THE ULTIMATE GUIDE TO STARTUP VALUATION

Valuing a startup can be a daunting task, especially if you’re new to the world of entrepreneurship. Fear not, because we’ve put together the ultimate guide to startup valuation, covering everything from intrinsic valuation to real options valuation, and everything in between. We’ll discuss the different methods and techniques, the importance of understanding risk, and how to avoid common mistakes when valuing your startup. So, let’s dive in!

Table of Contents

-

-

- About CA Viswanathan V

- Intrinsic Valuation

- Scenario Analysis and Simulations: A Probabilistic Approach to Valuation

- Relative Valuation and Price Analysis

- Real Options Valuation

- Risk-Free Rate Guide

- Price of Risk in Risky Ventures

- Startups in Their First Stages of Development

- How To Do Startup Valuation For Startups

- Startup Valuation Metrics : Understanding the Key Performance Indicators (KPIs)

- How to Value A Company: An In-Depth Guide To The Business Valuation Process

- Business Model Design

- Business Valuation Services: A Step By Step to Get Registered Valuer Certificate for Startup Valuation

- Business Valuation: How Do You Valuate Your Company?

- 7 Major Startup Funding and Valuation Mistakes First-Time Entrepreneurs Make (and How to Avoid Them)

- Valuation for Business

- Definition and Reasons for Business Valuation

- Startup Valuation Methods To Value Pre-Revenue Startup Valuation

- When Ownership Disputes Lead To Business Valuations

- 10 Things To Do Before You Sell Your Business!

- Registered Valuer for Valuation of Shares

- Valuation Advisory Firms in India

- Valuation Consulting Companies

- Valuation Companies in Mumbai

- Guide on Understanding Terminology Used by Investors During Valuation Stage for Startups

- A Complete Guide on Compulsory Convertible Preference Shares (CCPS) & Optionally Convertible Preference Shares (OCPS)

- Business Valuation Services – The Importance of Well negotiated deal with Venture Capital Firms

- When Ownership Disputes Leads To Business Valuations

- Definition and Reasons for Business Valuation

- Valuation for Business

- 7 Major Startup Funding and Valuation Mistakes First-Time Entrepreneurs Make (and How to Avoid Them)

- Merchant Banker Valuation

- Subsequent events in the world of business valuation

- Business Valuation

- Analyzing Recent Startup Valuations In India

- Key Metrics for Evaluating Startup Valuation: A Comprehensive Guide

- The Pros and Cons of Different Startup Valuation Methods

- Role of Market Size and Competition in Startup Valuation: A Comprehensive Analysis

- Valuation in 2023 and Beyond: The Latest Trends and Developments in the Field

- VirtualAuditor’s Game-Changing Startup Valuation Services: The New Benchmark

- Business Valuation Services: A Comprehensive Guide

- Expert Business Valuation Consultant: Unlocking Your Company’s True Value

- Top-notch Business Valuation Services | Company Valuation Consultants in Bangalore

- Top-notch Business Valuation Services In Mumbai | Company Valuation Consultants in Mumbai

- Business Valuation Services In Hyderabad | Company Valuation Consultants in Hyderabad

- ESOP Valuation: A Comprehensive Guide to Employee Stock Options

- Sweat Equity Valuation in India: A Comprehensive Guide

- Brand Valuation Advisory in India: A Comprehensive Guide

- Dispute Valuation: A Comprehensive Guide to Navigating Business Conflicts

- Valuation of Intangibles Assets in India: An In-Depth Guide

- Demystifying Convertible Instruments Valuation in India: A Comprehensive Guide for Startups and Investors

- SaaS Valuation in India: Methods, Techniques, and Best Practices

- Term sheets and shareholders Agreements comparison in the Indian startup ecosystem

- Startups in India environment

- Why do many startups fail?

- A Comprehensive Guide to Pre-revenue Valuation for Indian Startups

- Understanding Customer Acquisition Cost (CAC)

- Risk Adjusted Startup Valuation: A Comprehensive Guide for Entrepreneurs and Investors

- Risk Assessment in Startup Valuation

- Startup Valuation Uncertainty

- Valuation for Series A

- How to do Exit Valuation

- Seed Stage Startup Valuation

- Post-revenue Valuation

- Startup Valuation Stages

- IND AS Valuation

- Distress Valuation

-

The Ultimate Guide to Startup Valuation

Startup valuation is a critical aspect of the entrepreneurial journey. It’s the process of determining the value of your startup at various stages of its lifecycle. This comprehensive guide will provide you with a deep understanding of the different valuation methods, factors that influence valuation, and how to avoid common mistakes. Let’s dive in!

