Business Advisory Services

Business advisory services focus on strategizing for the success and growth of the business. it provides consulting service to both public and private sectors, towards building long-term partnership services. Organizations are constantly challenged to evaluate opportunities, across all facets of their business.

Starting at Rs.14,999/-

EMI Available

Who Choose Business Advisory From Virtual Auditor

The main objective of offering business advisory services is to bring more focus to the value proposition by delivering a broader range of advisory services and competencies.

Finance and process consulting

Technology and risk consulting

Specialized services to a financial institution

Detailed Overview Of Business Advisory

Business advisory services focus on strategizing for the success and growth of the business. it provides consulting service to both public and private sectors, towards building long-term partnership services. Organizations are constantly challenged to evaluate opportunities, across all facets of their business. Business priorities change in relation to various factors that include the socio-economic environment and the age of the enterprise. And a business can always benefit from expert advice. Our Business Advisory team https://virtualauditor.in/business-advisory develops and offers tailored, innovative and comprehensive solutions for a specific client. Therefore, business needs that may not require the expression of opinions based on professional standards. The main objective of offering business advisory services is to bring more focus to the value proposition by delivering a broader range of advisory services and competencies. Our key business advisory services offer includes:

A strategic initiative could be one program with related projects or could contain several programs with related projects. It should be managed with proper program management, and it is characterized by the following features,

- Finance and process consulting

- Technology and risk consulting

- Specialized services to a financial institution

- Accounting advisory service

- Greenfield and brownfield projects advisory

- Strategic initiatives management and special projects

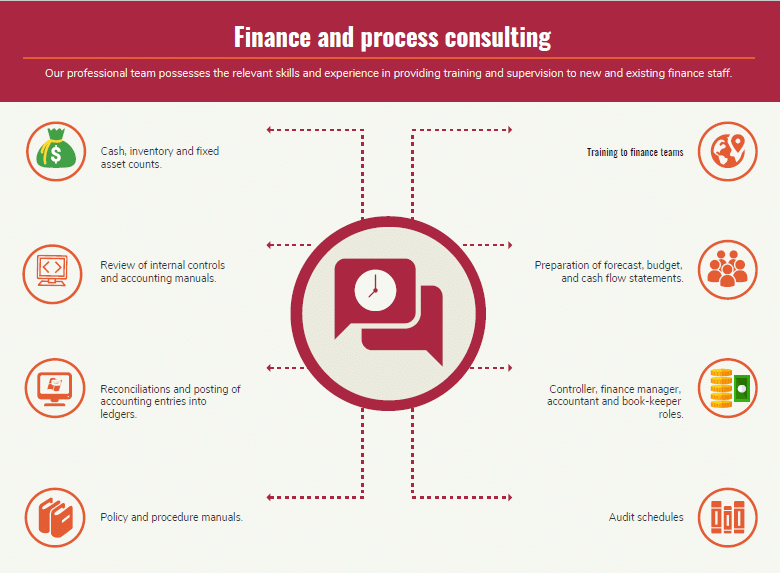

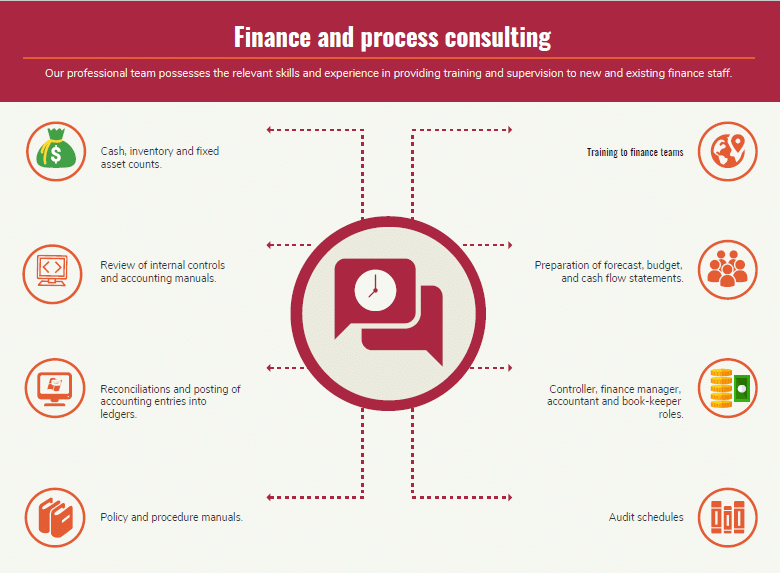

1. Finance and process consulting

Our professionals are committed to understanding and exceeding the specific organization requirement, and will work under the direct supervision of management. here, such activities are included, but they are not limited to the following.- Assistance with the clearing of audit queries.

- Debtors control, budget control, reconciliation and clearing of suspense accounts.

- Development of standard charts of account.

- Outsourcing of the financial function.

- Policy and procedure for design and implementation.

