exacerbated when assessing the stock of companies, because organizations in the same industry might yet have varying levels of risk, growth potential, and cash flows. When comparing a multiple across various companies, it becomes critical to consider how to account for these variances.

Relative value is simple to understand and use, but it may also be easily squandered. Relative value is outlined in four steps in this chapter. To confirm that multiples are utilized appropriately, we will also construct a set of tests.

Source https://corporatefinanceinstitute.com/resources/knowledge/valuation/relative-valuation-models/

Do you know what “relative valuation” means?”

Relative valuation is a method of valuing an item by comparing it to other assets in the market. When deciding how much to offer for a home, a potential buyer looks at the comparable homes in the area’s price range. To arrive at a reasonable estimate of the market worth of a Mickey Mantle rookie card, a baseball card collector looks at the transaction values of additional rookie cards for Mickey Mantle. To get an idea of how much a stock is worth, a potential buyer looks to the market price of “similar” securities.

The three main processes of relative value are described in this description. Baseball cards and homes make it easy to identify similar assets that are valued by the market, but equities are more difficult to find. Analysts often compare whether it be a utility business to other utilities or a software company to other software firms, as if they were interchangeable. In this chapter, however, we’ll look at whether or not this strategy really leads to the creation of similar enterprises.

Relative Valuation and Price Analysis

The second stage is to normalize prices so that they are comparable by converting to a prevalent variable in the market. Assets of different sizes or units may be compared to each other necessitates the use of a comparison tool, such as the Mickey Mantle rookie card. If everything else is equal, a smaller dwelling should be less expensive than a bigger one.

Equalization in stock markets often involves multiplying the market value of an equity stake or of a company by multiples of its profits, book value or sales. Third and last stage is compensating for variances in investments when comparing their standardized values. When comparing houses, newer ones with more up-to-date features should command a greater price than older ones that need remodeling.

All the fundamentals we discussed with discounted cash flow valuation may be used to explain price differences across companies. As an example, higher-growing firms in a given industry should be valued at greater multiples than those with lower growth rates. In order to compensate for these discrepancies, many analysts use each comparable valuation as a storytelling opportunity; those that tell better and more credible tales are awarded credit for superior values.

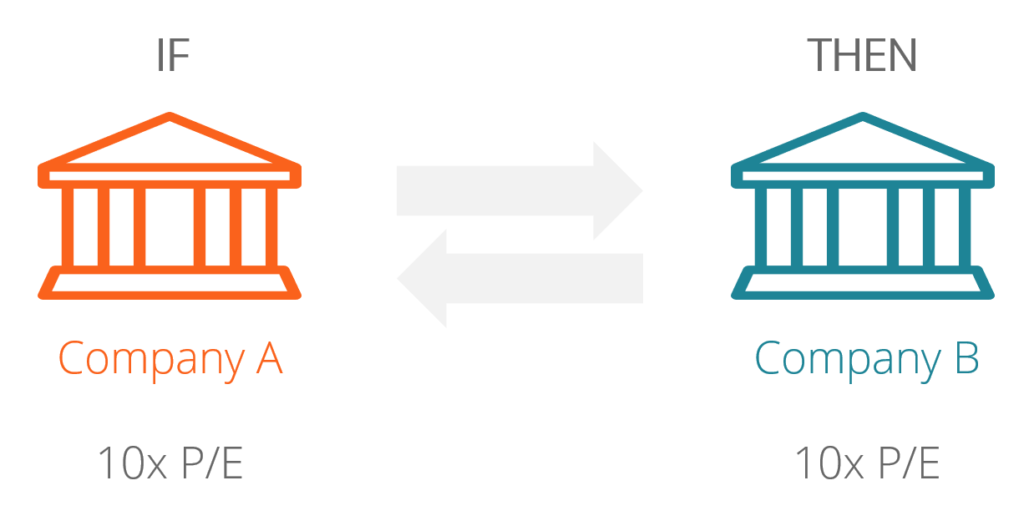

Both relative value and discounted cash flow have conceptual underpinnings that are fundamentally distinct from one another. We may be able to assess the asset’s true worth by utilizing a method called discount rate valuation if the asset has the potential to generate the future flow of money. When comparing an asset’s value to that of comparable assets, the method of relative valuation may be used to determine its true worth. It’s possible that discounted cash flow and relative valuations might converge if the market values assets correctly.