About CA Viswanathan V

CA Viswanathan V is a renowned valuation expert and a chartered accountant with years of experience in startup valuation. His expertise spans across intrinsic valuation, relative valuation, and real options valuation. He has guided numerous startups in their valuation journey, helping them navigate the complex world of finance.him a sought-after consultant and speaker on this topic. In this ultimate guide, Viswanathan shares his knowledge and insights to help you better understand the process of startup valuation and make informed decisions for your business for more About CA Viswanathan V

Intrinsic Valuation

Intrinsic valuation is a method of determining the true value of a company by examining its fundamentals, such as revenue, growth, and cash flow. This approach focuses on the company’s potential to generate future cash flows and how they compare to other investment opportunities. Learn more about intrinsic valuation and how it can be used to assess the value of your startup.for more about Intrinsic Valuation

Scenario Analysis and Simulations: A Probabilistic Approach to Valuation

Scenario analysis and simulations are valuable tools in the valuation process, allowing you to consider various outcomes and their likelihood. By modeling different scenarios, you can gain a better understanding of the potential risks and rewards associated with your startup. Discover the benefits of using a probabilistic approach to valuation and how it can help you make more informed decisions.for more about Scenario Analysis and Simulations: A Probabilistic Approach to Valuation

Relative Valuation and Price Analysis

Relative valuation involves comparing your startup to similar companies or industry benchmarks to determine its value. This approach relies on the use of financial ratios and multiples, such as price-to-earnings (P/E) or price-to-sales (P/S), to evaluate your company’s performance relative to its peers. Dive into the concepts of relative valuation and price analysis to better understand how they can be used in your startup’s valuation process.for more info on it click here Relative Valuation and Price Analysis

Real Options Valuation

Real options valuation is a more advanced approach that considers the potential value of future opportunities and decisions that your startup may face. By examining these “real options,” you can gain a better understanding of the strategic value of your company and its potential for future growth. Learn more about real options valuation and how it can provide a more comprehensive view of your startup’s worth.for more info on it click here Real option valuation

Risk-Free Rate Guide

The risk-free rate is a critical component in many valuation models, as it serves as a baseline for determining the required return on investment. Understanding the risk-free rate and how it affects your startup’s valuation is essential for making informed decisions about funding and growth. Explore the concept of the risk-free rate and its importance in the valuation process for more info on it click here risk free rate guide

Price of Risk in Risky Ventures

Startups often involve significant risks, and investors require a higher return to compensate for this uncertainty. The price of risk represents the additional return that investors demand for investing in a risky venture. Learn more about the price of risk and how it impacts your startup’s valuation, as well as strategies for managing risk and attracting investors.for more info on Price of Risk in Risky Ventures

Startups in Their First Stages of Development

Valuing startups in their early stages of development can be particularly challenging due to the lack of historical financial data and the high degree of uncertainty involved. Discover the unique challenges of valuing early-stage startups and the valuation methods and techniques that are best suited for these situations.for more info on it click here Startups in Their First Stages of Development

How To Do Startup Valuation For Startups!

Conducting a startup valuation involves a combination of art and science, requiring both quantitative and qualitative analysis.for more info on it click here How To Do Startup Valuation For Startups!

How to Value A Company: An In-Depth Guide To The Business Valuation Process

Valuing a company is a critical step in the process of buying, selling, or investing in a business. Understanding how to value a company can help you make informed decisions and avoid costly mistakes. This guide provides an in-depth look at the business valuation process and the methods used to determine a company’s worth. Click here to learn more about How to Value A Company: An In-Depth Guide To The Business Valuation Process

Business Model Design

Business Model Design – A well-designed business model is crucial for the success of any company. It defines how a company creates, delivers, and captures value from its customers. In this guide, we will explore various aspects of business model design and its significance for a business. Business Model Design

Business Valuation Services: A Step By Step to Get Registered Valuer Certificate for Startup Valuation

Business Valuation Services: A Step By Step to Get Registered Valuer Certificate for Startup Valuation – Business valuation is the process of determining the economic value of a business or company. In this guide, we will discuss the step-by-step process of Business Valuation Services & The Importance of Well negotiated deal with Venture Capital Firms

Business Valuation: How Do You Valuate Your Company?