- Preparation of Annual Financial Statements including performing reconciliations and preparing audit files.

- Cash, inventory and fixed asset counts.

- Review of internal controls and accounting manuals.

- Reconciliations and posting of accounting entries into ledgers.

- Policy and procedure manuals.

- Preparation of forecast, budget, and cash flow statements.

- Controller, finance manager, accountant and book-keeper roles.

- Audit schedules

- Training to finance teams

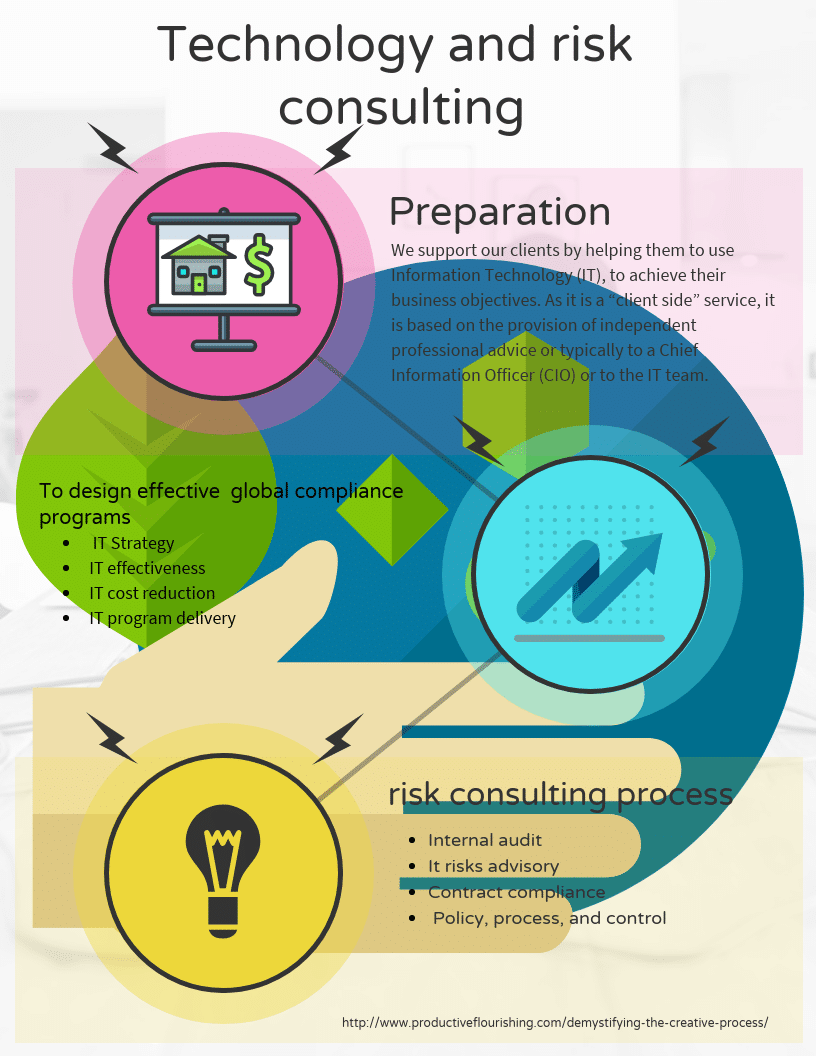

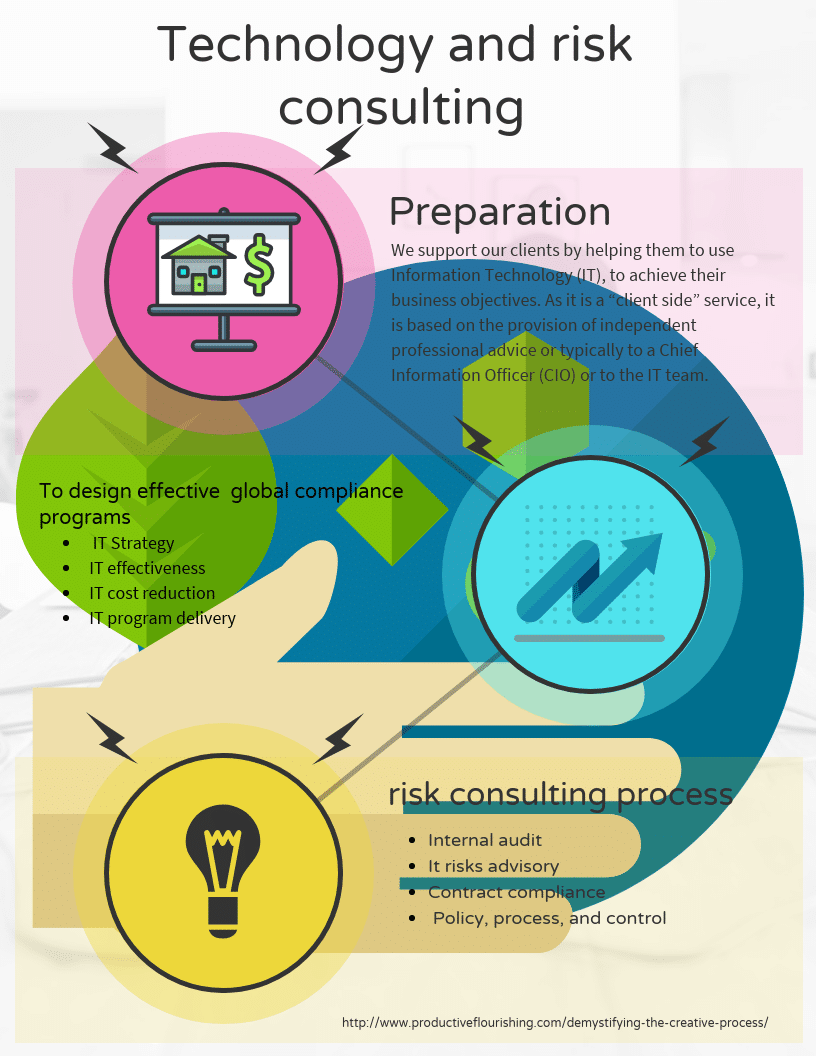

2. Technology and risk consulting

We support our clients by helping them to use Information Technology (IT), to achieve their business objectives. As it is a “client side” service, it is based on the provision of independent professional advice or typically to a Chief Information Officer (CIO) or to the IT team. However, we do maintain a close relationship with the major technologies of vendors. So that we can understand their capabilities, services, and products and can collaborate with them according to our clients’ interest. Our professionals have a deep understanding of industry issues and provide guidance to public and private companies for startups enterprises. We also help clients to design and implement global compliance programs and drive results through internal audit. Some of the areas have an effective and risk consulting process in (BAS) are, Effective Risk consulting- IT Strategy 1. Internal audit

- IT effectiveness 2. It risks advisory

- IT cost reduction 3. Contract compliances

- IT program delivery 4. Policy, process, and control

3. Specialized services to financial institution

Financial Services Industry (FSI) practices offer a wide array of services, specifically designed for financial institutions, in the areas of risk management, financial and corporate governance, regulatory compliance, and technology solutions. A number of special financial institutions have been set up by the central and state governments to provide long-term finance to the business organizations. The list of specialized financial institution are Export-Import Bank Of India, Board for Industrial & Financial Reconstruction, Small Industries Development Bank of India, National Housing Bank. As these institutions aim at protecting the industrial development of the country. These are also called as development banks or the developed financial institution (DFI). They provide specialized service to the financial institution are:- Granting loan- for a longer period.

- Establishment of business units- a Large number of funds for the business unit.

- Economic development- To provide support for economic development.

- Advisory service- To offer specialized services for the development of an economy.

- Help in a new project- To provide technical and professional services in the evaluation of the new project.