Cash flow discounted at a certain rate values may depart from relative valuations if the market is persistently overvaluing or undervaluing a collection of assets or the industry as a whole. A visual comparison of the value and price processes is a simple but effective technique to illustrate the differences.

Relative Valuation’s Widespreadness : Relative Valuation and Price Analysis

Despite classroom and theoretical emphasis on discounted cash flow valuation, most assets are priced, not appraised. Consider:

Relative Valuation and Price Analysis

Multiples dominate equity research papers. PE, EBITDA, price, and price-to-sales ratios are examples. In early 2001, relative values outweighed discounted cash flow valuations roughly ten to one. 1 Many stock research papers featured cash flow charts, but valuations and recommendations were approximated using similar businesses and multiples. When experts say a stock is undervalued or overpriced, they commonly use relative valuation. Sell-side equity research is mostly a pricing game.

Acquisitions and corporate finance use discounted cash flow. Casual empiricism implies that every purchase is underpinned by the cash flow discounted method is used to arrive at a valuation, however the price paid for the asset is usually determined using a multiple. Many discounted cash flow projections are instances of relative values in acquisition valuation since terminal values are established using multiples.

Most investing guidelines uses multiples. Many investors view firms that trade below book value and equities with low PE ratios to be cheap.

Relative valuation is so prevalent that rejecting it as an unsophisticated technique would be wrong. As we explain in this and the following two chapters, relative valuation or pricing differs based on an assessment of discounted cash flow.

Popularity, risks in Relative Valuation and Price Analysis

Why is relative value popular? Why do managers and analysts prefer multiples and comparable over discounted cash flow? This section discusses multiples’ popularity.

Discounted cash flow valuation takes more time and resources. Discounted cash flow estimations demand more data than relative assessments. Relative valuation helps analysts with limited time and information.

Stocks are simpler to sell when analysts and salesmen employ valuations. A relative value is simpler to sell than a DCF valuation. Discounted cash flow appraisals may be hard to explain to customers, particularly in a hurry. Many investors with little time are pitched over the phone or online. Relative values, on the other hand, fit perfectly into short sales presentations. Relative valuations are simpler to spin than discounted cash flow valuations.

Analysts must justify their value assumptions to supervisors, coworkers, and customers. Discounted cash flow values are harder to justify than relative valuations, where a multiple is frequently based on what the market is paying for comparable businesses. Financial markets may be responsible for most relative valuations. In a way, we’re pushing investors with valuation issues to go to the market.

Relative valuation reflects market imperatives since it measures relative and not intrinsic worth. In a market when all technology firms are bought up, relative valuation may produce greater values than discounted cash flow valuations. Relative valuations are closer to market prices than discounted cash flow valuations for all companies. This is significant for investors whose job it is to determine relative worth and who are themselves rated relative. Consider tech-fund managers. These managers’ performance is compared to other technology funds. They are rewarded for picking inexpensive technology companies, even if the industry is overpriced.

Relative valuation’s merits are also disadvantaging. First, the simplicity with which a relative valuation may be put up, using a multiple and a set of similar enterprises, might result in inconsistent assessments, where risk, growth, or cash flow potential are overlooked. Second, since multiples reflect market sentiment, using relative valuation to determine an asset’s worth might result in too-high or too-low valuations when the market overvalues or undervalues related enterprises. Third, although any valuation may be biased, the lack of transparency in relative values makes them subject to manipulation. A biased analyst who chooses the multiple and similar businesses may justify practically any value.

THE ULTIMATE GUIDE TO STARTUP VALUATION

A COMPLETE GUIDE TO STARTUP VALUATION IN INDIA OTHER GUIDES

- About CA Viswanathan V

- The Ultimate Guide to stat up valuation

- Intrinsic Valuation

- Scenario Analysis and Simulations: A Probabilistic Approach to Valuation

- Real Options Valuation..

- Risk Free rate guide

- Price of Risk in Risky Ventures.

- Firms in Their First Stages of Development.

-

How to Value A Company: An In-Depth Guide To The Business Valuation Process

-

7 Major Startup Funding and Valuation Mistakes First-Time Entrepreneurs Make (and How to Avoid Them)

-

Startup Valuation Methods To Value Pre-Revenue Startup Valuation

-

Business Valuation Services – The Importance of Well negotiated deal with Venture Capital Firms