Business Valuation: How Do You Valuate Your Company? – Business valuation is a critical process for business owners who are looking to sell their company or seeking funding. In this guide, we will explore various methods to value a business and factors to consider while valuing a company. How to Value A Company: An In-Depth Guide To The Business Valuation Process

7 Major Startup Funding and Valuation Mistakes First-Time Entrepreneurs Make (and How to Avoid Them)

7 Major Startup Funding and Valuation Mistakes First-Time Entrepreneurs Make (and How to Avoid Them) – Startups often struggle to get funding, and first-time entrepreneurs often make mistakes that can affect their valuation. In this guide, we will discuss the common funding and valuation mistakes made by first-time entrepreneurs and how to avoid them.7 Major Startup Funding and Valuation Mistakes First-Time Entrepreneurs Make (and How to Avoid Them)

Valuation for Business

Valuation for Business – Valuation is an essential aspect of any business, and it helps business owners make critical decisions. In this guide, we will explore the significance of business valuation and the different methods used to value a business.https://virtualauditor.in/learn/valuation-for-business/

Definition and Reasons for Business Valuation

Definition and Reasons for Business Valuation – Business valuation is the process of determining the economic value of a business or company. In this guide, we will define business valuation and discuss the reasons why it is crucial for a business.

Startup Valuation Methods To Value Pre-Revenue Startup Valuation

Startup Valuation Methods To Value Pre-Revenue Startup Valuation – Startups often struggle to determine their valuation, especially in the pre-revenue stage. In this guide, we will explore various startup valuation methods used to value pre-revenue startups.

When Ownership Disputes Lead To Business Valuations

When Ownership Disputes Lead To Business Valuations – Ownership disputes can arise in any business, and it can lead to business valuations. In this guide, we will discuss the role of business valuation in resolving ownership disputes.

10 Things To Do Before You Sell Your Business!

10 Things To Do Before You Sell Your Business! – Selling a business is a complex process that requires careful planning and preparation. In this guide, we will discuss ten things you should do before selling your business to ensure a successful sale.

Valuation Advisory Firms in India

Valuation advisory firms in India provide various valuation services to businesses and individuals, including business valuation, intangible asset valuation, brand valuation, real estate valuation, and more. These firms have a team of experts who use their knowledge and expertise to determine the value of assets and businesses accurately

Valuation Consulting Companies

Valuation consulting companies are firms that offer expert advice on valuation-related matters, such as business valuation, financial reporting valuation, intellectual property valuation, and more. These firms have a team of professionals who use their knowledge and expertise to provide accurate and reliable valuations to clients.

Valuation Companies

Valuation companies provide valuation services for various assets, including businesses, real estate, intellectual property, and more. These companies have a team of experts who use their knowledge and expertise to determine the accurate value of assets. They help individuals and businesses make informed decisions based on the value of their assets.

Key metrics for Evaluating Stat-ups Valuation

Startup valuation is an important aspect of the funding process, and it can be challenging to determine the true value of a startup. This guide provides a comprehensive analysis of the key metrics that investors use to evaluate startup valuation, such as revenue, growth rate, market size, and competition.

The Pros and Cons of Different Startup Valuation Methods

There are various methods that can be used to value a startup, and each method has its pros and cons. This guide provides a detailed analysis of the different startup valuation methods, such as discounted cash flow (DCF), market approach, and venture capital method. It also explains the advantages and disadvantages of each method. Click here to learn more.

Role of Market Size and Competition in Startup Valuation: A Comprehensive Analysis

The market size and competition are important factors that can influence the valuation of a startup. This guide provides a comprehensive analysis of the role of market size and competition in startup valuation. It also explains how investors use these factors to evaluate the potential of a startup. Click here to learn more.

Valuation in 2023 and Beyond: The Latest Trends and Developments in the Field

The field of business valuation is constantly evolving, and it is important for businesses and investors to stay up-to-date on the latest trends and developments. This guide provides an analysis of the latest trends and developments in the field of valuation, such as the use of artificial intelligence and machine learning. It also explains how these developments are expected to shape the future of valuation. Click here to learn more.