4. Accounting advisory service

In the current global environment, there are many companies operate within the global environmental services. Also, there are many challenges for these companies from an accounting perspective as shareholders, regulators and other external stakeholders take a greater interest in how companies report, disclose and communicate their financial results. It is more important for an organization to obtain specialist technical accounting advice, and support to help them adapt and succeed. Our teams are committed to help clients and reach the right accounting answer in the context of reporting objectives, commercial reality, and regulatory requirements. Therefore, Our teams deliver consistent cost-effective service, resources of a network of professionals worldwide, and forming one of the world's leading accounting advisory networks. Here are a few services we can help you with:- Embedding new standards and processes.

- Standardizing your conversion and integrating your reporting.

- Updating your accounting tools and function, including in-house training.

- Supporting with recurring accounting and reporting compliance.

- Board reporting and internal controls.

- Remediating any issues identified.

5. Greenfield and brownfield projects advisory

'Brownfield’ and ‘greenfield’ are software development project advisory. Both, the terms directly relate to IT production operation. It describes the problem space which needs the development and deployment of a new software system. The attributes that summarise the greenfield and brownfield are,Greenfield attributes

- Slow change, but reliable & scalable

- Maintaining workloads

- Not cloud platform enabled

- Waterfall release cycles

- Legacy, monolithic tools

- Legacy, serial processes

Brownfield attributes

- Fast change and innovative and more tolerant of bugs

- Maintaining workloads across infrastructures

- Cloud platform enabled

- Agile development cycles

- New, composable tools

- New, collaborative processes

6. Strategic initiatives management and special projects

Directors of strategic initiatives develop, oversee and help implement programs and projects that support a company's vision in short and long-term plans. There may be part of a company's executive leadership team or report directly to a company's president or board of directors.

- Translating organizational strategy into a specific initiative

- Temporary endeavor as a foundation for related programs and projects

- Only top management can initiate these improvement processes (exists mostly in the area of business improvement)

- Has an impact on one or several management elements (structure, processes, culture, people) and thus always on the business results

- Contains related programs and projects

- Program management as a methodology