VirtualAuditor’s Game-Changing Startup Valuation Services: The New Benchmark

VirtualAuditor is a leading provider of startup valuation services, and its innovative approach has set a new benchmark in the industry. This guide provides an analysis of VirtualAuditor’s game-changing startup valuation services, and how they can help startups and investors make informed decisions based on accurate valuations. Click here to learn more.

Business Valuation Services: A Comprehensive Guide

Business valuation is an important process that businesses go through at various stages, such as mergers and acquisitions, fundraising, and internal decision making. This guide provides a comprehensive overview of business valuation services, including the types of businesses that require valuation, the different methods used for valuation, and the factors that influence the value of a business. It also covers the benefits of business valuation, how to choose a valuation expert, and what to expect during the valuation process. Click here to learn more.

SaaS Valuation in India: Methods, Techniques, and Best Practices

Software as a service (SaaS) companies have become increasingly popular in India, and their valuations are a crucial aspect of fundraising and acquisitions. This guide provides an in-depth analysis of the methods, techniques, and best practices used for SaaS valuation in India. It covers the key metrics, such as monthly recurring revenue (MRR) and customer acquisition cost (CAC), and the different valuation methods, such as discounted cash flow (DCF) and comparable company analysis (CCA). Click here to learn more.

Registered Valuer for Valuation of Shares

In India, it is mandatory to get the shares of an unlisted company valued by a registered valuer for the purpose of transfer, issue or buyback. A registered valuer is an individual who has been accredited by the Insolvency and Bankruptcy Board of India (IBBI) to perform such valuations. This ensures the accuracy and fairness of the valuation process. Click here to learn more.

Business Valuation Services – The Importance of Well-negotiated deal with Venture Capital Firms

Business valuation services are essential for startups seeking funding from venture capital firms. This guide highlights the importance of a well-negotiated deal with venture capital firms to ensure that the startup receives a fair valuation. It also discusses the factors that venture capital firms consider when valuing a startup and provides tips for negotiating a favorable deal. Click here to learn more.

Guide on Understanding Terminology Used by Investors During Valuation Stage for Startups

During the valuation stage of a startup, investors use various terms and metrics to assess the value of the company. This guide provides an in-depth understanding of the most commonly used terminology and metrics used by investors during the valuation stage, including pre-money and post-money valuation, dilution, exit strategy, and more. It also explains how these terms and metrics can impact the valuation of a startup. Click here to learn more.

A Complete Guide on Compulsory Convertible Preference Shares (CCPS) & Optionally Convertible Preference Shares (OCPS)

Compulsory Convertible Preference Shares (CCPS) & Optionally Convertible Preference Shares (OCPS) are instruments used by startups to raise funding. This guide provides a complete analysis of these instruments and their advantages and disadvantages. It also explains how they differ from other funding instruments and how they can be used to raise funds for a startup. Click here to learn more.

Merchant Banker Valuation

Merchant bankers are financial experts who offer a wide range of services to businesses, including valuation. They use various methods and techniques to determine the value of a company or its assets. This guide provides an overview of merchant banker valuation and its importance in the world of business. Click here to learn more.

Subsequent events in the world of business valuation

Subsequent events can have a significant impact on the value of a business, especially during the valuation process. This guide provides an overview of subsequent events and their effect on business valuation. It also discusses the steps that businesses can take to mitigate the risks associated with subsequent events. Click here to learn more.

Business Valuation Services: A Comprehensive Guide

Business valuation is an important process that businesses go through at various stages, such as mergers and acquisitions, fundraising, and internal decision making. This guide provides a comprehensive overview of business valuation services, including the methods and techniques used, the importance of accurate valuations, and the challenges faced by businesses during the valuation process. Click here to learn more.

Expert Business Valuation Consultant: Unlocking Your Company’s True Value

A business valuation consultant is a professional who specializes in providing valuation services to businesses. This guide provides an overview of the role of a business valuation consultant and the benefits that they can provide to businesses. It also discusses the factors to consider when choosing a business valuation consultant. Click here to learn more.

Top-notch Business Valuation Services | Company Valuation Consultants in Bangalore

Business valuation services are essential for businesses that are looking to make strategic decisions or raise funds. This guide provides an overview of top-notch business valuation services and company valuation consultants in Bangalore. It also discusses the factors to consider when choosing a business valuation consultant. Click here to learn more.

Top-notch Business Valuation Services In Mumbai | Company Valuation Consultants in Mumbai

Business valuation services are essential for businesses that are looking to make strategic decisions or raise funds. This guide provides an overview of top-notch business valuation services and company valuation consultants in Bangalore. It also discusses the factors to consider when choosing a business valuation consultant. Click here to learn more.

Business Valuation Services in Hyderabad | Company Valuation Consultants in Hyderabad

Discover top-notch business valuation services and company valuation consultants in Hyderabad to help you determine your company’s worth accurately and strategically.It also discusses the factors to consider when choosing a business valuation consultant. Click here to learn more.

ESOP Valuation: A Comprehensive Guide to Employee Stock Options

Learn about ESOP valuation, its importance, and the various methods used to calculate employee stock options for startups and established companies.

Sweat Equity Valuation in India: A Comprehensive Guide

Explore the concept of sweat equity valuation in India, its significance, and the methods to determine the value of non-monetary contributions by founders or employees.

Brand Valuation Advisory in India: A Comprehensive Guide

Understand the importance of brand valuation advisory in India and discover the methods used to determine the value of a brand and its contribution to a company’s success.

Dispute Valuation: A Comprehensive Guide to Navigating Business Conflicts

Examine dispute valuation and its role in resolving business conflicts, including various methods and approaches for determining the financial impact of disputes.

Valuation of Intangible Assets in India: An In-Depth Guide

Dive deep into the valuation of intangible assets in India, exploring the methods and techniques used to calculate the value of intellectual property, trademarks, and other intangibles.

Demystifying Convertible Instruments Valuation in India: A Comprehensive Guide for Startups and Investors

Uncover the nuances of convertible instruments valuation in India and learn about the methods and best practices for startups and investors to navigate this complex financial instruments.

Term sheets and shareholders Agreements comparison in the Indian startup ecosystem

This guide provides a detailed comparison of term sheets and shareholders agreements in the Indian startup ecosystem. We’ll explore the legal and regulatory framework around term sheets and shareholders agreements, and provide insights on how to use them effectively.

A Comprehensive Guide to Pre-revenue Valuation for Indian Startups

Valuation of pre-revenue valuation startups can be a challenging process due to the absence of financial metrics. This guide provides an in-depth analysis of pre-revenue startup valuation in the Indian context and explains the methods and techniques used by investors and entrepreneurs.

Understanding Customer Acquisition Cost (CAC)

Customer Acquisition Cost (CAC) is an important metric for startups to measure the cost of acquiring a new customer. This guide provides an overview of CAC and explains how it is calculated and used in startup valuation. Click here to learn more.

Risk Adjusted Startup Valuation: A Comprehensive Guide for Entrepreneurs and Investors

Startup valuation is a complex process that involves assessing various risks. This guide provides an overview of risk-adjusted startup valuation and explains the techniques used by entrepreneurs and investors to adjust for risks in the valuation process. Click here to learn more.

Risk Assessment in Startup Valuation

Risk assessment is a critical component of startup valuation as it helps investors and entrepreneurs to make informed decisions. This guide provides an overview of risk assessment in startup valuation and explains the different types of risks that need to be considered. Click here to learn more.

Startup Valuation Uncertainty

Startup valuation is inherently uncertain due to the unpredictable nature of startups. This guide provides an overview of startup valuation uncertainty and explains the techniques used to deal with it. Click here to learn more.

Valuation for Series A

Valuation for Series A is an important process for startups looking to raise funds from investors. This guide provides an overview of the Series A valuation process and explains the factors that need to be considered when valuing a startup at this stage. Click here to learn more.

Exit Valuation

Exit valuation is the process of valuing a company at the time of its exit, such as during a merger, acquisition, or initial public offering (IPO). This is an important step for investors to determine the return on their investment and for the company to attract potential buyers. Various methods, such as discounted cash flow (DCF) analysis, comparable company analysis (CCA), and precedent transaction analysis (PTA), are used to determine the exit valuation. Click here to learn more.

Seed Stage Valuation

Seed stage valuation is the process of estimating the value of a startup in its initial stages, typically before it has generated significant revenue. At this stage, investors look at a variety of factors, such as the potential market size, the startup’s competitive advantage, the team’s expertise, and the feasibility of the product or service. Methods used for seed stage valuation include the Berkus method, the Risk Factor Summation method, and the Scorecard Valuation method. Click here to learn more.

Post-revenue Valuation

Post-revenue valuation is the process of valuing a company after it has started generating revenue. This is an important step for investors to determine the company’s potential for growth and profitability. Various methods, such as discounted cash flow (DCF) analysis, comparable company analysis (CCA), and market multiple analysis, are used to determine the post-revenue valuation. Click here to learn more.

Startup Valuation Metrics : Understanding the Key Performance Indicators (KPIs)

Understanding key performance indicators (KPIs) is essential for measuring the success of a startup and determining its valuation. KPIs can vary based on the industry, but common metrics include monthly recurring revenue (MRR), customer acquisition cost (CAC), churn rate, gross margin, and lifetime value (LTV). Investors use these metrics to determine the health and growth potential of a startup and make informed investment decisions.

Post-revenue Valuation

This guide explains post-revenue valuation, including the importance of valuing a company after it has started generating revenue. We’ll discuss different methods of post-revenue valuation, such as discounted cash flow, earnings multiples, and market comparables, and how to choose the best method for your business.

Startup Valuation Stages

This guide covers the different stages of startup valuation, including pre-seed, seed, early-stage, and late-stage. We’ll explore the characteristics of each stage, how to value startups at each stage, and the importance of understanding valuation at different stages of a startup’s development.

IND AS Valuation

This guide provides an overview of IND AS (Indian Accounting Standards) valuation, including the importance of adhering to these standards for accurate and transparent financial reporting. We’ll cover the different types of assets and liabilities that are subject to IND AS valuation, methods of valuation, and how to ensure compliance with these standards.

Distress Valuation

This guide explores distress valuation, which is the process of valuing a company that is facing financial distress or bankruptcy. We’ll discuss the importance of understanding distress valuation, methods of valuation, and how to navigate the unique challenges of valuing a distressed company.

Price of Risk in Risky Ventures

I’ve always believed that defining value is a simple process that we complicate. The intrinsic value of an asset is determined by the length, size, and consistency of the asset’s cash flows. Private and public enterprises and their securities are valued in this manner as well.

Despite the fact that the fundamentals of valuation are very straightforward, the issues that arise as an organization progresses through its life cycle are more complex. There are four distinct stages of a company’s life cycle: a startup, a mature company, a company on the verge of becoming a publicly traded company, and a company on the verge of bankruptcy.

With varying knowledge and precision, we predict cash flows and growth rates at each phase. It’s easy to succumb to the temptation to abandon our core values in the face of uncertainty or lack of information, leading us to develop new paradigms and abandon common sense.

In this series THE ULTIMATE GUIDE TO STARTUP VALUATION We intend to explore a lot about company valuation and startup valuation in complete details

Startups and Indian’s Environment

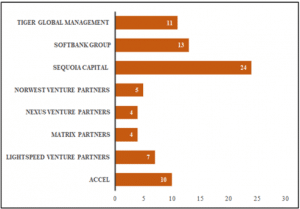

As a result of the epidemic, organisations all over the globe have hastened their digital adoption, making it easier for investors from other countries to make cross-border investments. Startup transaction prices are surging to new heights due to the overheated western markets driven by traditional investors like Tiger Global, Andreessen Horowitz, and Sequoia Capital. Investors from across the world, notably in China and India, are now looking into the startup marketplaces in these countries and other growing nations.

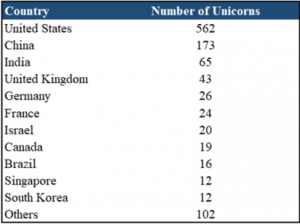

While much has been written about the various benefits of the Chinese startup environment, the Indian startup industry seems as promising and deserves more investigation. There are more than 60,000 startups operating throughout India’s 642 districts, making it the country with the third-largest startup ecosystem in the world. There might be up to 65 unicorns in India by the end of April 2022, with significant international investors pouring in billions of dollars.

In spite of the high level of excitement surrounding Indian startups, it is anticipated that 90% of them would fail within the first 5 years.

Therefore, global investors must be on the lookout for hidden dangers before taking the leap.

REASONS FOR FAILURE OF START UP

● Discordance between different cultural groups

In contrast to their Western counterparts, Indian entrepreneurs see the world in a different light. When it comes to sharing information, the former tend to be more reticent and take longer to trust others outside their group. Several early-stage Indian startups have blown investors’ money. Investors’ money is treated as if it were their own in contrast to the stricter socio-ethical standards prevalent in Western nations. It’s also usual for Indian companies to feature family members in leadership positions because of the focus on family connections in Indian culture. Conflicts over governance concerns may occur in the future if the Indian founding family refuses to give any influence even to investors with strong ownership shares, signaling that replacing them is never simple.

● Ignorance of the market and the target audience

As the world’s most populous country with an estimated middle class of 600 million, India is claimed to be a vast market for goods and services. However, this might be deceiving, considering the fact that the Indian market is far smaller in actual size. Take, for example, consumer technology. Most of India’s 622 million active internet users are using basic cellphones that lack processing power and memory, according to a 2020 research by the Internet and Mobile Association of India. In addition, middle-class consumers in India have lesser buying power than their counterparts in wealthy nations. Clients in India have a general aversion to using their credit cards to make purchases online, which makes it more difficult for businesses in remote locations to win over customers used to paying with cash at local establishments. In addition, the Indian consumer is price-conscious, making client retention a constant issue and resulting in revenue burn via discounts and bargains.

● Differences in legislation and other aspects

Rather than a lack of regulation, Indian firms are hampered by overregulation, which leads to a lack of transparency in the government. Another prevalent regulatory disease is under-implementation, which is the opposite of over-regulation. This challenge is exacerbated in India because startups often establish new industries that are not covered by the current legal framework (e.g., the absence of complete laws for self-driving cars). Additionally, Indian startups are confronted with regulatory snags. Many subscription-based business models, such as payment wallets, were severely affected by the recent revocation of the auto-payment option by the Indian central bank. There are several micro-markets in India that are distinct from each other in terms of income, regional economic development, and cultural values. This complicates things further since India is not a single homogenous market. In order for startups to succeed, they must traverse a maze of legal and other complications that are difficult to comprehend.

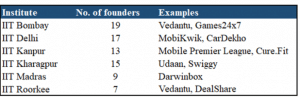

● Thinking outside of the Ivy League

Indian Ivy League colleges have a strong track record of attracting international investors who prefer to invest in businesses formed by IIT and IIM alumnae.

However, using academic credentials as a surrogate for entrepreneurial prowess might result in disastrous investments.

Instead of focusing just on an entrepreneur’s educational background, investors should look at their social capital, technical expertise, founding team experience, patent filings, and even links with third parties to better assess their chances of success.

The Indian startup ecosystem may also be tested by international investors by partnering with local incubators and accelerators.

● Costs of leaving

It is essential for foreign investors to remember to have an exit strategy in mind when they invest in a potential business. Exiting the Indian market might be a challenge. Walmart’s 2018 $16 billion purchase of Flipkart, a startup, is an exception when it comes to high-profile startup acquisitions. Many companies are “marked to myth” rather than “marked to market” in acquisitions that do not result in high-value agreements. No matter how hard you try, pulling off a successful initial public offering (IPO) is impossible. As a result of the recent IPOs (Paytm, Zomato, and Nykaa are just a few examples), the number of businesses going public in India is still extremely low when compared to the US or China, despite SEBI’s recent loosening of regulations. For this reason, ordinary investors in India’s capital market have shown only a moderate level of interest. The moment a company goes public, it is common for the stock price to fall quickly, forcing investors to doubt the company’s enormous valuation. More and more firms are reconsidering their initial public offerings, making it more difficult for investors to leave.

India’s startup ecosystem has grown rapidly, reaching a total of $100 billion in financing between 2022 and 2030. However, despite the confidence, it is still difficult to build a successful company in India. Investors from outside India, in particular, should be aware of the potential pitfalls and how to avoid them. To tackle all these issues, the following chapters will expound on the issues and their remedies and how the investors can prudently avoid these pitfalls.